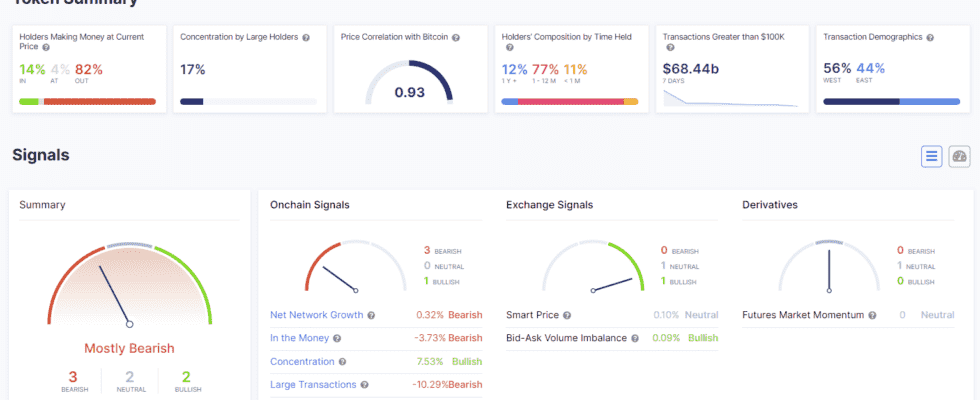

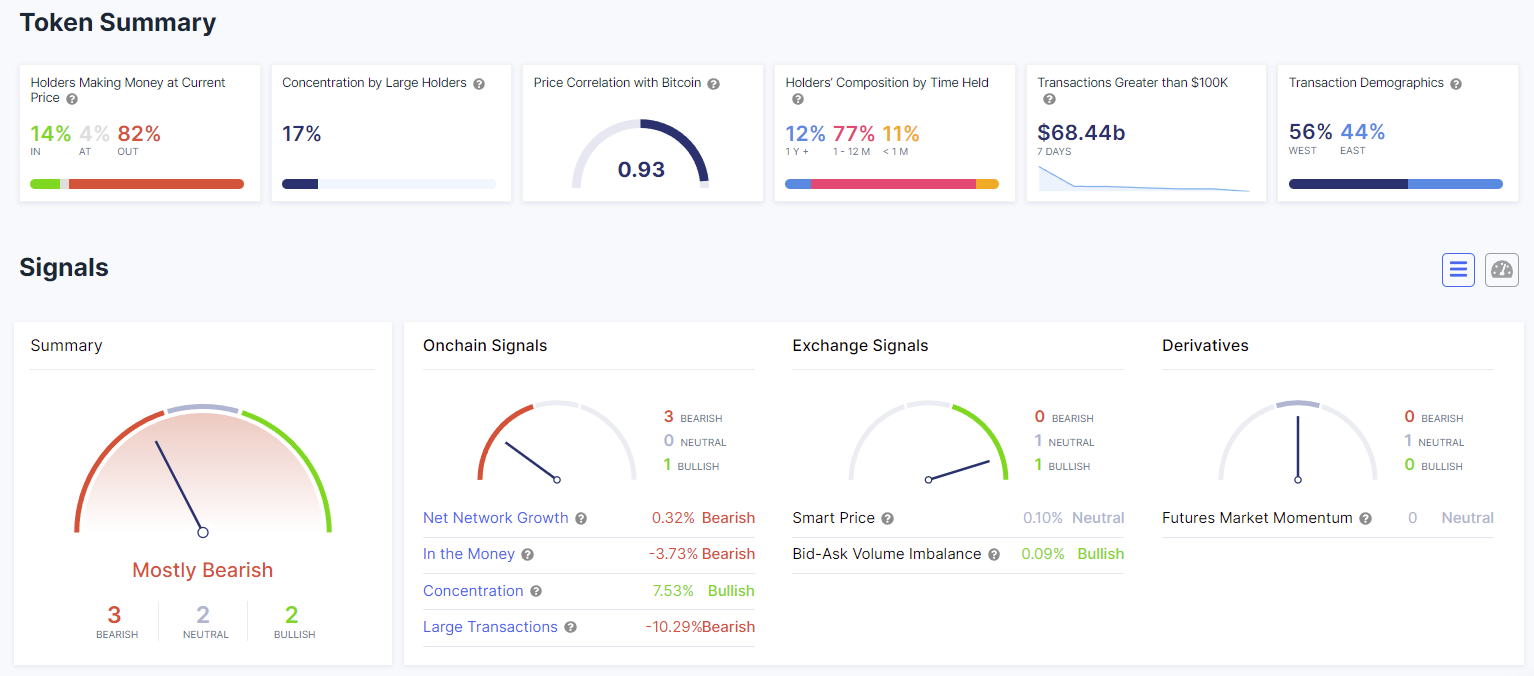

While Cardano’s profitability remains low compared to other popular cryptocurrencies, it seems like major wallets still believe in the project.

The percentage of whales with more than 10 million ADA in their balance reached 46.66 percent on Monday, according to a recent analysis. This is the highest level since the digital asset was trading at one cent.

ADA has always been the holders’ token. One of the largest percentages of the network’s circulating supply is currently staked by investors.

These investors typically think that the best way to profit is to earn tokens by staking while helping to secure the network.

This is what has led to tremendous support for the digital asset, according to experts, and judging by the continued purchases of whales and the growth in accounts, these big wallets seem to be doing the same.

Although Cardano’s profitability is extremely low, whales are actively accumulating

cardano network and its native cryptocurrency ISLANDThe coin has had a pretty successful start to 2022, with a pump of over 54 percent it experienced in March, giving all investors hope that the cryptocurrency has finally broken its long-term downtrend and could eventually pull back. But unfortunately, the same was not the case for the profitability of the coin; because ADA’s profitability remained below 20 percent.

What does profitability tell us?

The profitability of the asset is a good criterion that helps us evaluate the effectiveness of an asset as an investment vehicle, because it shows the percentage of profitability that previous investors have gained from the altcoin.

The profitability metric can also act as an “overbought” and “oversold” signal generator. When an asset’s profitability reaches or exceeds 90 percent, traders or investors are more likely to take profits, resulting in a series of liquidations and further uptrend reversals.

Conversely, when the asset’s profitability is extremely low, more new purchasing power is more likely to flow there, as traders who have lost a lot of money are less willing to sell at the bottom. This creates an opportunity for upward movement.

Cardano’s tough market journey

Although Cardano is one of the most established projects in the industry, it is not a very popular cryptocurrency among retail and institutional investors as it almost missed the bull run between September and November.

However, despite the relatively poor performance in the last months of 2021, Cardano became one of the most actively growing cryptocurrencies on the market in August following the launch of smart contracts technology.

In fact, the recent surge in altcoin was thought to be based on the announcement of a series of DeFi projects and solutions that gradually expanded the use of Cardano and as a result increased demand for the base ADA currency.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.