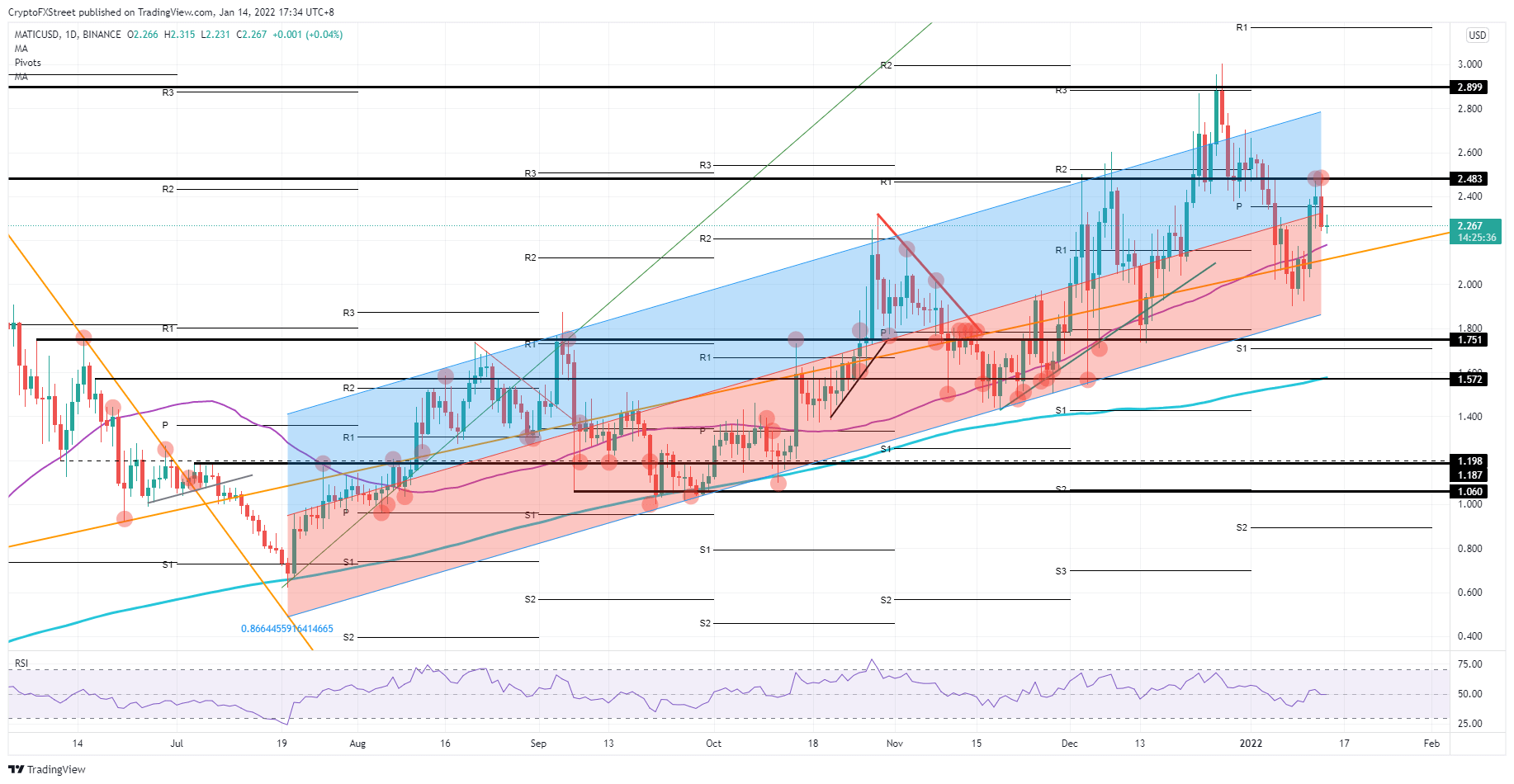

Polygon (MATIC) priceappears to have consolidated in the middle of the long-term trend channel. While the MATIC price action still attracts significant attention from investors to capture the uptrend, the price target is still set at $3 in the coming weeks.

Polygon (MATIC)In the last weeks of 2022, it was mainly located in the ‘blue area’ and sometimes traded upwards from this area, but soon dropped back to the red bottom of the bandwidth, ending it.

At the moment, the price seems to have consolidated somewhat in the middle of the trend channel with the Relative Strength Index (RSI) at 50. Futures price action after that could go either way, but the continuation of the uptrend seems more dominant as the actual $3 target remains in sight.

Even if Matic sinks to the lower end of the channel, $3 remains in sight for buying.

Started investing again in August MATIC Investors will probably have a hard time understanding why the media and markets are complaining when they look at the performance of their portfolios.

A stable trend channel has been playing in favor of the bulls for over five months, with just one breakout to a new high at $3. A retest of $3 is within reach as the trend channel continues to rise with no end in sight.

Price action has been consolidating these past few days, as markets have been somewhat turbulent due to monetary policy news and geopolitical problems.

Even if the consolidation falls in favor of the bears, the orange ascending trendline will provide support or at least a slowdown and keep the uptrend in place.

Even a false break should not be a problem as there are multiple support levels, including $1.75 and the nearby S1 support level, to quickly catch up with the price and provide the ground for a bounce.

If the consolidation results in a return to the upper blue side of the bandwidth in addition to a few external tailwinds, $3 could be retested and end with a new all-time high.

If the bulls can form a daily close above $2.90, it won’t be an exaggeration to expect even a set of new lines at the all-time high. The monthly R1 resistance level is a level that will trigger profit taking and result in a retracement to $2.90 or a reversal within the trend channel.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.