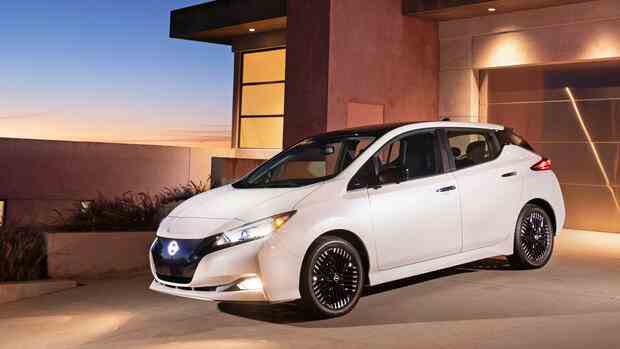

With this model, the Japanese car manufacturer is one of the pioneers of electromobility.

(Photo: AP)

Tokyo The Japanese carmaker Nissan raised its sales targets for electrified vehicles worldwide and especially in Europe on Monday. The share of battery electric cars and hybrid cars in sales is expected to rise to 55 percent by 2030 – five percentage points more than the most recent forecast from November 2021.

By then, 19 electric cars and eight hybrid vehicles are to be brought onto the market – four more vehicles powered exclusively by electricity than previously planned.

Nissan expects the momentum for electric cars in China to slow down. For Europe, on the other hand, the group has increased the value from 75 to 98 percent. The region has become “a core market” alongside Japan, the United States and China, Chief Operating Officer Ashwami Gupta said on Monday.

Nissan relies on a special hybrid variant

Despite a recent market share of just under two percent, one can learn from trends in emission regulations, customer demand and the acceptance of electric vehicles. “That’s why Europe matters,” Gupta said.

The carmaker, who was one of the pioneers of electromobility with the Leaf, relies on its alliance with Renault. With a French platform, Nissan can close a gap in the so-called B segment and access Renault’s financial services in Europe. In addition, Nissan not only sells fully electric mobility, but also its own hybrid variant E-Power.

This drive combines an electric motor with a small and therefore cheaper battery and a small combustion engine as a power generator. This distinguishes Nissan significantly from local competitors Toyota and Honda, which combine combustion engines and electric motors for the drive.

>> Read about this: Renault and Nissan agree partnership on an equal footing

Nissan expects the use of the electric drive to make production much easier and cheaper. This allows the group to use more engine parts than its rivals in both hybrid and all-electric models, increasing volumes and reducing production costs.

Apparently, the idea has resonated with customers. In Europe, Nissan’s electric cars account for 17 percent of sales, while e-power models account for 21 percent. In Japan, the difference is even greater at 11 percent to 41 percent. But the Japanese have not yet completely dispensed with combustion engines. Nissan wants to offer customers multiple drives and then let them decide, Gupta said.

Local production in the US, less momentum in China

In the USA, too, the Japanese want to increase their share of electrified vehicles from the current two to more than 40 percent by 2030 and expand local production. They want to benefit fully from the purchase premium of $7,000 per car, which the US government ties half to the production of vehicles and batteries in the North American free trade zone NAFTA.

From 2026, Nissan even wants to meet the condition that the raw materials for the batteries must not come from China. How Nissan wants to implement this in concrete terms was left open by Gupta, as was a problem with the battery manufacturer Envision AESC. The company, which emerged from Nissan’s own battery production with the Japanese technology group NEC, is majority Chinese-owned. However, Gupta emphasized that the carmaker is in close negotiations with the US and Japanese governments to find solutions.

The carmaker wants to benefit from the US subsidies for electric mobility.

(Photo: Bloomberg)

In China, on the other hand, Nissan has lowered its expectations for the share of electrified drives from 40 to 35 percent. He cited the dominance of local manufacturers as the reason. But the demand for electric vehicles is also not increasing “as much as expected for 2018, 2019 and 2020”.

>> Read about this: The Chinese EV market is ‘brutally competitive’

Gupta attributed this to the postponement of stricter emissions regulations that would accelerate the spread of electric cars in Europe. “The use of internal combustion engines will therefore definitely last a little longer than expected.”

Another pillar of the strategy is the development of cars into software platforms. For Nissan, programs and services are becoming a core competency of automakers that the Japanese want to control themselves.

Gupta wants to cooperate with companies on the software. But he promises “100 percent Nissan software for all advanced mobility technologies”. Overall, Nissan wants to employ more than 4,000 software engineers in-house and with partners, four times as many as planned a year and a half ago.

More: From because of discontinued model: Japan celebrates the mini car