Polygon (MATIC) The price continued to decline over the weekend after Putin’s pledge to take the war with Ukraine through to the end. In addition to this development, with the peak of inflation in the world, especially in the USA, price pressure increases and the rise in energy prices creates a panic atmosphere in the markets. In this environment, MATIC could also fall as low as $1.2-$1 over the course of the week as the dollar’s strength outweighs that much.

MATIC Price Technically Caught On A Death Cross!

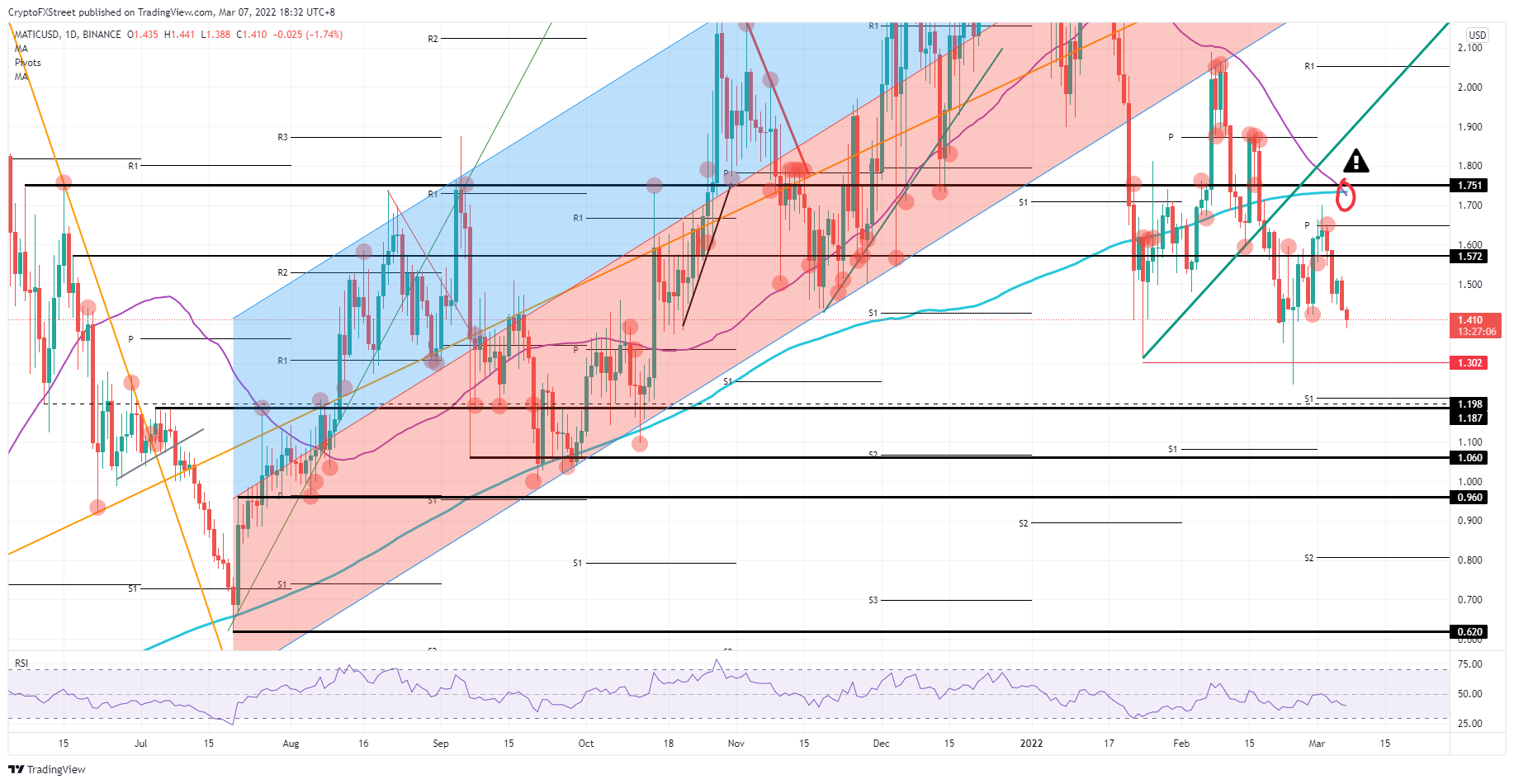

polygon in fact it seems to be under siege in many ways, bearish pressure is increasing day by day and short sellers seem to have taken over the game. In addition, the strength of the dollar is outweighing and increasing losses. Worse still, the bulls failed to show any signs of a reversal over the weekend, and this incomplete 55-day simple moving average (SMA) broke below the 200-day SMA, around $1.7. This points to more bearish pressure as shorts will only add more to their shorts.

MATIC price could drop further during the week as there is no positive news in sight, and could initially test at $1.30 in the next 24 hours. The next leg could be the monthly S1 support level and $1.20. While Putin has been roughing it over the weekend, we expect to see more downside pressure, which could see $1.06 on negative headlines or even see a break below $1, meaning losses of between 16% and 33%.

Alternatively, the dollar’s pullback would already trigger some upside rally. This could happen if the situation in Ukraine stabilizes a bit. As a result of this, MATIC It could bounce 12% on the day to $1.57 or even $1.65, and the monthly pivot could move higher if there is a follow-up.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.