It seems like the Ethereum price has recovered from the corrections it has been experiencing for a while and has started to gather enough momentum to advance to the desired levels. Ethereum price recently surpassed a so-called “bull flag pattern” and is moving towards the $4816 target.

Ethereum price seems to have started to catch the expected uptrend for a while, having managed to overcome an important level that has been an obstacle in front of it for a while. While the short-term outlook for ETH is alarming based on some metrics, other data shows that the long-term scenario remains largely bullish.

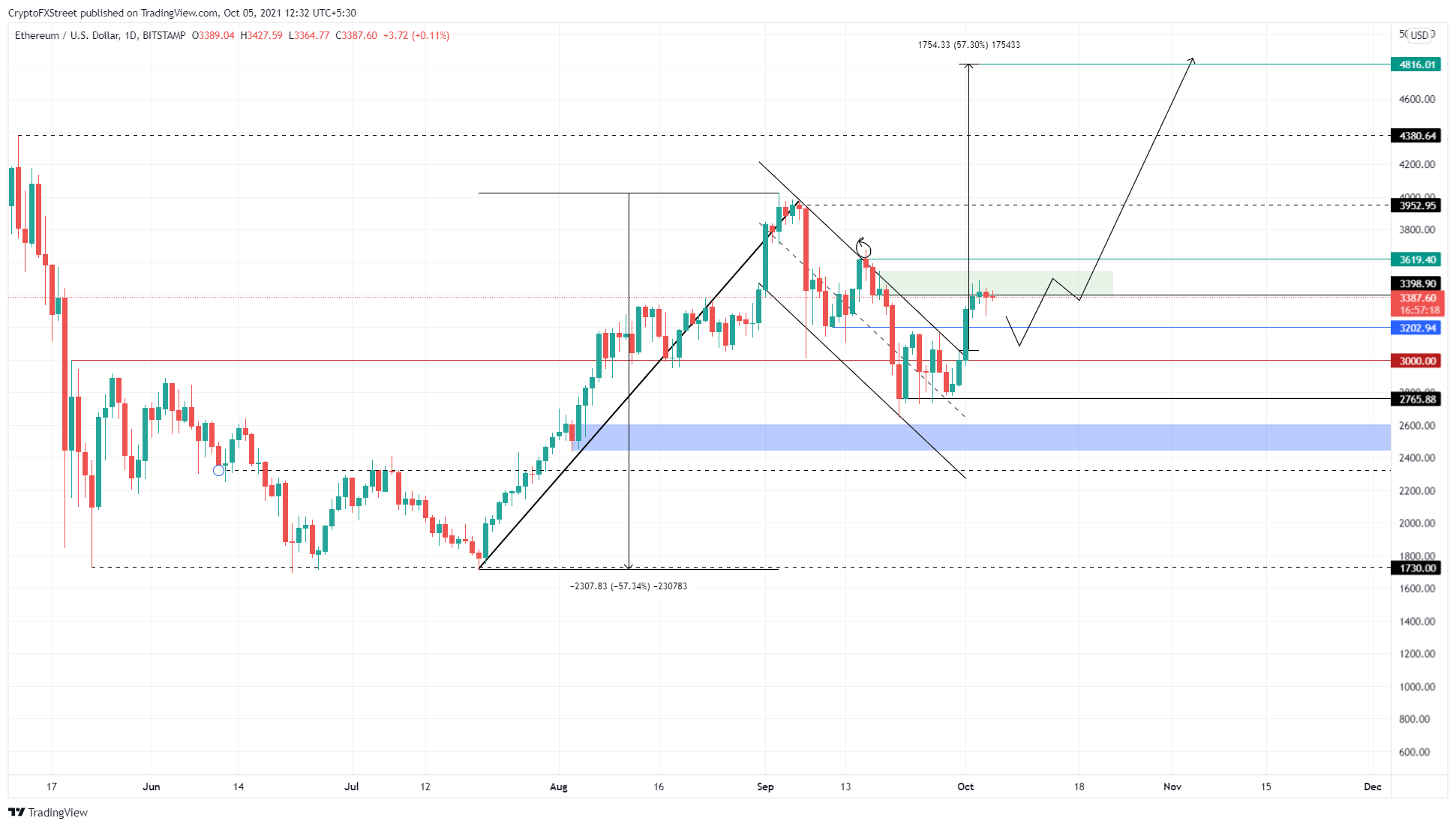

Ethereum price is currently forming a bull flag. ETH increased 134% between July 20 and September 3, forming a flagpole. However, it soon consolidated in a downward sloping channel.

