According to Hasrate Index’s second quarter 2022 report, the negative effects of the bear market continue to put pressure on Bitcoin (BTC) miners.

Hasrate Index 17 July an important factor in Bitcoin mining, according to its report dated difficulty level especially in the second quarter of 2022 compared to last year. showed a slowdown. The miners’ inability to make enough profits and their helplessness in the face of falling prices continues to create selling pressure. Bitcoin in the second quarter of 2022 7-day moving average difficulty Only 7%showed a growth. in the first quarter of this year 15%and in the last quarter of 2021 %27According to the data in the report, the mining difficulty level increased by has lost its bullish momentum turns out to be.

In the report, old generation mining rigs “except for miners with low or almost free electricity” It has been argued that its use has now become completely unprofitable. For mid-generation machines, electricity consumption costs 0.07 USD/KWhIt is stated that the producers below . Especially 0.08 USD/KWhEven miners with the latest generation equipment, which have an electricity consumption of more than 1,000,000 have to continue to work at low profitability rates. Based on average electricity prices Antminer S19XP It is currently the most profitable Bitcoin mining device on the market.

In the table below ASIC Antminer Electricity price-based profitability ratios of the devices are included.:

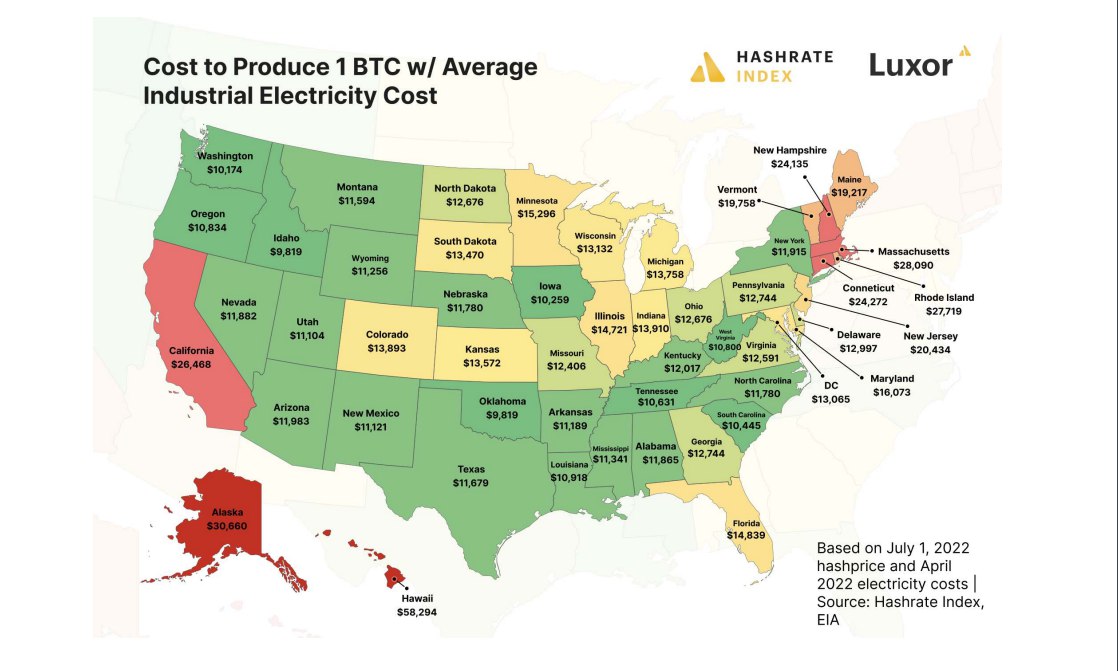

The report also US states A study was carried out on According to this research To generate 1 Bitcoin Considering the average energy cost required Idaho and Oklahoma, $9,819 with cheapest It is among the states where Bitcoin can be produced at a price. 1 July According to the research carried out considering the energy costs in the history of Hawaii if $58,294To produce Bitcoin with a cost of It is the most unprofitable state.

in 2021 FEDDue to the fact that . But by the first half of 2022, rising inflation and loan interest rates on the dollar higher than last year caused a decline in borrowing opportunities. As noted in the report, Bitcoin miners are now both trying to pay off debts as well as to increase equity They are looking for new methods.