Institutional investors are of great importance in the cryptocurrency field. According to the weekly digital asset inflow report of CoinShares, which shares data on institutional fund initiatives in crypto assets, institutional investors are selling SOL coin, ETH and Bitcoin.

CoinShares report: There is a total outflow of $126 million

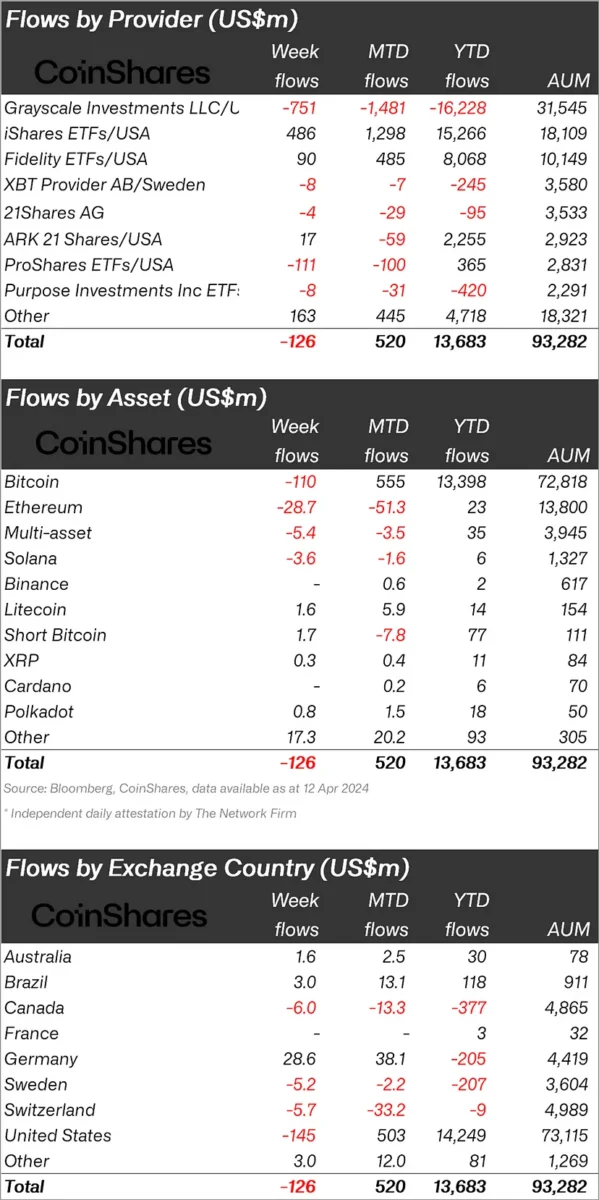

Crypto asset investment products experienced a shift in sentiment last week, with small outflows totaling $126 million. This marks a departure from the positive momentum of previous weeks. Thus, it shows that investors have adopted a more cautious approach as price increases have stopped.

Data compiled from various sources reveals that investors’ interest in established cryptocurrencies such as Ethereum is decreasing. Ethereum experienced the most significant outflows in relative terms, with US$29 million leaving the asset class for the fifth week in a row. This ongoing breakout suggests that investors may take profits or shift their focus to other areas of the crypto asset market.

There is an exit from SOL coin and other cryptos

Despite the general cautious trend, altcoins continued to see positive inflows. This week, entries targeted “smaller names” such as Decentraland (MANA), Basic Attention Token (BAT), and LIDO (LDO). Apart from this, Litecoin received $1.6 million and short Bitcoin received $1.7 million. Inflows into XRP and Polkadot were 300 and 800 thousand dollars, respectively. Cardano and BNB remained neutral this week. On the other hand, according to CoinShares, an asset outflow of $3.6 million occurred from Solana. $28.7 million came out of Ethereum and $110 million came out of Bitcoin.

The report also examines regional trends and reveals that the largest source of outflow, totaling 145 million US dollars, is the USA. This could be attributed to American investors taking profits or a reassessment of risk tolerance. In contrast, Germany saw recent price weakness as a buying opportunity and brought in inflows of US$29 million last week.

cryptokoin.com As we reported, although Bitcoin witnessed an outflow of US$110 million last week, it has managed to maintain positive inflows totaling US$555 million month-to-date. This suggests that despite the short-term decline in investor confidence, Bitcoin continues to maintain its long-term appeal for a segment of the market. Interestingly, short Bitcoin positions aimed at profiting from price declines saw a reversal of the three-week outflow trend, with a small inflow of US$1.7 million.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.