This model predicts a 57% rise obtained by measuring the height of the flagpole and adding it to the breaking point. A decisive close above the flag’s upper trendline predicts a target of $4816.

Ethereum price started a 17% rally as of October 1, but this rally faced significant resistance at $3398. Although ETH is momentarily traded at $ 3433 and rises slightly above the important level, according to analysts, ETH can be withdrawn to $ 3202 from time to time.

If it ignores the upcoming corrections and ETH continues to climb, it will face the $3619, $3952 and $4380 resistance levels, respectively. Therefore, buyers need to break through these hurdles to hit the $4816 target.

In ETH, 1.95 million wallets recently bought 3.17 million ETH at an average of $3815 and somewhat exhausted their money. Therefore, closings above $3815 will be profitable for these investors and will remove the unwanted selling pressure.

This development could trigger a major bull run for ETH and push it to the all-time high of $4380 and the intended target of $4816.

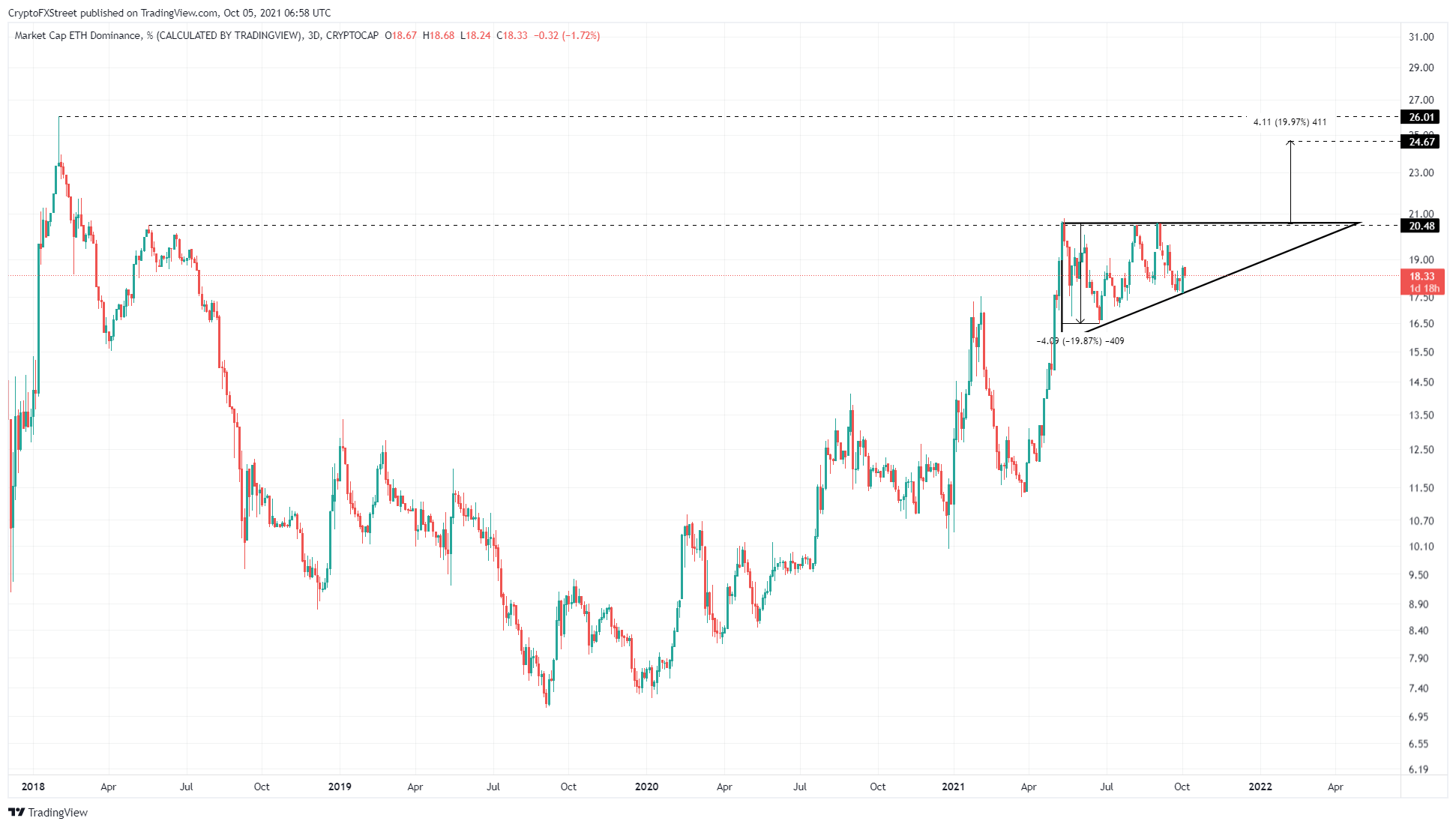

On the other hand, the increase in Ethereum’s strength in the market is also considered an important indicator.

