Investment firm Multicoin Capital has transferred approximately $1.66 million worth of altcoins to Coinbase. The company is starting to turn its investments into cash in 2020.

Multicoin Capital transferred this altcoin to Coinbase

According to a report from on-chain data source Ember on May 26, Multicoin Capital transferred 833,332 LDOs to Coinbase. The size of the transaction was valued at approximately $1.66 million.

Multicoin Capital had purchased 10 million LDO through investment on December 7, 2020. The company’s average cost of purchase was $0.00846. Since October 16, 2022, Multicoin has sold/transferred 9,166,667 LDOs to Coinbase. It currently only has 833,333 LDOs.

Despite whale sales, individual investors continue to show interest in LDO

According to IntoTheBlock data, crypto whales have an incredible command over the entire token concentration of Lido Finance. In recent days, 87% of the supply was in the hands of the big owners.

Interestingly, this trend occurred despite more traders losing out compared to winners. An example like this might suggest that large investors find LDO extremely undervalued.

It’s also worth noting that 66% of all whales occur in the last 365 days. This was due to the negative correlation of Lido with Bitcoin price in 2022. Another factor worth mentioning is the Liquid Staking project’s contribution to activity on the Ethereum network. What’s more, Lido’s launch of its V2 is among the developments affecting the increased operations of whales.

Meanwhile, a sizable chunk of large transactions of $193.11 million in the week of May 8 were withdrawals.

Therefore, implying the accumulation of whales may not coincide with short-term goals. However, according to Santiment’s data, the realization rate of these transactions had decreased. Therefore, there is no strong reason to panic about the increasing selling pressure.

Altcoin traders accompany with small purchases

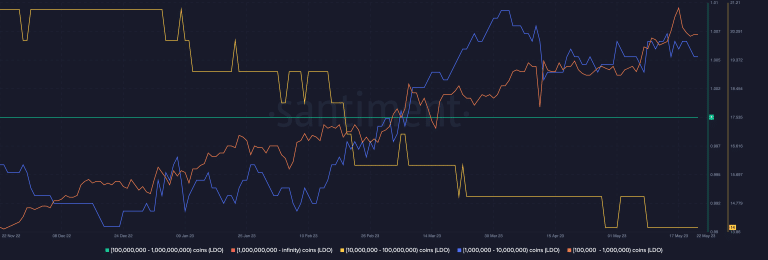

For the individual investor, LDO’s metrics did not change significantly. However, on-chain data showed that most holders of 0 to 100 tokens join the whales in the accumulation hunt. However, not every group from the party joined.

For example, the group holding 10 to 100 LDOs was resistant to heavy loading. However, pervasive clustering proved that belief in LDO was high relative to others.

So, are there any new members of the LDO whale family? Not much has happened with this metric, according to Santiment data. The 10 million to 100 million group has flattened since May 10.

This metric meant that the number of whales in the group had remained nearly the same since that date. But for most of the other groups, the number of addresses has witnessed a decline.

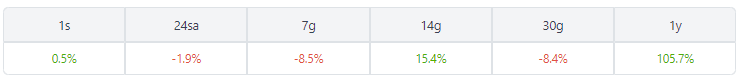

cryptocoin.comAs you follow, the LDO price is currently down around 2.5%. In an environment where whale sales became widespread, it lost about 10% in value compared to the last month.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.