Tokyo Investors appeared to have anticipated Softbank’s record loss on Thursday. The share price of the world’s largest technology investor fell by eight percent by the time the Tokyo stock exchange closed. Only then did Softbank present the official figures. The bottom line is the largest quarterly loss in the history of the Japanese company.

Overall, the shortfall in the past fiscal year added up to 1.7 trillion yen (around 12.5 billion euros) – caused primarily by the fallen prices of technology stocks in Softbank’s portfolio.

The crash is big: last year, Softbank reported the highest net profit in its history at five trillion yen (around 36.7 billion euros). But the rapid decline in the value of tech stocks caught the busy investor off guard. Softbank adjusts the value of its holdings on a quarterly basis and recognizes gains and losses in its financial statements even if they are unrealized. The fund division therefore made a loss of 2.64 trillion yen (20 billion euros), more than ever before.

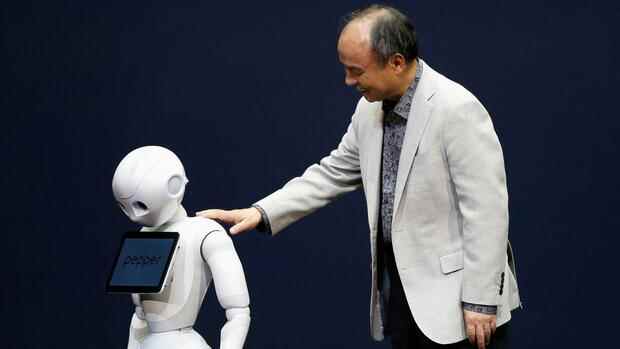

The change from a technological conglomerate to an investment group, which has been massively promoted in recent years, is now taking its revenge. Founder Masayoshi Son launched two billion-dollar funds to invest in start-ups, which he believes have disruptive potential: the Vision Fund alone is worth $100 billion, and its successor, Vision Fund 2, has a further $51 billion.

Top jobs of the day

Find the best jobs now and

be notified by email.

But technology stocks have been under more pressure worldwide in recent months than many classic corporations. In addition to concerns about the global economy, it is above all the rising interest rates that have slowed the rise of many start-ups. In China, an important market for Softbank’s investments, stricter regulation is slowing down what was once a booming sector.

There are also problems with unlisted technology companies, whose valuations are also under massive pressure. This is particularly noticeable with Vision Fund 2, which has invested money in the Berlin solar startup Enpal, the logistics service provider Forto and the e-scooter company Tier, among other things. Competitors like Tiger Global had a similar experience recently.

Grab and Didi flying low

The share price of Korea’s e-commerce giant Coupang alone fell by 40 percent in the past quarter. It was even worse for the Asian competitors of the ridesharing service Uber: The prices of Grab in Singapore and Didi Chuxing in China have more than halved.

In the past financial year, the Japanese had also risen to become the largest single shareholder in Deutsche Telekom behind the federal government. Softbank wants to work more closely with the Bonn-based Dax group in the future. In order to get fresh capital to finance the multi-billion share buyback program, the company recently sold shares in the Telekom subsidiary T-Mobile US to the Bonn-based company.

Softbank is currently making profits primarily from its Japanese mobile network Softbank and the British chip designer Arm, whose merger with the graphics card manufacturer Nvidia failed. But they cannot currently compensate for the high losses from the investments.

>> Read about this: One-man cult, price drop, manager flight: How the major investor Softbank is struggling for trust

A reason for Softbank boss Son to go into reverse gear: “Now it’s time to take a defensive position,” he said when presenting the balance sheet. Holdings are to be sold in order to build up larger cash reserves. Stricter criteria apply to new investments.

Son had already sold shares worth 4.5 trillion yen (about 33.5 billion euros) two years ago – at the height of the corona pandemic – in order to reduce debt and buy back its own shares. This enabled him to stabilize the Softbank share price at the time. As a result, rising prices brought him new capital for expansion.

But this time Son doesn’t have much leeway to maintain the course. Softbank had already announced last year that it wanted to part with shares worth one trillion yen (7.44 billion euros).

However, Son has not lost his optimism with the decline in the value of the holdings. Net asset value has fallen only slightly to 18.5 trillion yen since December, while leverage has even improved, he said. The group earned more from the IPOs of its portfolio companies and the sale of shares than it invested in new companies. “Our ecosystem works,” said the Softbank boss combatively.

More: Lost $60 billion in ten months: Didi shows what can go wrong with Chinese stocks