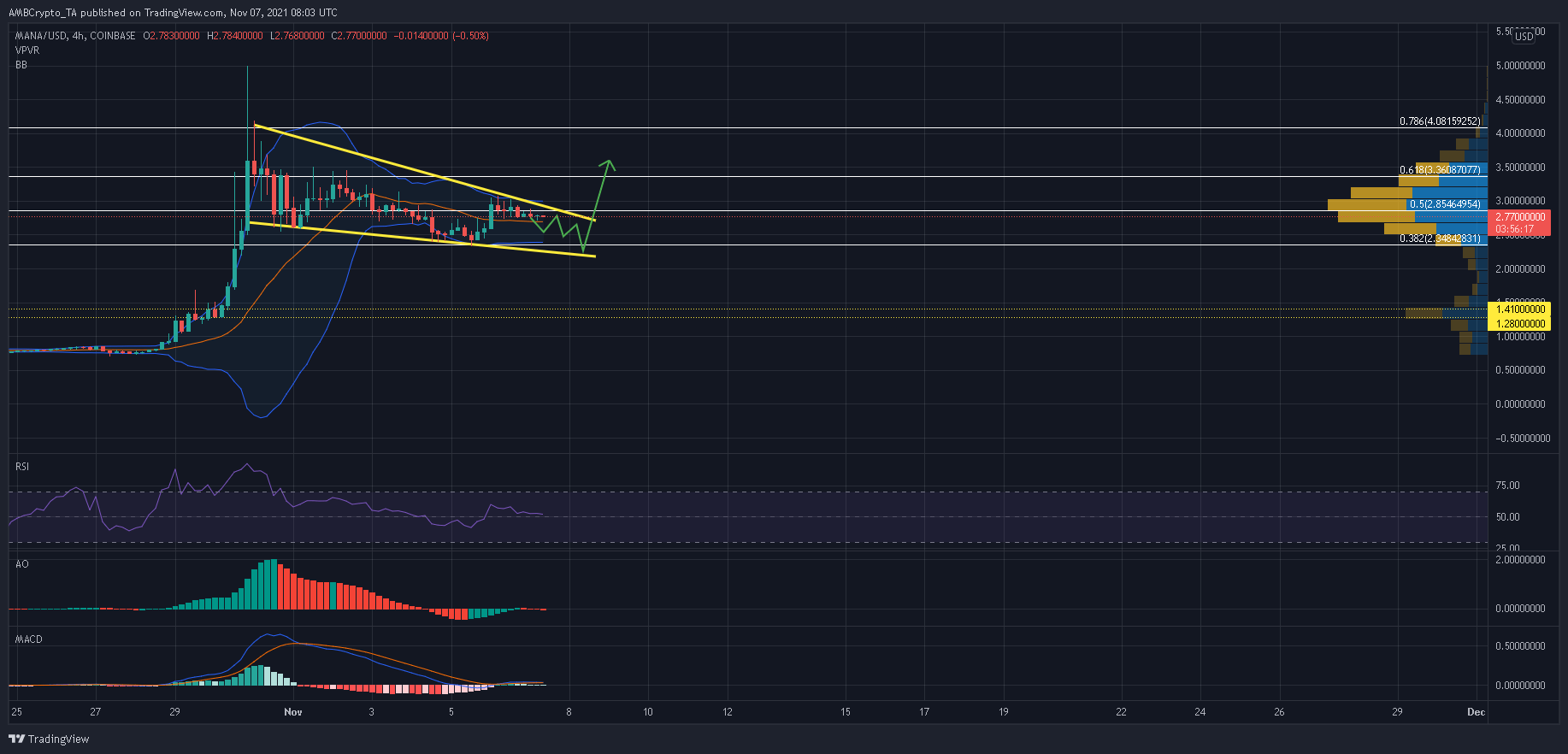

metaverse one of the assets Decentraland (MANA) altcoin towards the end of October 500%Although it had a huge breakout, it has now taken a step back. MEANING It lost 24% of its value last week, trading between the 61.8%, 50% and 38.2% Fibonacci levels.

Bollinger Bands given its compressed nature, MANA may continue on a “falling line” before experiencing an uptrend again. MANA is currently trading down 5.3% at $2.77.

MANA 4-Hour Chart

last week MEANING, 61.8%, 50% and 38.2% Fibonacci realized a high rate of “cooling” between levels. At this stage, successive lower highs (lower highs and higher lows) led to a falling wedge setup. In the short term, a narrowed Bollinger Bands and Awesome Oscillator A weak momentum throughout could allow MANA to continue moving forward within the falling wedge.

When MANA retests the 38.2% Fibonacci level, it could create an opportunity for buyers to experience a 35% breakout. After a successful breakout, MANA will easily see above the 61.8% Fibonacci level. Meanwhile, $3.5 and $3.68 will appear as important resistances on the way to $4.

If MANA dips below $2.19, rapid pullbacks could be seen as sellers failed to form a strong support level. According to the “Visible Range Profile” model, key support lines for MANA lie between $1.28 and $1.41.

The 4-hour RSI had rebounded from overbought levels a week ago. MACD and the Great Oscillator experienced the same setback. MEANING If it follows in the footsteps of the previous uptrend, an upside break could occur when the price retests the 38.2% Fibonacci level.

If investors are waiting for the next rally, they can buy at these levels and wait for a long time. If the MANA price is dominated by bears and pushes the price below $2.19, the price could drop very sharply. Therefore, traders can place a “stop-loss” order at $2.19.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.