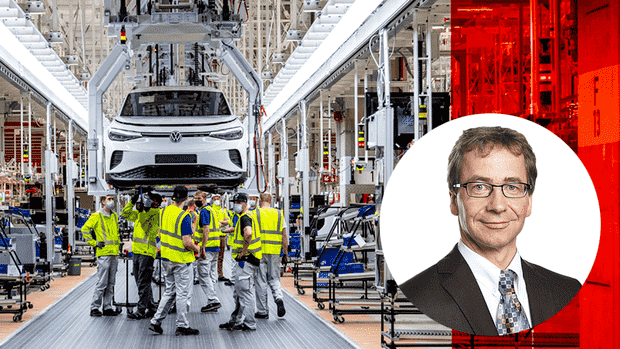

The car industry has a lot of weight in the Dax.

(Photo: DPA, Max Brunert (M))

Frankfurt With 15,677 points, the Dax rose to its highest level since January last year on Monday. The reason for this was good specifications from Wall Street, but the strong annual figures from a number of Dax companies from the previous week also had an effect. The profitable car manufacturers in particular are likely to have played a key role in this. Because the Dax has never been as car-heavy as it is today.

The thesis that expensively manufactured products that consume fossil fuels are becoming less important in times of climate protection would be refuted, at least as far as the German stock market is concerned.

With a net profit of 50 billion euros in the 2022 financial year, BMW, Mercedes, Volkswagen and Daimler Truck account for almost 45 percent of the profits of all 40 DAX companies. Porsche’s billions in profits are not included in this figure because they are also included in the VW Group’s balance sheet.

With an expected 17.4 billion euros, the car manufacturers are paying out more to their shareholders in the spring than ever before. The industry represents a third of the Dax dividends. VW has drastically increased its payout from EUR 7.56 to EUR 8.76 per preferred share.

In addition, there was already 19.06 euros per share, which the group had distributed in January after Porsche’s IPO. This special dividend is not included in the overall calculation.

Car manufacturers are among the cheapest Dax titles

In terms of stock market value, BMW, Mercedes, VW, Daimler Truck, Porsche Holding and Porsche AG total 379 billion euros. That is 20 percent of the entire Dax.

Measured against the shares of profits and dividends, this number seems almost modest. This reflects the low valuation: Mercedes is only worth 5.6 times as much on the stock exchange as the group earned net in 2022. At VW, the price-earnings ratio calculated in this way is 4.4, at BMW it is only 3.7.

This means that the car manufacturers are among the cheapest Dax titles. This is not due to the skepticism of the analysts. 13 out of 27 international banks and independent financial institutions recommend BMW as a buy, only four recommend a sell. 22 out of 26 analysts rate Mercedes as a buy, and no expert believes it is a sell. Volkswagen received 16 buy, six hold and two sell votes.

The low valuation obviously has other reasons: Many shareholders do not trust the manufacturers to continue the profits of today, let alone increase them. This is indicated by the very high dividend yields of between six (VW) and seven and a half (BMW) percent. These numbers are a clear vote of no confidence. The car manufacturers have been delivering high profits and dividends for years. But the share prices have meanwhile risen only below average, which caused the stock market value to fall.

However, a revaluation may have started: Over the course of a year, BMW, Mercedes and Daimler Truck beat the Dax with price increases of more than 30 percent each.

The index is only up 21 percent. Only VW lags behind with a price gain of four percent in twelve months. The significant jump of a good ten percent in a single trading day doesn’t help either, when the group published its business figures at the end of last week, which were well above expectations.

On Monday, skepticism once again prevailed. In the strong overall market, BMW and Mercedes tended only to the level of the previous day, VW lost around two percent. Meanwhile, the Dax ended trading up 0.4 percent at 15,654 points.

More: The weak outlook of the corporations weighs on the mood