The cryptocurrency market is buzzing with excitement as the New York Stock Exchange (NYSE) takes a significant step to expand trading options for spot Bitcoin Exchange Traded Funds (ETFs). In just three days since their launch, spot Bitcoin ETFs have witnessed a significant increase in trading volumes, reaching an impressive $10 billion. But the latest development suggests that options trading may soon become a reality for these ETFs, opening up new avenues for investors.

Options trading for spot Bitcoin ETFs

Last Saturday, Bloomberg analyst Henry Jim reported a groundbreaking development: The NYSE filed a 19b-4 application seeking approval for the listing and trading of options on Commodity-Based Trust Shares, in accordance with the structural framework of the recently introduced Bitcoin ETFs. Bloomberg senior ETF strategist Eric Balchunas emphasizes the importance of this application and expects potential approval within two months. If approved, options trading would not only increase trading volume and revenue for the NYSE, but would also increase liquidity for the newly introduced BTC ETFs.

James Seyffart, a Bloomberg strategist, provides insight into the potential timeline for approval, speculating on delays based on the SEC’s historical approach. The approval timeline, which ranges from faster approval to waiting until late September or early October 2024, comes amid growing interest in the convergence of traditional financial markets and the cryptocurrency ecosystem.

ProShares introduces five new leveraged ETFs

Simultaneously, leading investment products provider ProShares filed with the U.S. Securities and Exchange Commission (SEC) for five different leveraged spot Bitcoin ETFs. These ETFs, consisting of ProShares Plus Bitcoin ETF, ProShares Ultra Bitcoin ETF, ProShares UltraShort Bitcoin ETF, Proshares Short Bitcoin ETF and ProShares ShortPlus Bitcoin ETF, offer various investment opportunities by offering different leverage options.

Eric Balchunas touched on the importance of leveraged Bitcoin ETFs, predicting that a dozen such ETFs may appear on the market in the coming months. But ETFStore’s president highlights Vanguard’s firm stance against hosting these leveraged ETFs on its platform, highlighting differing perspectives in the investment community.

What is the latest situation in Bitcoin price?

Amid these developments, asset management giant Grayscale continues to play a key role in increasing Bitcoin ETF trading volumes. James Seyffart’s latest update reveals significant net outflows, specifically predicting a significant outflow of approximately $594 million from Grayscale’s Bitcoin Trust ($GBTC). While the dynamics of fund flows in the Bitcoin ETF market remains in focus, several other Bitcoin ETFs are experiencing inflows, raising questions about their ability to offset significant outflows from $GBTC.

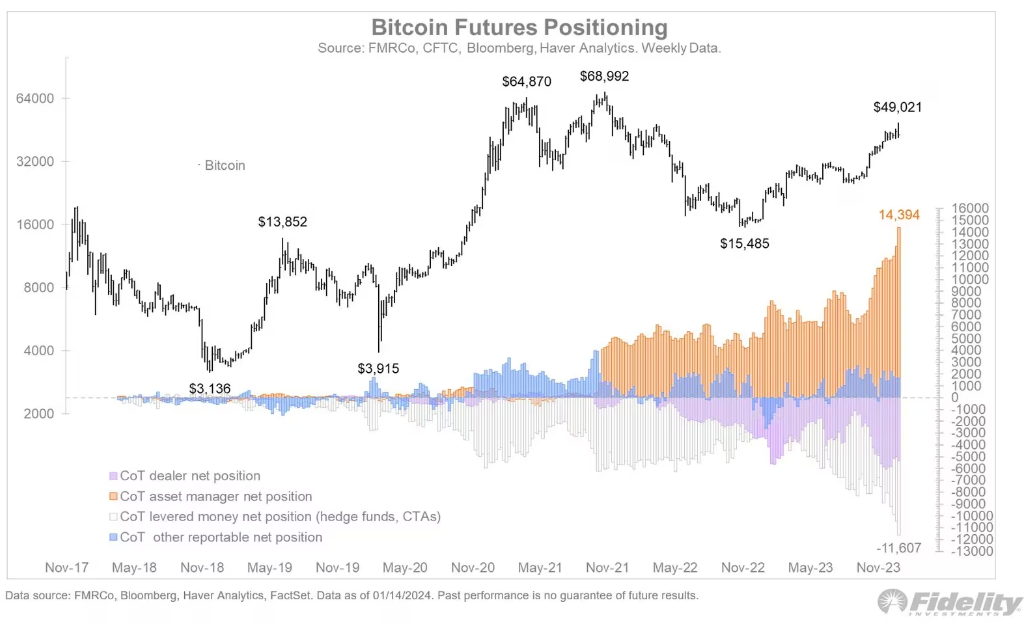

Meanwhile, the Bitcoin price corrected almost 7% last week following the approval of BTC ETFs. Fidelity’s Jurrien Timmer sees this as a short-term position adjustment rather than a long-term trend reversal. Timmer expects consolidation of recent gains considering current market dynamics, despite some forecasts for a drop to the $32K to $38K range.

Timmer’s analysis suggests that the sell-off may be a “sell the news” moment and time is needed for recent gains to consolidate. Despite short-term volatility, many asset managers maintain a significant net long position in the Bitcoin futures market. Additionally, the recent “golden cross” with BTC’s 50-week simple moving average breaking above its 200-week average adds an interesting dimension to the market dynamics, indicating a potential long-term uptrend.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.