FTX crisis as well as native token FTT wither also had bad consequences. High volatility and increased supply in the altcoin resulted in the restriction of SOL transactions. Here are the current developments.

According to Amberdata data Left (LEFT) The expected price daily (implied) volatility in the short term increased by 270 percent year on year. In Bitcoin, this rate is 135%. The 30-day implied volatility in the SOL price increased by 190%. By comparison, this rate is 95% in Bitcoin.

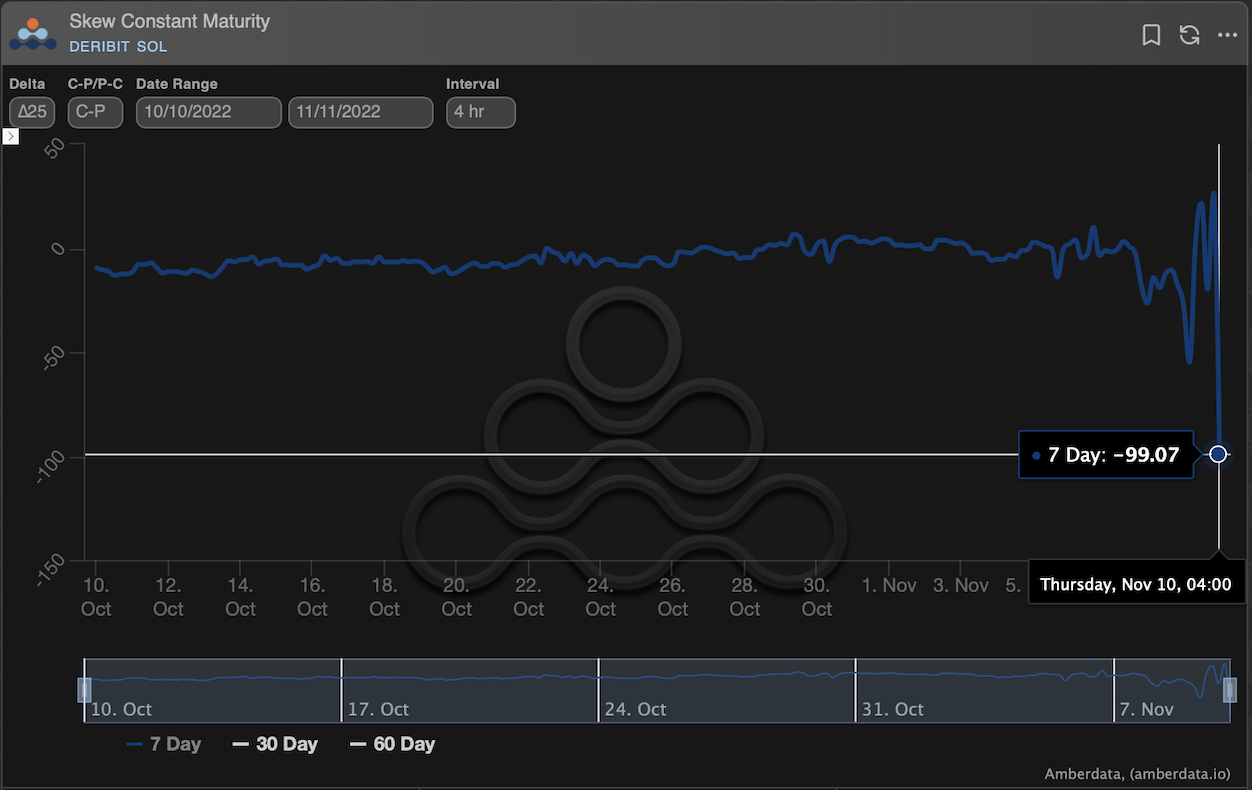

SOL’s seven-day call/put-call curve has dropped to -99%, its lowest level ever. This is a sign of record demand for the downtrend, according to bullish calls. Investors often buy while waiting for a price drop.

Solana Surrendered to Panic

Gregoire Magadini, director of derivatives at Amberdata, commented that “There is panic in the SOL market”, noting the increase in implied volatility.

“Traders are nervous about the Solana value and huge liquidation potential. SOL is a collateral asset. FTX/Alameda is likely to be liquidated as it needs to raise cash. Therefore, the options market is pricing more volatility against SOL.”

Rumors that FTX and Alameda Research are liquidating Solana assets triggered a drop in SOL price. Koinfinans.com As we reported earlier, SOL price has lost 58% in four days.

Additionally, the incoming supply deluge frightened investors in both spot and derivatives markets.

Solana validators that provide security to the blockchain, cryptocurrency ready to unlock in a matter of hours, approximately $800 million in SOL assets, which make up 5.4% of the unit’s total supply.

“We expect a minimum of 32,214,758 SOLs for potential sales in the secondary market. This number will increase as a result of further deactivation of the validator.”

As a result, dYdX exchange restricts transactions. announced.

Due to extreme market volatility, SOL-USD will be put into close-only. No new positions can be opened at this time.

— dYdX (@dYdX) November 9, 2022

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.