The long-dormant Mt. Gox saga has taken a dramatic turn, sparking concern and anticipation in the crypto community. After a decade of legal turmoil following a massive hacking attack, the defunct exchange appears ready to begin repayments to creditors, potentially sending a wave of Bitcoin and altcoin Bitcoin Cash (BCH) into the market. Here are the details…

Mt. New development for Gox creditors

Mt. Gox has officially postponed the overall repayment date to October 2024, recent developments suggest that some creditors may receive their compensation in Bitcoin as early as the next two months. This news, fueled by reports of email verification processes and confirmed account ownership claims, fueled speculation about the potential impact on the market.

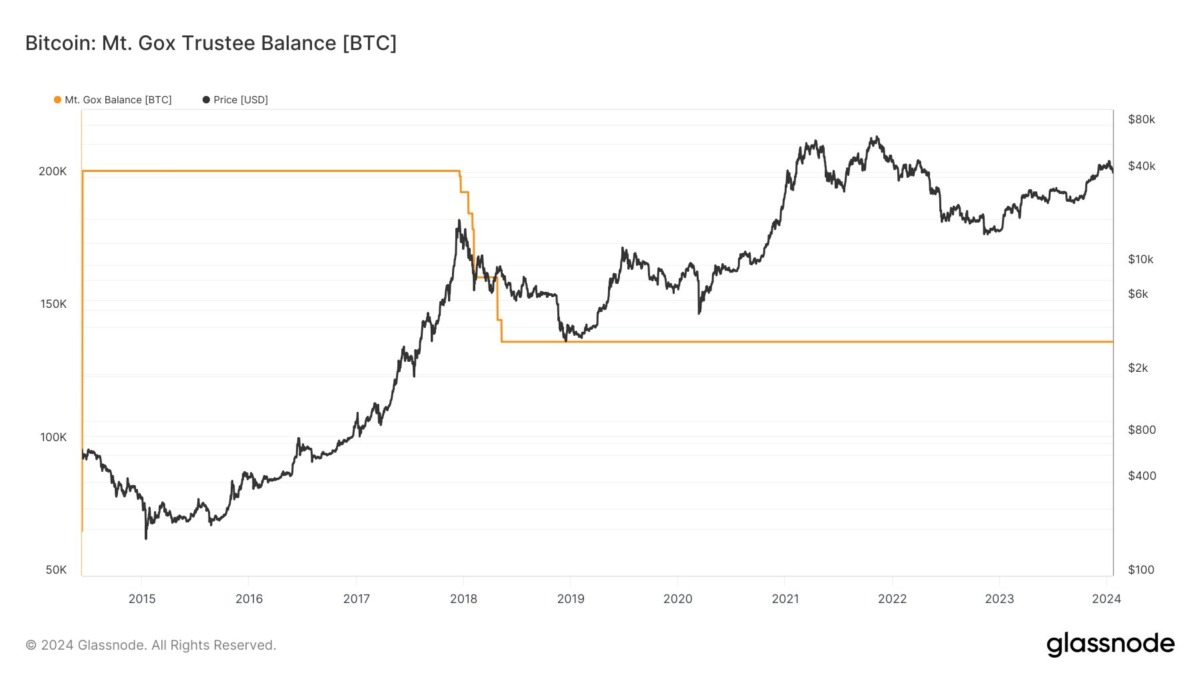

While estimates vary widely, the potential volume of Bitcoin released is staggering. While some sources whisper 142,000 BTC, others paint a bleaker picture with figures as high as 200,000 BTC – roughly 1.1% of the total current supply. Adding to the complexity, Mt. Gox holds 143,000 BCH, further raising concerns about a double whammy for market dynamics.

Bitcoin will flow into the market

Market participants are particularly cautious about the possibility of 200,000 BTC being released in the next 60 days. This coincides with Mindao Yang’s warning on Twitter, where the dForce Network founder emphasized that various factors such as GBTC re-pricing and Bitcoin halving are coming together to create a perfect storm for “interesting supply dynamics.”

Conflicting reports regarding the method and timing of refunds add further fuel to the fire. While Reddit sources are calling for early Bitcoin distributions for some creditors, experts disagree. While some believe the refunds will be spread out throughout the year, others fear a single large dump. This uncertainty adds another layer of volatility to an already tense atmosphere.

What is the potential impact on the market?

Mt. The potential flow of Bitcoin from Gox has undoubtedly cast a shadow of doubt over the stability of the market. Concerns that creditors seeking cash equivalents will sell are evident. But some experts, such as Yang, suggest that selling pressure may ease given the debt sell-off over the years. Market sentiment remains cautiously optimistic, which is reflected in Bitcoin’s increasing trading volume. While the price has fallen in the last 24 hours, traders appear to be actively positioning themselves in anticipation of the coming months.

Mt. Gox saga is not over yet. As creditors grapple with the complexities of getting refunds, the crypto community is holding its breath, preparing for the potential impact on the market. In the coming weeks and months, the world will be watching to see whether this once-dormant giant will unleash a Bitcoin tsunami and reshape the crypto landscape forever.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.