Phantom (FTM) experienced a meteoric rise on December 14, achieving an impressive rally of 18%. This fluctuation seems to have enabled the altcoin to reach the highest level since May.

At the time of writing the news altcoin It is trading at $0.4224. In this context, according to data from CoinMarketCap, FTM remained at a high level of 6% in the last 24 hours.

O to PhantomCurrent Demand is at its Highest Level

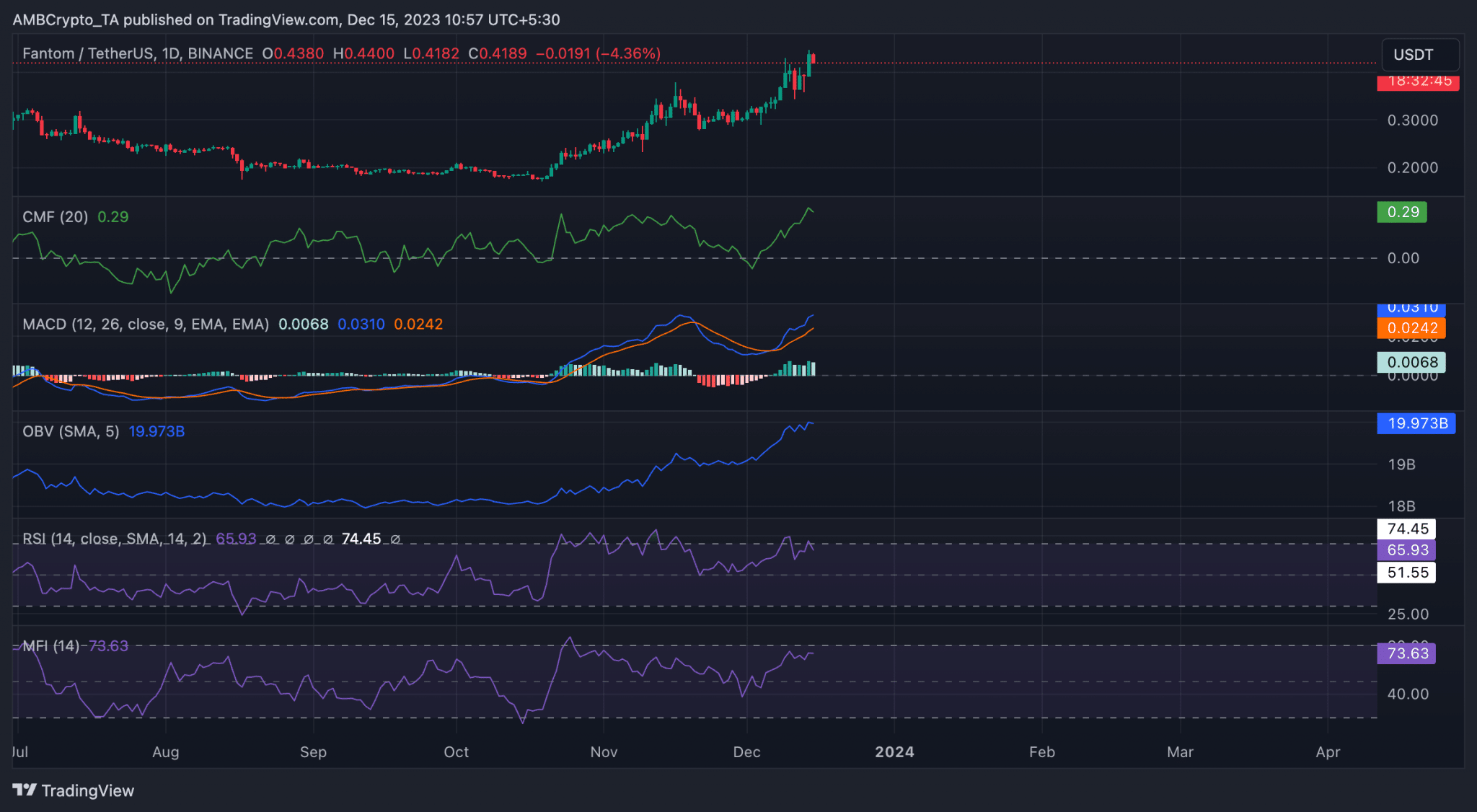

Last week saw an increase in demand for FTM. Evaluating the token’s performance on the daily chart revealed that a new bull cycle began on December 6. On that day, the token’s Moving Average Convergence/Divergence indicator (MACD) witnessed the MACD line crossing with the trend line in the uptrend. When an asset’s MACD line crosses above the trend line and begins trending upward, this is considered a bullish signal.

Koinfinans.com As we reported, this crossover showed that the short-term moving average (MACD line) broke above the long-term moving average (signal line) and the bulls re-emerged. Since the bulls emerged to displace the bears on December 6, the price of FTM has increased by over 20%. Since the MACD crossover, the token’s Chaikin Money Flow (CMF) has started an uptrend. This indicator measures the volume of money flowing into and out of the asset. So when it rises like this, more money comes into the market and pushes the price up.

Additionally, key momentum indicators are positioned near overbought levels, indicating that FTM accumulation has exceeded token distribution. For example, the token’s Relative Strength Index (RSI) is 65.93, while its Money Flow Index (MFI) is 73.63.

Likewise, FTM’s On Balance volume, which was 19.97 billion at the time of writing, also reached an all-time high. This indicator is used to measure the buying and selling pressure of an asset. A rise in OBV indicates strong buying pressure, indicating that investors are accumulating the asset.

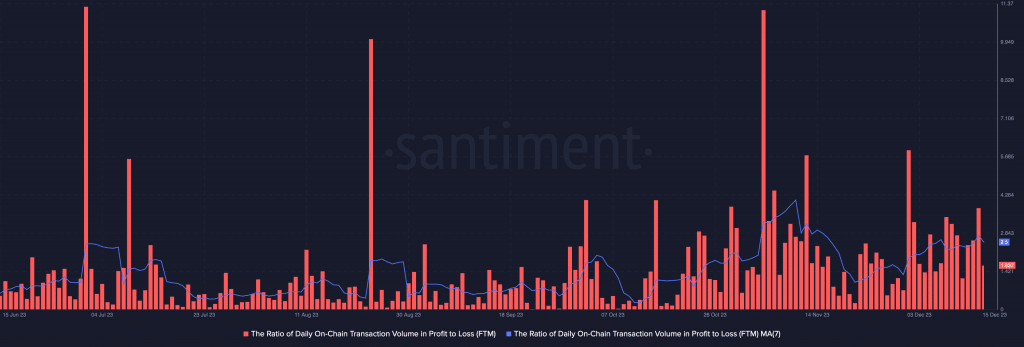

Last week’s price increase also caused an increase in the profit/loss ratio of daily FTM transactions.

The rate evaluated on the seven-day moving average was 2.5. This means that for every FTM trade that resulted in a loss in the last seven days, 2.5 trades resulted in a profit.