Investing in crypto has traditionally been thought of as a way to diversify your portfolio and hedge against market risks or inflation. However, looking at Bitcoin’s recent price performance, analysts debate whether mainstream adoption and its global events have changed this narrative.

FUD and Russia Tensions

Data from Santiment showed that Bitcoin was on shaky ground as it climbed above $40,000. This analysis comes after a week-long decline. But what’s notable is that the S&P500 has also dropped. On the other hand, gold prices rose to an eight-month high.

📊 #Bitcoin is barely hanging on above $40k, and this mid-sized drop to end the week coincided with the #SP500 once again dropping. Meanwhile, #gold has soared to an 8-month high. Look for a $BTC correlation break to be a sign of a positive breakout. 👍 https://t.co/QyUyr5Zgzz pic.twitter.com/8481wsk1vk

— Santiment (@santimentfeed) February 19, 2022

What could be the reason for these radical changes? Civil and economic tensions in Europe can be an important factor. After all, news companies have been speculating for days on whether Russia will invade Ukraine. As the FUD spreads, it’s quite normal for investors to turn to tangible assets like gold. Stocks – and now Bitcoin – seem to be paying the price.

However, the growing correlation between stocks and Bitcoin has given both analysts and traders good reason to worry. To this end, it may also be useful to examine investor sentiment.

Investor Sentiment

The weighted sentiment for Bitcoin was largely positive in February 2022. But it dropped below zero shortly before press time. This happened as the price of Bitcoin fell 6.38% in the last seven days and 1.58% in the last 24 hours.

After weeks of market crashes, it makes sense for investors to lose hope again.

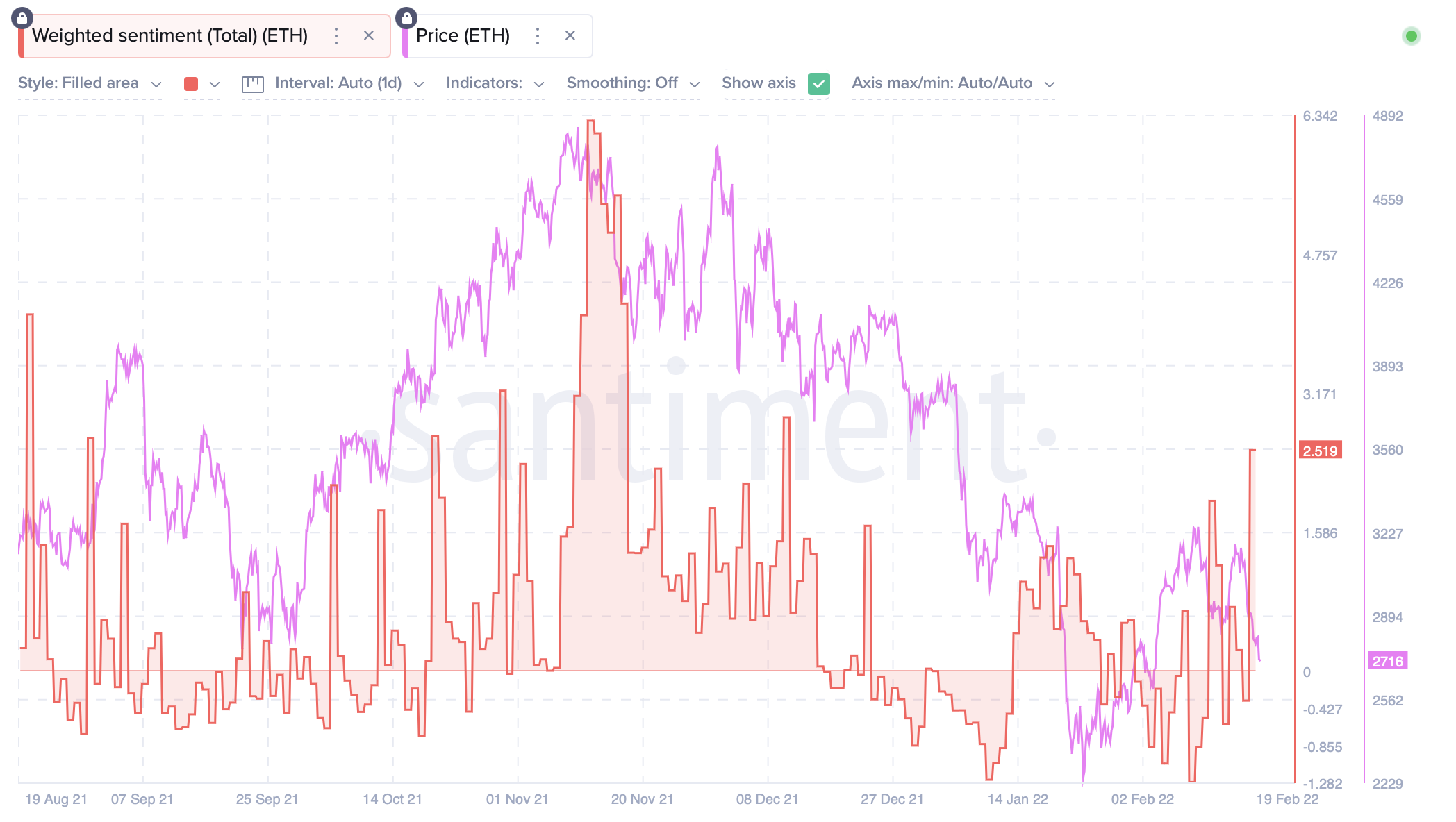

It may also be necessary to look at the top altcoin to better understand the sentiments of other traders. According to Santiment data, the price of Ethereum has dropped sharply. There has been a 4.56% drop in just the last 24 hours. Despite this, the investor sentiment was positive and well above zero. If the bearish trend in price continues, investor sentiment is likely to drop drastically as well.

It’s time to face the facts

Meta [eski adıyla Facebook] Shares fell more than 20% again when it released its Q4 report with lower-than-expected earnings per share. This was followed by the Nasdaq’s 1.9 percent decline.

However, what shocked both traders and analysts was the king coin, which fell 2.1% at around the same time.

While Bitcoin is starting to rebound, this similarity is definitely something to consider, as many BTC holders wonder if their portfolios are diversified enough in light of the correlation.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.