Leading crypto Bitcoin (BTC) is having a hard time after the FTX collapse. While some analysts say they’ve seen the bottom, others point to deeper levels. Is Bitcoin heading to the $13,000 range now? Crypto analysts are looking for an answer to this question.

Levels to watch for leading crypto

After Bitcoin broke the key support near the $18,000 level, Morgan Stanley strategists warned that Bitcoin could incur additional losses. Straejists predict that BTC will likely fall to the prices it reached in 2019 and 2020. In a note released Friday, one market analyst wrote:

Technically speaking, BTC has dropped below $18,000, a support area, in recent weeks. The next levels to watch are 2019 highs of $13,500 and 2020 Q3 highs of $12,500.

When it comes to technical analysis, the experts who provided input for this story point out a few key levels that traders should follow, including one that Morgan Stanley mentions. According to independent crypto analyst Armando Aguilar, it is possible for BTC to fall to the price levels set by Morgan Stanley. On this move, it will first encounter significant support at the lows of $16,000 and mid-$15,000.

Is Bitcoin going to $10,000?

Brett Sifling, the investment advisor of Gerber Kawasaki Wealth & Investment Management, also emphasizes the importance of the $12,500 and $13,000 levels. Accordingly, he notes that the 2019 high and the 2020 3rd quarter high will act as a forward support level. It also assesses the case of Bitcoin falling below the aforementioned price points. In this case, he states that the $10,000 level would be a major support level. In this context, Sifling says:

$10,000 is a round number that psychologically attracts investors. However, its importance is not limited to this. It also acted as support before the last big breakout in late 2020.

market outlook

cryptocoin.comAs you follow, many cryptocurrencies are experiencing losses due to the FTX collapse. “The market seems to be pricing in the most predictable defaults/contagion right now,” says Armando Aguilar of the stock market failure. Referring to the November 15 data, the analyst says:

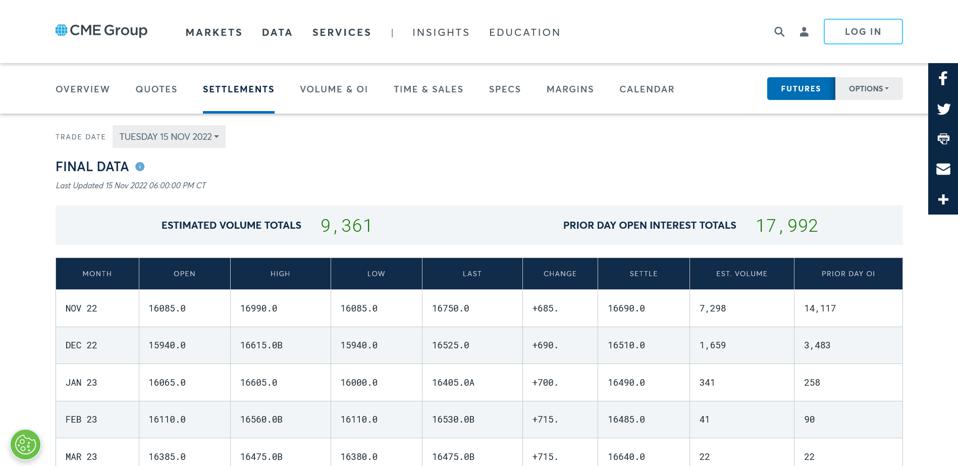

Despite a volatile week, open interest on CME BTC futures rose slightly during the week, according to data from Coinglass. Also, the volume has exceeded $25 billion.

The table below shows this activity:

“Despite the sale, investors still show appetite for Bitcoin,” the analyst emphasizes. He also cites payment data for CME Bitcoin futures, which shows that market participants trading these derivatives contracts expect the digital currency to fluctuate between roughly $16,000 and $17,000 through the rest of 2022 and early 2023. The chart below illustrates these expectations.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your own research and due diligence before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.