Altcoin markets continue to suffer since the beginning of December. There is an altcoin that has managed to maintain its strength even in the face of this situation. Terra (Luna). There are exceptions, with Terra emerging as the key winner of most large-scale alternatives. Terra is the leading decentralized and open-source public blockchain protocol for algorithmic stablecoins. And it could be argued that there is good reason behind the protocol’s recent popularity.

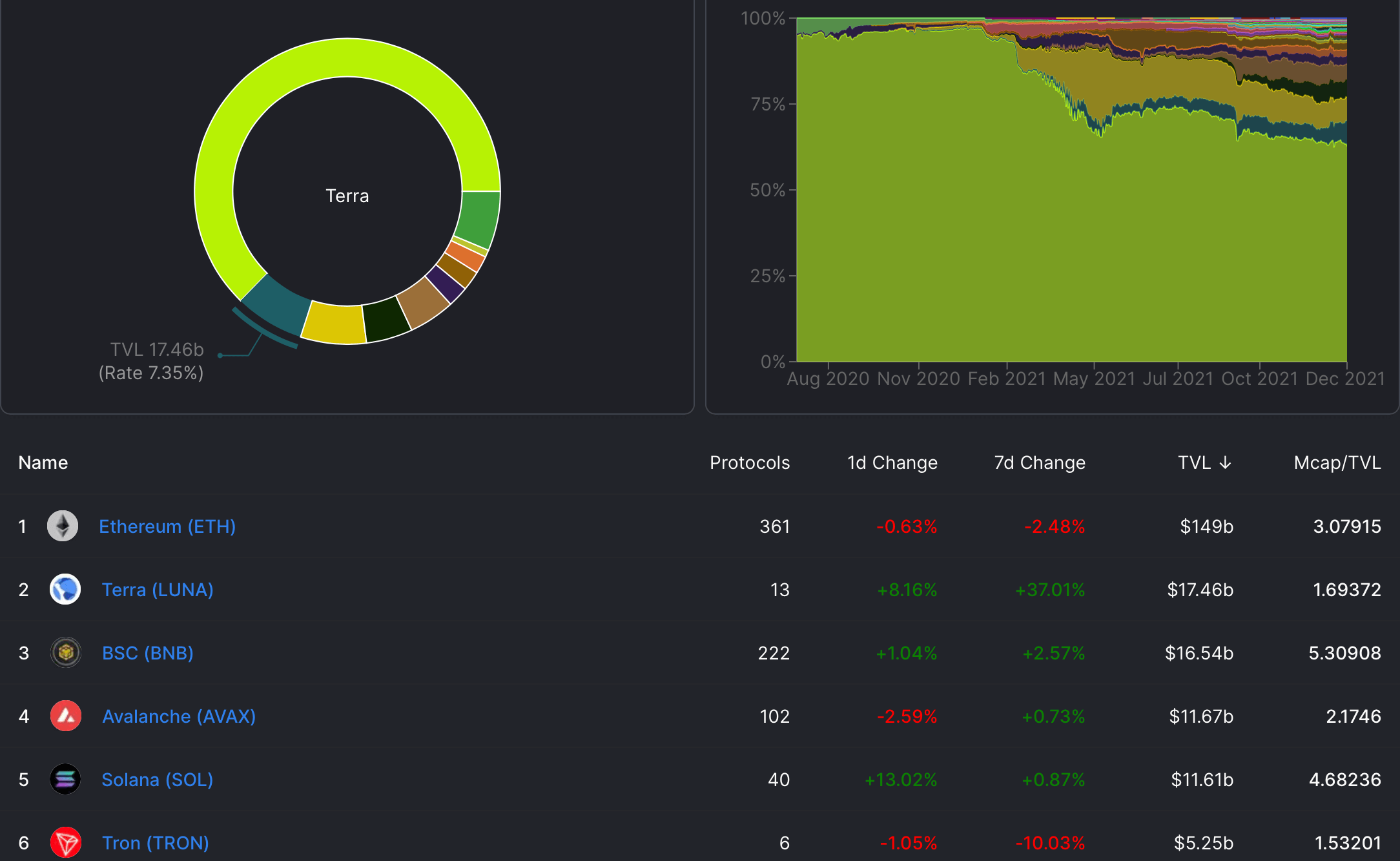

In fact, Terra stands out as the second largest smart contract platform currently in terms of “total locked value (TVL)”, surpassing Binance Smart Chain, according to data provided by Defi Llama. Currently, the TVL value is more than $17 billion, up 8% in 24 hours.

However, we would like to remind you that there is a warning about these values. The aforementioned stats were inaccurate, as Delphi Digital’s Larry counted Defi Llama’s Terraswap and Astroport’s TVL twice, shortly after doing the rounds.

stop posting ‘Terra flips BSC in TVL’ lol

it flips because @DefiLlama double counts Terraswap and Astroport TVLs rn

when liquidity is migrated in 1.5 days, we likely will drop back to 3rd

— *larry (@larry0x) December 19, 2021

Double-counted or not, Terra and its native token LUNA have really come a long way since its inception.

At press time, the LUNA is up 10% in one day to close to $78. As a result, the asset entered the top 10 on CoinMarketCap, replacing Polkadot in the process.

What are some of the main reasons behind this unprecedented dominance and where does this TVL, double counted or uncounted this come from?

UST or Terra USD

One of the biggest improvements from the network’s Columbus-5 upgrade in October was a new design experiment to keep stablecoins pegged to their fiat values. Pressing UST lights up the LUNA with the same amount of value. 93 million Luna tokens were burned in the production of UST. UST not only has clear support, but users can also use this UST to lock down multiple DeFi offers with great incentives.

– DeFi Protocols and User incentives

a saving protocol AnchorWith a locked value of $7.14 billion, it is the most popular protocol on the Terra network. Liquid staking protocol Lido and decentralized exchange Terraswap are among the next projects on the list.

Automated market maker Astroport also appeared after the launch of the ‘lockdrop’ event recently. In doing so, it allowed users to lock the LUNA to receive an ASTRO token.

✦ Mission Update | Lockdrop Phase 1b ✦

Thank you, fellow Astrians, for contributing to reaching this spectacular milestone: 1B TVL locked 🌌

Astroport is just getting started together with the whole @terra_money ecosystem. Let’s check the following steps! 🧑🚀

🧵👇 /n pic.twitter.com/nooHiyEOAe

— Astroport ✦ (@astroport_fi) December 19, 2021

LUNA It is followed with interest by many different investors. For example, crypto exchange platforms such as Binance and Kraken started to support the token and its ecosystem. However, if the above claims are true and the amount of locked value is counted twice and this is corrected, the LUNA price may be affected.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.