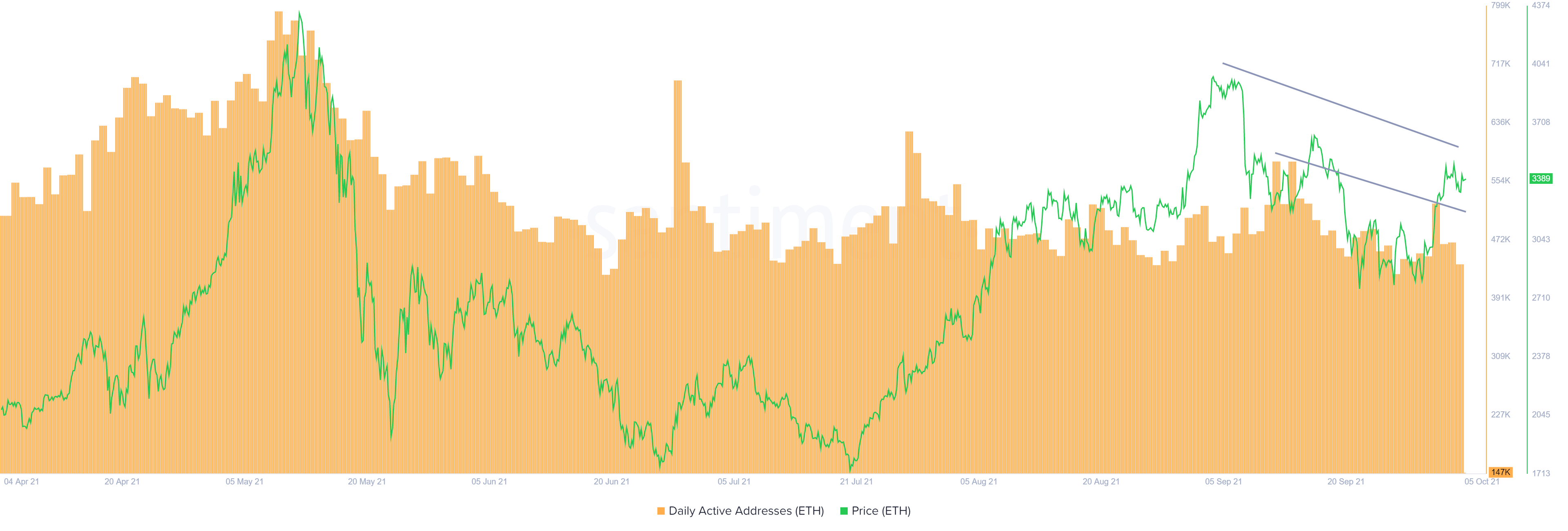

On the other hand, the fact that the number of wallets investing in Ethereum has not increased enough for a while is proof that Ethereum is still cautious. If the number of cautious investors increases, naturally ETH will have fewer investors and in such a scenario, the price of ETH may be withdrawn to the level of $ 3200.

