Together, we look at the interesting and impressive life journey of the mathematical genius who taught at Harvard and MIT, worked at the National Security Agency to break Soviet codes, and eventually became the best in the field of finance.

Have you ever heard of Jim Simons? Alright one of the best investors in modern history Would it be an exaggeration to say? Of course no.

How can mathematical genius Jim decipher markets better than economists? Now this is all together ‘The Genius of Financial Markets’ Let’s examine.

Great investors usually do their education in economics and business.

An investor is a person who creates a portfolio for himself or his company, especially with stocks on the stock exchange, and uses his capital in his possession. taking risks People who try to increase it. Sometimes they can act alone and sometimes as a group.

In order to be a good investor, it is actually necessary to receive training in this field. So much so that the world famous investor Warren Buffett studied business administration. Another famous investor, Peter Lynch, had a master’s degree in business administration. But the Jim Simons we will talk about today is a little different from them.

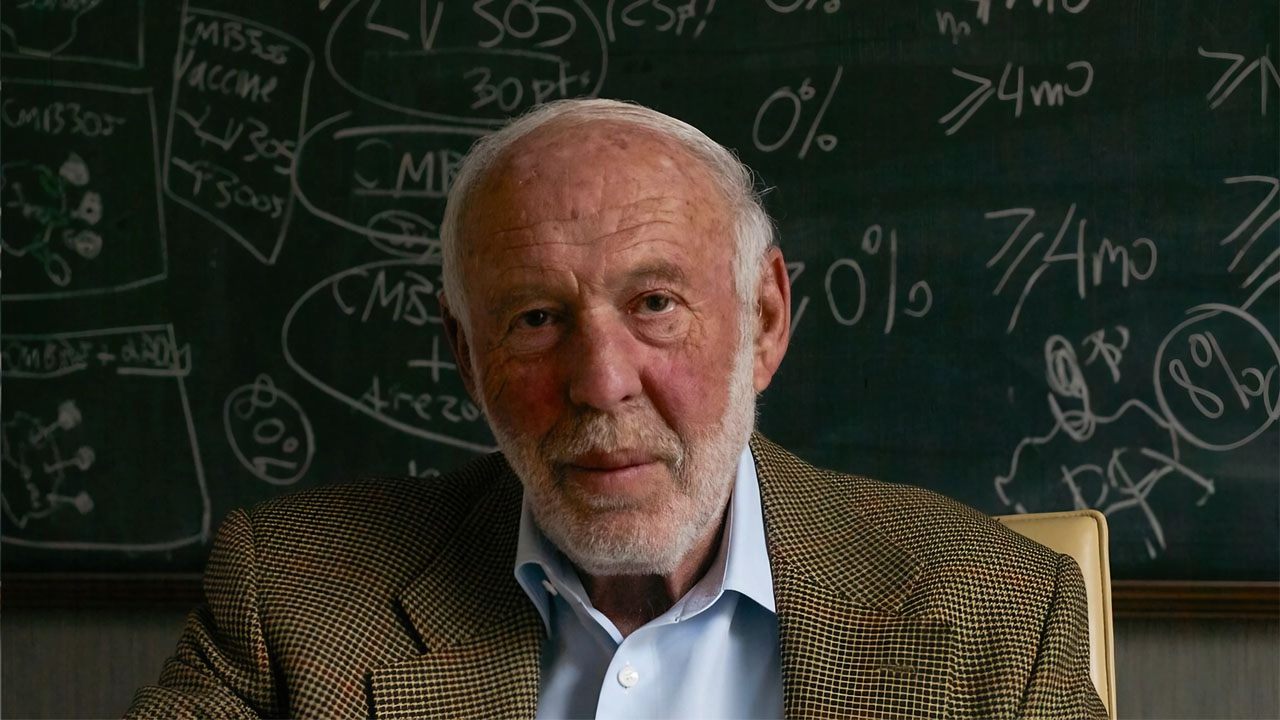

He was obsessed with mathematics since childhood.

He was born in 1938 in Brooklyn, USA. He loved to read books, but he really His interest was in numbers.. He would divide numbers backwards by two, multiply them by two, and perform operations in his head. His family considered him a genius. And so it was.

Despite everything, his family did not care about his interest in mathematics and wanted him to become a doctor, but he wanted to study at MIT (Massachusetts Institute of Technology) and teach there. And so it was. He received his doctorate at the age of 23 and He taught at MIT.

He attributed every subject to mathematics and patterns, and thought about them day and night.

Jim, who stands out with his intelligence as well as looking at life from a mathematical perspective, also taught at Harvard. The period in which he was teaching coincided with the Cold War period. That’s exactly why he needed to break Soviet codes. To the Institute For Defense Analyses was called.

In his interview with TED under the title “The mathematician who cracked Wall Street | Jim Simons”, Jim explained this work: “Actually, they didn’t call it exactly. An operation where they hire mathematicians to break secret codes and such There was. They were paying a lot of money. So it was an overwhelming job.” he explained.

He entered the job with no experience. fast code cracking algorithm developed. Again, in his interview with TED, he mentioned that they only spend half of their time breaking codes and developing algorithms, while the other half is free and free. He spent his free time researching the world of finance.

He was fired from his job in 1968 and the financial period of his life began. So why?

While he continued his code-breaking work, he began to disagree with people at work about the Vietnam War. He explained this in his TED interview by talking about his bosses. Since the bosses are war supporters and because he finds war stupid He said that he gave an interview to Newsweek Magazine and was fired exactly 5 minutes after hearing about it.

