Mike McGlone, senior macro strategist at Bloomberg Intelligence, bitcoin that its price will face a major test in the second half of 2023. warns.

Mike McGloneconsidering that after the strong performance in the first half of the year, BTC will probably have to endure tough recession conditions over the next six months.

The macro expert also underlined that the stock market will start to decline, and Bitcoin will have a chance to prove itself as a store of value or “digital gold” by not falling along with stocks.

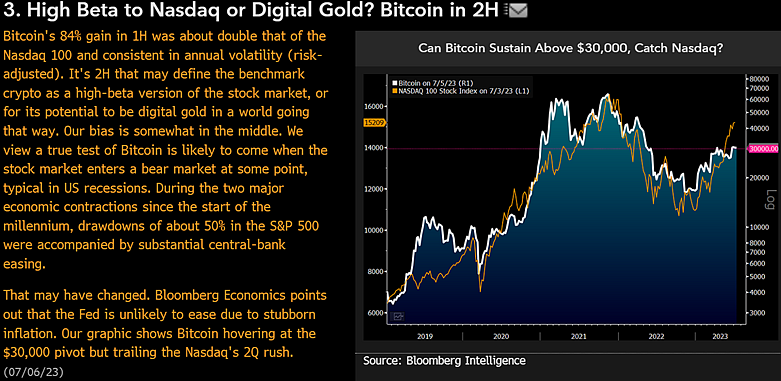

Bitcoin’s 84% gain in the first half was nearly double the Nasdaq 100 and was consistent in terms of annual volatility (adjusted for risk). The second semester could define crypto as a high-beta version of the stock market, or the potential to become digital gold in a world headed in that direction.

NEWS CONTINUES BELOWOur trend is somewhat in the middle. We think the real test of Bitcoin will happen when the stock market enters a bear market at some point, which is typical in US recessions.

Mike McGlone also referred to previous recessions, noting that the Federal Reserve was too quick to loosen its monetary policy. However, he expects no such easing policy in the current situation because inflation is already high.

According to McGlone, a weakening in the second quarter of the year as stocks gained as top digital assets tracked by the Bloomberg Galaxy Crypto Index (BGCI) fell. cryptocurrency market has already emerged.

McGlone also noted that headwinds are coming for risky assets like Bitcoin, as Bloomberg Economics predicts a recession in the second half of the year with US unemployment rising from 3.6% to 4.3%.

You can follow the current price action here.