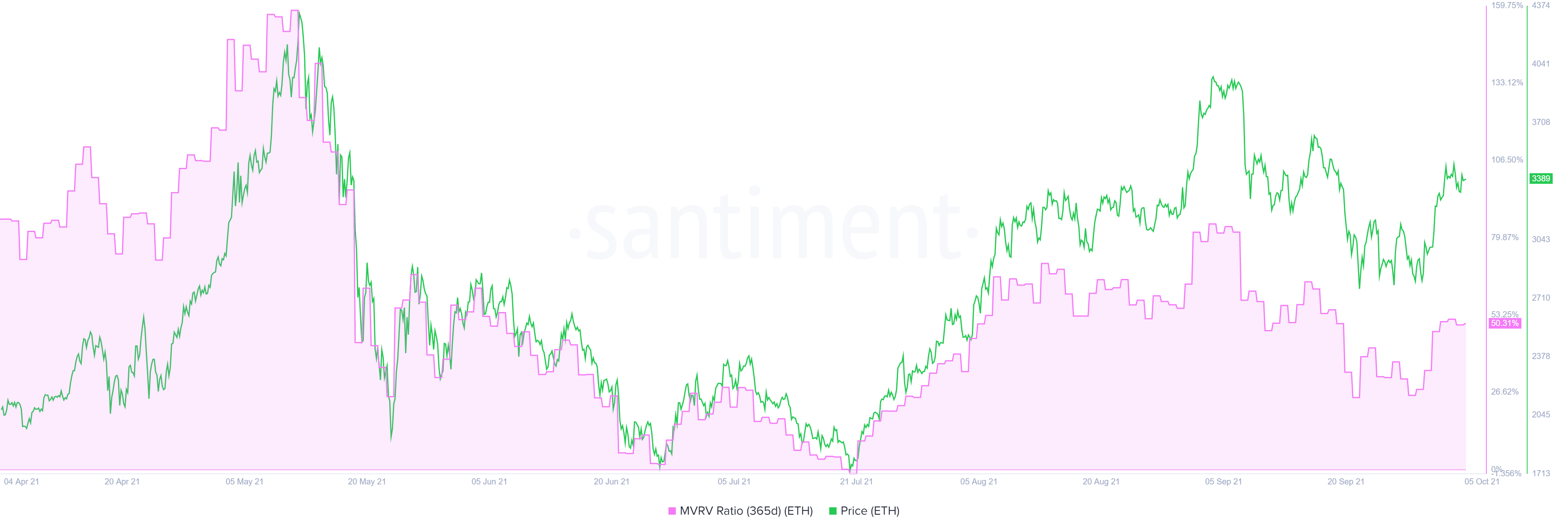

ETH’s 365-day MVRV (Market Value to Realized Value) model hovers around 50%. This showed that more than half of the investors who bought ETH are now in profit. Therefore, these investors can take profits by triggering a short-term drop for Ethereum price.

ETH’s 365-day MVRV (Market Value to Realized Value) model hovers around 50%. This showed that more than half of the investors who bought ETH are now in profit. Therefore, these investors can take profits by triggering a short-term drop for Ethereum price.

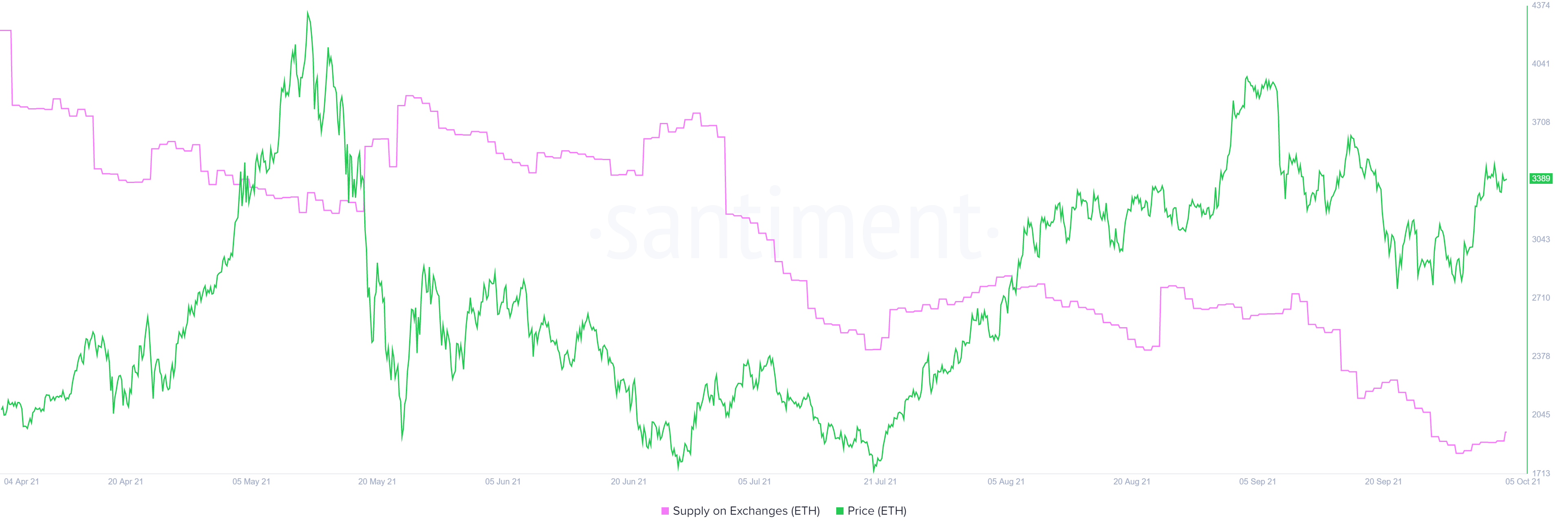

The supply of ETH on exchanges has increased by 170,000 in the past week, suggesting that investors can rush to central institutions to take profits, adding more confidence to the short-term bearish outlook.

