We constantly convey that the latest wave of sales in Bitcoin and crypto money markets is related to the US markets and the statements of the FED.

When we watch the price movements in Bitcoin, we observe that the correlation with the US stock markets has increased considerably.

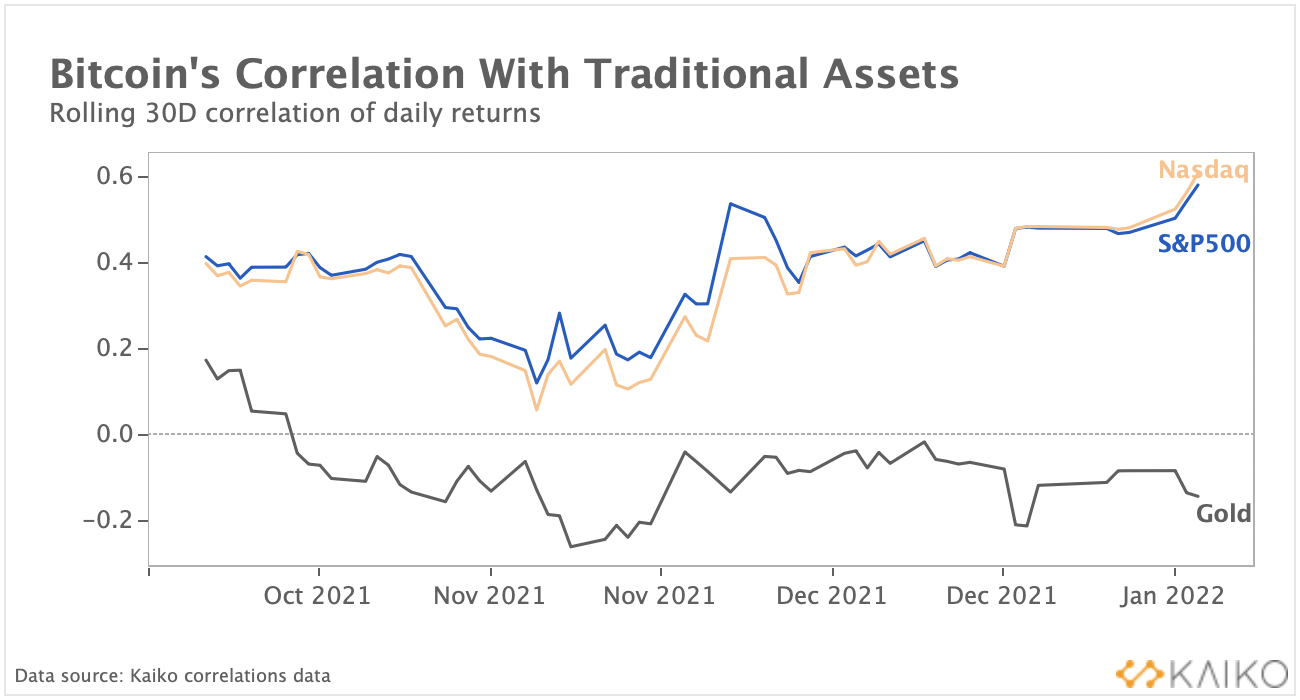

Data on this correlation was shared in the latest Bitcoin report published by data analysis company Kaiko.

When we examine the chart, we observe that Bitcoin’s correlation with the Nasdaq and S&P 500 has increased. Especially after the FED decision in December, we observe that the correlation between Bitcoin and indices has increased with the start of the escape from risky products.

Kaiko used the following statements about correlation:

“FED’s December meeting raised the possibility of monetary tightening and risky products reacted. During this volatility, Bitcoin acted as a strong risk asset and moved along with the Nasdaq and S&P 500. During this movement, the correlation jumped to the highest level of the last 1 year with 0.61 and 0.58. During volatility, Bitcoin’s correlation with gold has remained in negative territory since September.”

*Not Investment Advice.