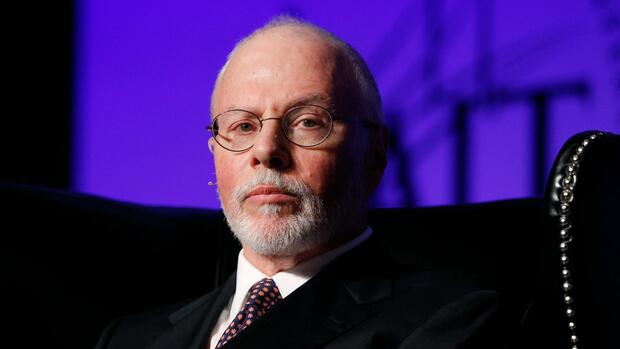

Paul Singer accuses the metal exchange LME that the market intervention was unjustified and unfair.

(Photo: Reuters)

London A court case begins in London on Tuesday that could have far-reaching consequences for the commodity markets. The American hedge fund Elliott Investment Management has sued the 146-year-old London Metal Exchange (LME) for allegedly unjustified interventions in the nickel market.

Elliott, who is led by the controversial financial investor Paul Singer, is now seeking damages of around 456 million dollars (490 million euros) before the London High Court.

Should Singer prevail with his claim, the LME is threatened with a flood of lawsuits from other investors who were affected by the so-called “nickel crisis” in March of last year.

The LME suspended trading in nickel on March 8, 2022 and at the same time canceled contracts worth around four billion dollars. This was preceded by an unprecedented increase in the price of nickel by up to 250 percent within two days, also because many traders feared a supply bottleneck after the outbreak of war in the Ukraine.

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Further

Read on now

Get access to this and every other article in the

web and in our app.

Further