Klaytn (KLAY) was at the top of the list of the most appreciated altcoins since last week. On the red side is XCN, which lost more than 20% despite the rally. Here are the altcoin projects that lost the most value in the past week between October 21 and October 28…

- Chain (XCN) -22.08%

- Maker (MKR) -13.66%

- Casper (CSPR) -4.99%

- BinaryX (BNX) -3.51%

- Quant (QNT) -2.37%

Top 5 altcoins that lost value in the week of October 21-28

XCN surpassed the $0.079 area, which acted as resistance in April. It has been moving downwards since then. It fell as low as $0.050 on October 28. Analyst Valdrin Tahiri stated that if it breaks $0.050, the bears will aim for $0.033. However, a daily close above $0.079 will indicate that the bulls are in the scene. However, buyers have not shown any clear strength so far.

Maker (MKR)

MKR price has been following an ascending support line since Sept. 21. The upside momentum is gradually moving towards $1,170 on October 9 and then $1,150 on October 19. On October 22, MKR broke from the ascending support line, indicating the end of the upward move. Currently, the price is trading above the $877 support area. If the downside continues, the next closest support area will be at $808. A break from the resistance line and a retracement of the $965 resistance area will indicate that the correction is complete and new highs are in store.

Casper (CPSR)

CSPR price has been correcting since October 14. Reached point C on the chart with a move similar to the downward ABC structure. The most likely level for the correction to end is at $0.036. This is both a horizontal support area and a 0.618 Fib retracement support level. On the contrary, an increase above wave B high of $0.050 (red line) indicates the completion of the correction and new highs to follow.

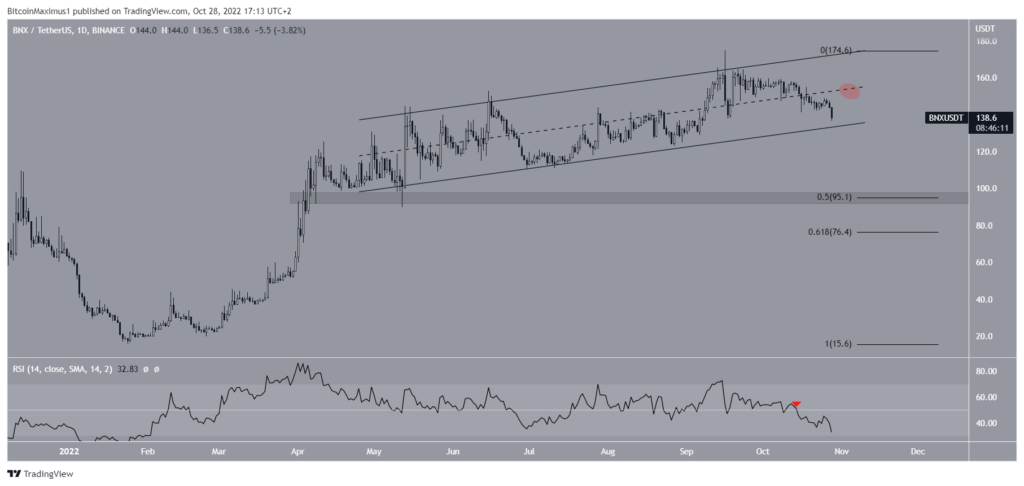

Similar to MKR, BNX price has been rising inside an ascending parallel channel since May 11. Such channels often contain corrective models. In such a case, the analyst says, the bears’ first target would be $95. On the other hand, a move from $155 triggers a move to the channel resistance level at $175.

Quant (QNT)

On October 20, QNT bounced off the $158 horizontal support area. The altcoin later hit new buyers at $194,880. It has since been falling within a descending parallel channel. Besides the descending parallel channel being seen as a bullish pattern, the six-hour RSI formed a bullish divergence (green line). As a result, a drop towards the $158 horizontal support area before an eventual break seems the most likely scenario. A daily close below $158 could invalidate this bullish hypothesis.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.