There is a series of events that have an earthquake effect in the crypto money markets. So much so that UST (TerraUSD), which is among the stable coins, has regressed to the level of $ 0.4. The depreciation of LUNA, the altcoin of the Terra network that supports UST, reached 97 percent.

“Strange” events are taking place in the cryptocurrency community, which has been shaky for a while. So much so that it is basically a stable coin indexed to the dollar. TerraUSD (UST) has inflicted huge losses on its investors. According to the information obtained, the team had to sell 3 billion dollars of Bitcoin and the events that followed, swept the markets. The LUNA altcoin of the Terra network, which supports UST, has lost around 97 percent of its value.

Those who deal with cryptocurrencies know; stable coins are generally dollar indexed and their values are also $1.01 to $0.99 varies in the range. These cryptocurrencies are essentially unofficial crypto versions of the dollar. Here at TerraUSD was one of them. Although there is no clear information for now, according to the allegations, someone or someone has paid for TerraUSD. he had an operation. That’s the operation, with the stable coin losing more than 50 percent of its value. up to $0.44 levels led to its decline. This situation put the investor, who held UST as stable coin, in trouble most… As Terra’s efforts did not yield any results, the extent of the loss reached incredible proportions.

It is said to have a $3 billion deficit.

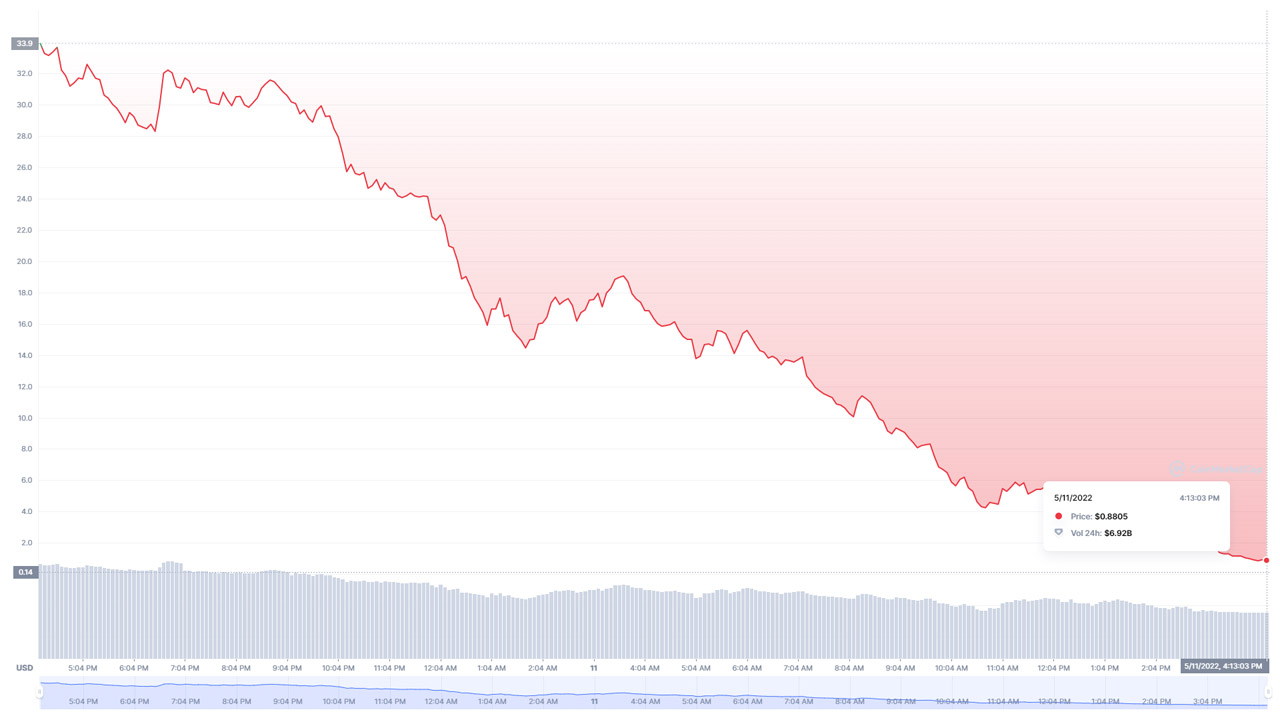

*You see the UST price chart.

According to unproven claims, the events in the UST worth $3 billion It is stated that it is due to the fact that Bitcoin is bought with debt and then this Bitcoin starts to be sold. It is not known who or who is behind the incident.

LUNA, whose value was $ 120, fell to $ 1.1

*You see the LUNA price chart.

LUNA, the cryptocurrency of the Terra network, has been hit hard by the events. in April From $120 levels LUNA, which is traded, is currently trading at $ 1.14 levels. The panic atmosphere in the crypto money community, especially bitcoin It has spread to all cryptocurrencies, including…

LUNA investors revolted on social media

Even in the last 24 hours of LUNA 97 percent The depreciation of around 900 meters caused the reaction of the investors. Users who shared numerous posts on social media almost rebelled against what happened. Here are some of the investors’ shares on the subject…

How to recover the events experienced, so that the value of a stable coin can reach the level of 1 dollar again. about what can be done still on the table. The LUNA Foundation, which stands behind TerraUSD, is also looking for solutions. So what will the investor do? To be frank, the investor holding the UST there is nothing he can do. Because the cryptocurrency, which should normally be around $1, is facing an unprecedented situation. If the current situation cannot be corrected, those who buy dollars from the bank or prefer UST over more established stablecoins such as Tether (USDT). investor’s job looks like.

US Treasury Secretary Statements After Collapse of LUNA and IHR

A series of events that have an earthquake effect in the crypto money markets US Treasury Secretary Janet YellenIt did not go unnoticed. “The stablecoin known as TerraUSD ran into a problem and lost value. I think this (stable coins) is a rapidly growing product and the risks it poses are also growing rapidly.” Minister Yellen said, “Digital assets for the financial system can create risks. Coordinated regulation needs to be established.” said…

This content is not investment advice…

Source :

https://www.haberturk.com/abd-hazine-bakani-yellen-den-terrausd-ust-aciklamasi-3434762-ekonomi