The cryptocurrency market has experienced great activity lately, and meme coins have been at the center of this activity. These coins are often supported by entertaining content and have gained popularity among communities. However, the events of the last few weeks have shown how quickly meme coins can rise and fall.

A week or two ago, meme coins made huge profits, outperforming other altcoins, and the “meme coin season” was greeted with joy by many community members. However, there are increasing signs that this season is coming to an end. Most of the meme coins have fallen by up to 30% in recent days, once again highlighting how volatile the market is.

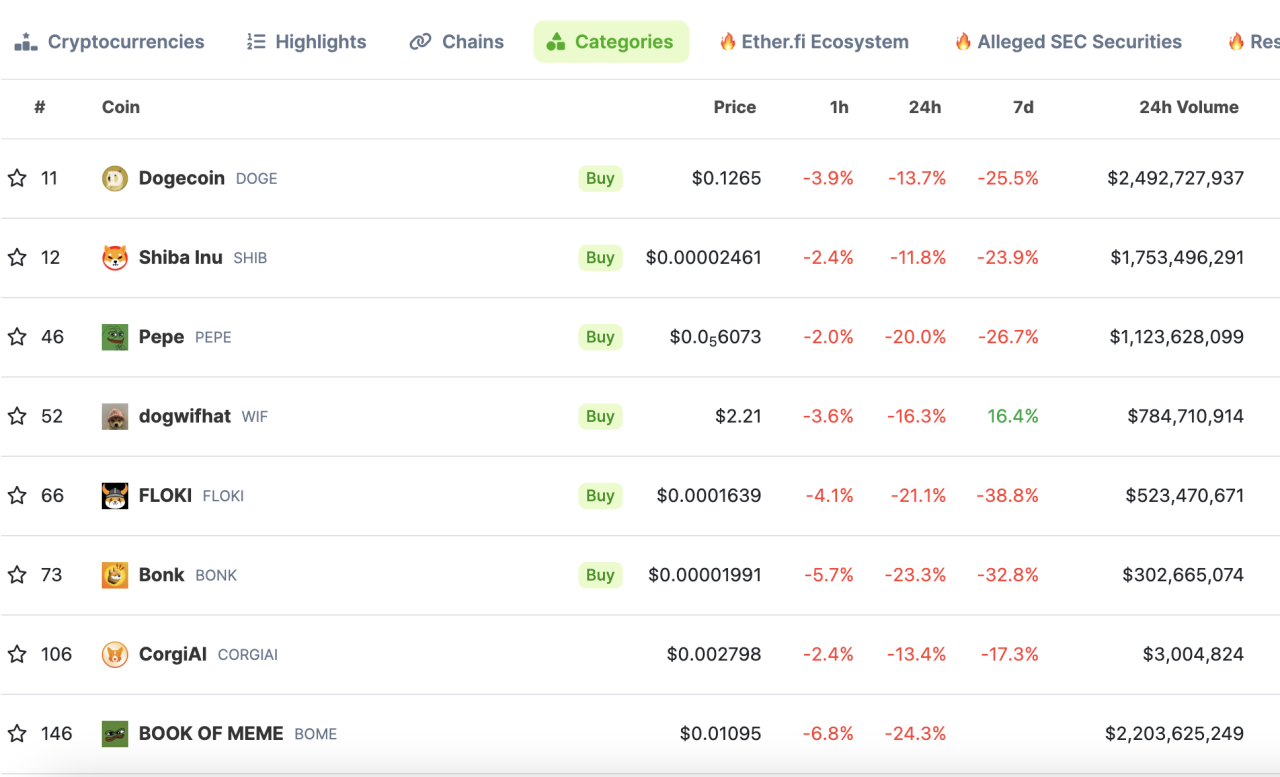

When examining the data, meme coin charts appear in red, indicating the price decline over the last few days. The price of Dogecoin, the number one meme coin, is at $0.1265 after a 25% drop in one week. Shiba Inu is trading at $0.00002461 after a 23% decline, while Floki Inu is trading at $0.0001639 after a 38% decline. This decline is not just for old meme coins as new ones are struggling as well.

On the other hand, popular cryptocurrencies such as Bitcoin and Ethereum are experiencing a similar downward trend. While Bitcoin has fallen to $64,428.90, worrying investors, Ethereum has fallen to $3335.6 and there is concern that it may fall even further. In addition to Ethereum’s decline, concerns are further heightened because the Ethereum Dencun Upgrade has just occurred. This creates uncertainty about Ethereum’s future performance and reduces investors’ risk appetite.

With the decline of meme coins and other cryptocurrencies, it is clear that there is a general selling pressure in the market. However, it is important to note that this is not the end of the world. Meme coins are still trading above their price levels from a month or two ago. Overall meme coin trading volume is making a comeback and currently stands at $12,091,292,078. It is estimated that this figure may increase further with new upward movements.

Meme coins are known for their high volatility and their survival often depends on the trend. Therefore, even a slight market fluctuation can cause significant shifts in prices. The cryptocurrency market is also very dynamic and has a rapidly changing structure. Therefore, it is important to remember that when a decline occurs, it does not represent a long-term trend. The market generally tends to recover and prices may rise again as confidence among investors is restored.

So, declines experienced by meme coins and other cryptocurrencies are usually a result of short-term fluctuations. However, investors should be careful when evaluating such situations and consider the general trend of the market. Although there are uncertainties, the cryptocurrency market maintains its future potential and should be considered as part of such fluctuations.

What is the reason for the decrease in Meme Coin prices?

Today, there is a general downward trend in the crypto market due to the impact of the meeting of the United States Federal Reserve Bank (Fed). The Fed’s two-day meeting will end with a policy statement. This meeting is a critical platform where the Open Market Committee (FOMC) of the Federal Reserve Bank of the United States meets to discuss monetary policy decisions regarding the country’s economy.

Fed meetings are held eight times a year and come up when steps need to be taken or policies need to be updated on important issues such as interest rates. Although this meeting started with the expectation that there would be no change in interest rates, there is great tension in the market before the reports are announced. This tension is one of the main reasons for the increasing selling pressure in the market.

However, it may be insufficient to explain this downward trend in the crypto market only with the Fed meeting. A similar decline in the Indian Stock market seems to be negatively impacting the crypto market as well. This may be an indication of increased general uncertainty and anxiety in global markets.

You can access current market movements here.