After being fired, a founded Monemetrics, a hedge fund management firm. He decided to think mathematically instead of conventional methods to unravel markets and their patterns. In order to find the password of the markets, you need to use mathematical knowledge and perspective. A system had to be developed. For this reason, he first started collecting computers.

In early 1980, he changed the name of Monemetrics to Renaissance Technologies and fully joined the financial world.

World Bank Archive

He wanted to establish a system that would be based entirely on quantitative analysis. For this hired programmers, mathematicians, physicists and cryptographers and formed his team. With this team, he collected large amounts of historical data from the World Bank, stock markets and foreign exchange price records and transferred them to computers. While other investors focused on instantaneous changes, Jim was thinking about seeing and analyzing the math part of the business. Because these markets had to have a logic.

Thanks to the high data storage space and live tracking system, his team began to access information that no one else could access. Thanks to Jim, the team put everything into mathematics and science and finally thick develop secret automatic strategies based on mathematical and statistical models He succeeded.

The fund they called the Medallion fund became the most profitable fund ever.

Medallion Fund from 1998 to 2018, before fees 66% annual return achieved and outperformed legendary investors. This percentage was updated to 71.8% in 2014. Well Profit over 100 billion dollars was obtained.

All investors wanted to enter the fund, which made a very high profit. But this fund is currently only to company owners, company employees and a few selected investors is open.

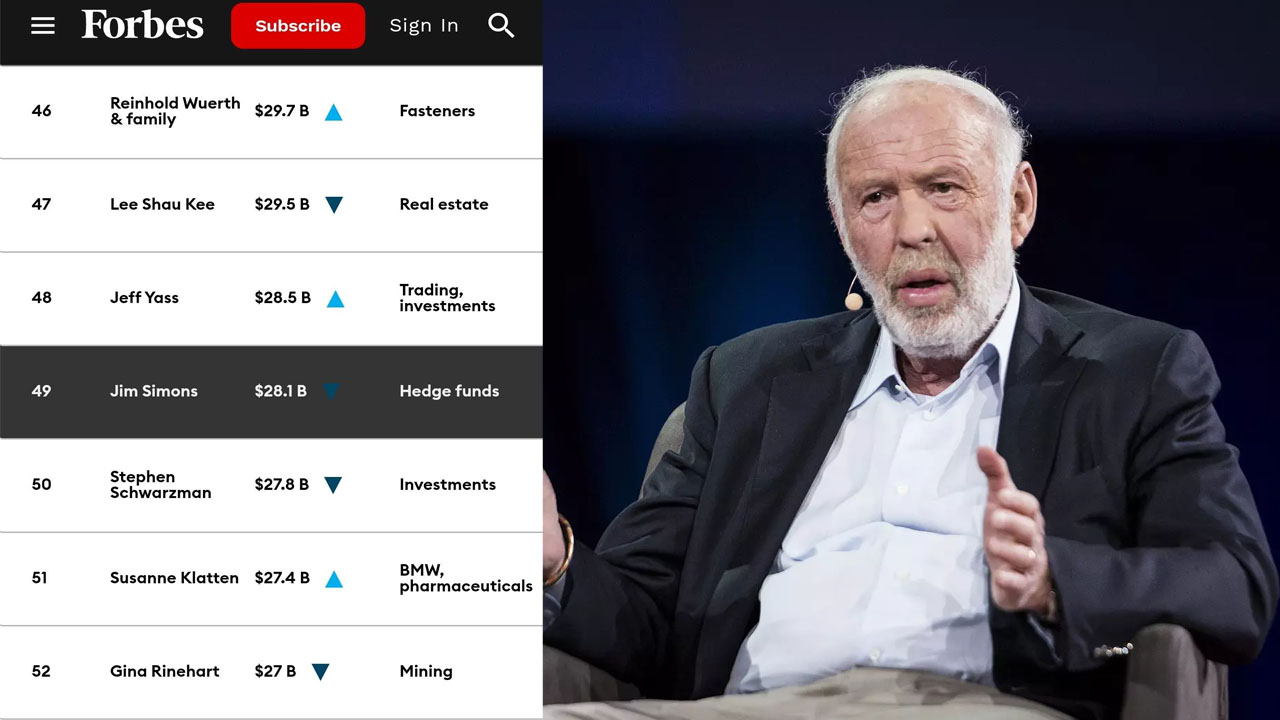

Jim Simons is in the top 50 on the “Forbes – World’s Richest People” list.

Jim gained a great fortune thanks to his high knowledge of mathematics and, more importantly, being a ‘mathematical genius’. According to Forbes data He has a wealth of 28.1 billion dollars. With this wealth, he is on the list of the richest people in the world. during 49th It is located.

With his wife in 1994 He founded the Simons Foundation and donated $2.7 billion of his fortune to this foundation.. The purpose of the foundation is to support education, health and autism research. In addition, in 2004, the aim was to develop mathematics and science teachers. founded Math for America.

So his wealth; Apart from mathematical knowledge, financial skills and intelligence being a helpful person It is also at the forefront with. Considering all this, communities see no problem in calling him the best investor ever.

Our other content about investment:

RELATED NEWS

What Is The Rug Pull Scam That Makes Investors Feel Like The World Is Collapsed?

RELATED NEWS

What kind of investment would we make with the 13.9 million dollars lost by Arda Turan? We would get a 253% profit.

RELATED NEWS