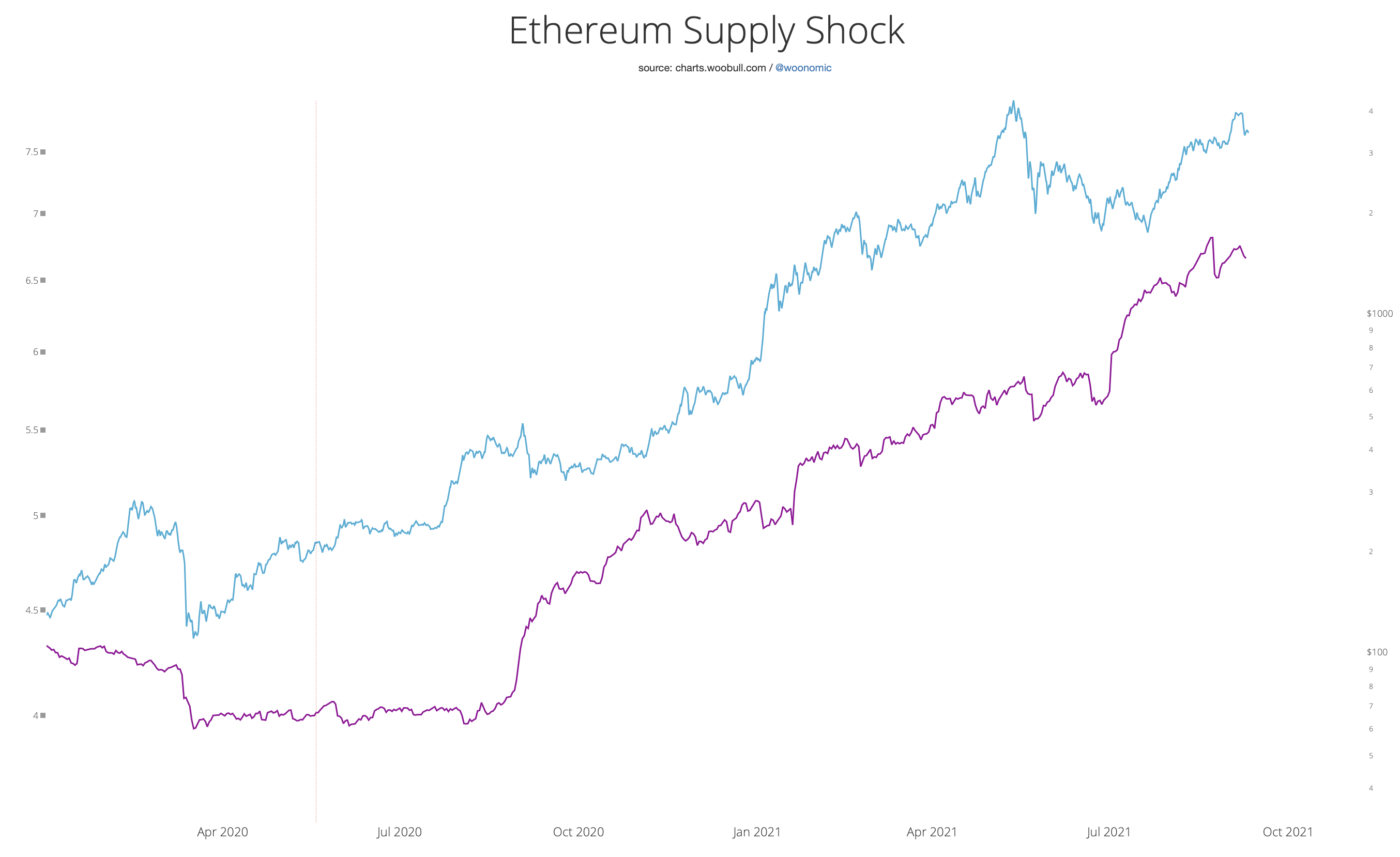

Willy Woo, a popular analyst, mentioned ETH and BTC in his latest newsletter:

“Ethereum’s underlying demand and supply is not climbing much compared to Bitcoin.” He also adds that this is historical strength zone, noting that the long-term outlook for both BTC and ETH remains bullish.

If Ethereum price drops below $2765 and produces a definitive close below it, it will create a lower low and invalidate the bullish thesis. In this case, ETH could bounce off the demand zone ranging from $2442 to $2605 and give the uptrend another chance.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.