After a difficult 2022, the macroeconomic situation started to recover gradually this year. Inflation began to fall in the major economies as most governments renewed their hawkish stance. Therefore, it is possible to say that signs of growth appear. bitcoin On the other hand, it seems to follow Chinese stocks.

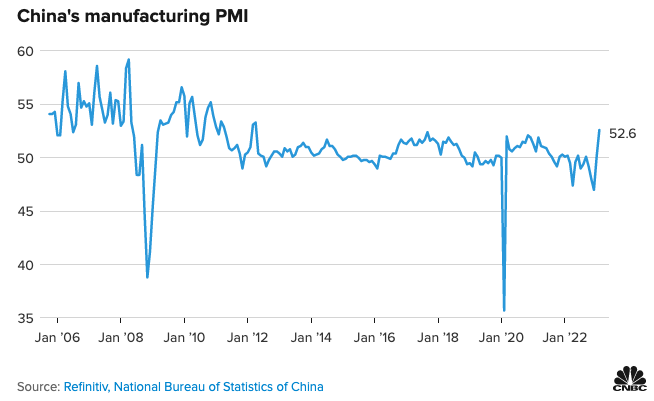

For example, China’s National Bureau of Statistics shared data on factory activities. The official manufacturing PMI rose to 52.6 in February. This is the highest value in about 11 years, as shown below. In April 2012, this index had reached a value of 53.5.

For example, the 50-point criterion serves as a distinction between growth and contraction. Traditionally, PMI above 50 represents expansion. Values below 50 indicate shrinking growth. Economists had expected a value of only 50.5, but the final figure managed to surprise everyone.

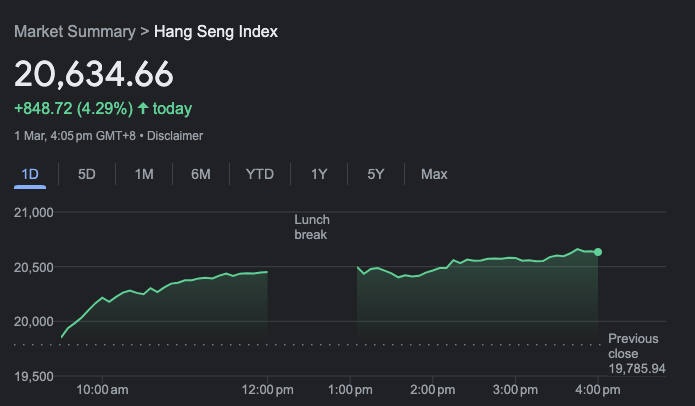

These data, on the other hand, had a positive impact on Chinese stocks. The CSI 300 index rose 1.4% on the day, while the SSE rose 1%. of Hong Kong Hang Seng Index increased by more than 4% on Tuesday, March 1

Koinfinans.com As we have reported, many people in this field have been helped by the breakout in equities. bitcoinWaiting for him to make the same move. Business analyst John Squire told Watcher Guru that BTC is no longer teaming up with the S&P 500. Instead, he said, he puts more emphasis on the Chinese market. In fact, other leading analysts in the field have seen something similar emerge. waiting.

After six consecutive months of contraction, today’s Chinese Manufacturing #PMI confirmed a move back to expansion 👀

Chinese stocks are breaking out of a 3-week consolidation at resistance, #Bitcoin could follow!! pic.twitter.com/va4ML5rrKi

— tedtalksmacro (@tedtalksmacro) March 1, 2023

Making a Situational Assessment for Bitcoin and Cryptocurrencies

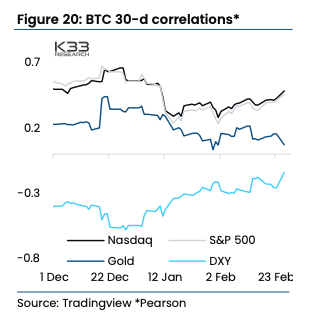

It is possible to say that the discussions about correlations produced a different result. It should be noted here that a recent analysis by Kaiko revealed that Bitcoin remains “unrelated” to Chinese stocks. As shown below, the CSI-Bitcoin correlation is slightly above zero. On the other hand, the HSI-Bitcoin correlation continues to hover in negative territory despite a slight recovery.

Bitcoin remains uncorrelated with Chinese equities. pic.twitter.com/GrPAX3ctNB

— unfolded. (@cryptounfolded) February 28, 2023

On the other hand, Bitcoin’s correlation with US stocks has been a little better lately. Nasdaq and S&P 500 as shown below [siyah, gri] Both correlation curves confirm the same thing, heading in the positive territory towards December 2022 levels.

The world’s largest economy continues to make decisions for Bitcoin, and even the second largest economy currently does not have the power to change this dynamic. Therefore, BTC will likely need a boost from US equities to continue rising.

You can follow the current price action here.