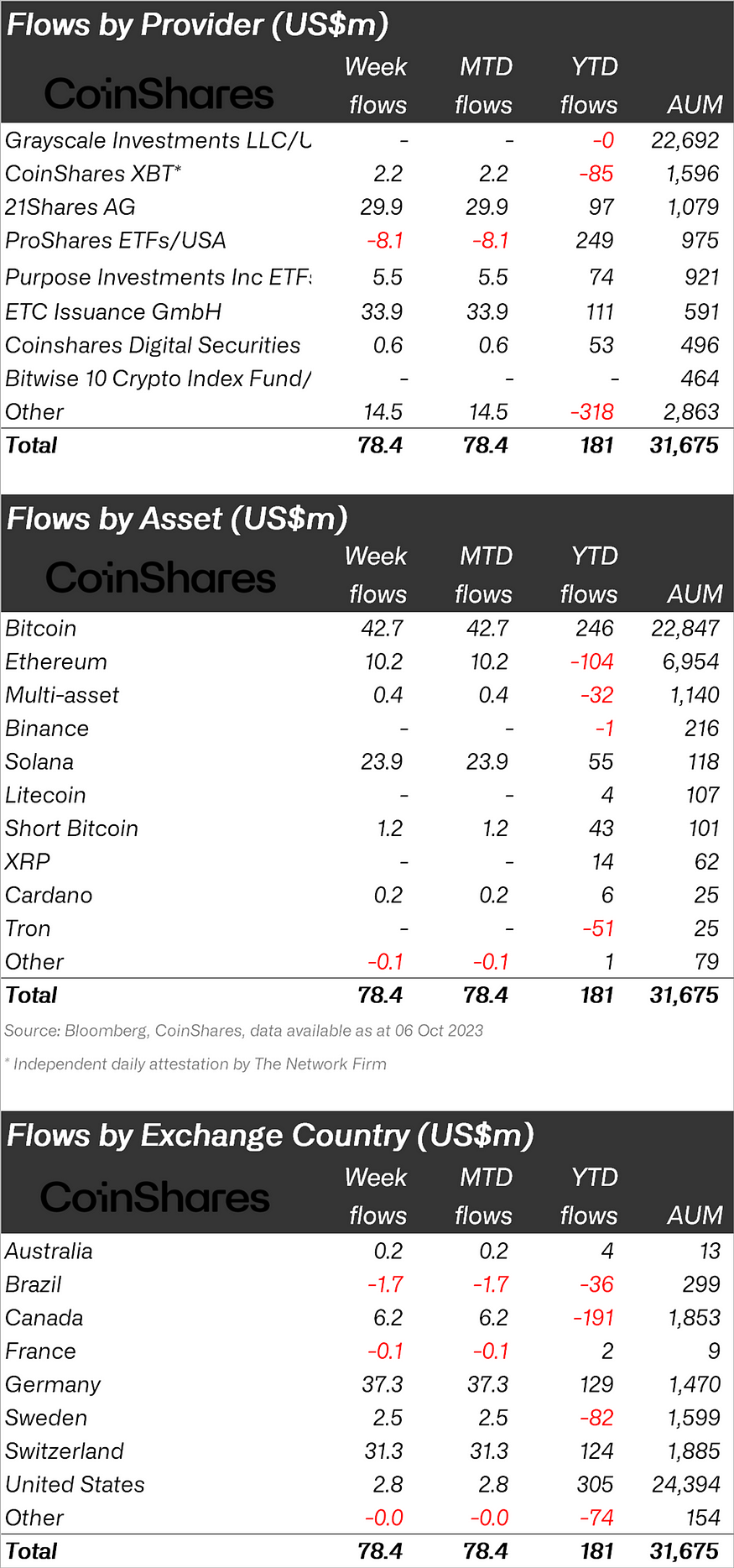

There is a significant development in the world of Bitcoin and altcoins this week. Accordingly, digital asset investment products witnessed significant inflows for the second week in a row. On the other hand, it collected a total of 78 million dollars. Simultaneously, trading volumes for Exchange Traded Products (ETPs) increased by 37%. Accordingly, it reached 1.13 billion dollars on a weekly basis.

Strong interest in Bitcoin BTC

Among digital assets, Bitcoin BTC attracted inflows of $43 million in the previous week. Accordingly, the institutional investor emerged as the primary beneficiary. However, interestingly, some investors saw the recent price increase as an opportunity to strengthen their short positions in Bitcoin. It also resulted in $1.2 million worth of inflows during the same period.

On the other hand, regional inequalities continue. From a regional perspective, there is a clear divide, with Europe leading the way, accounting for 90% of total arrivals. In comparison, the United States and Canada witnessed relatively modest inflows, with just $9 million combined. This regional variation continues to underscore changing sentiments and market dynamics.

Reaction to Ethereum futures ETF

Last week was an important litmus test for investor appetite for Ethereum. Accordingly, the ETF coincided with the launch of six futures-based ETFs in the United States. However, these new ETFs managed to attract just under $10 million in their opening weeks. This lukewarm response is in stark contrast to the launch of futures-based Bitcoin ETFs, which raised an impressive $1 billion in their first week.

It is worth noting that this contrast can be attributed to the current low investor interest in digital assets. Additionally, it would be a bit unfair to compare it to the launch of Bitcoin futures ETFs in October 2021. Because the general market appetite for digital assets was quite high at that time.

Solana’s remarkable entries

Apart from Bitcoin and Ethereum, Solana especially attracts attention. It experienced its most significant weekly entry since March 2022. The total figure was 24 million dollars. This impressive performance reinforces Solana’s status as the altcoin of choice, especially in light of recent Ethereum product launches. Solana’s growing appeal appears to be reshaping the landscape of digital asset investments. Apart from Solana, there is also some entry into Cardano.

These latest trends in digital asset investment products and inflows highlight the dynamic nature of the crypto market. Bitcoin maintains its appeal. Other digital assets such as Solana are also making strong progress. All of these reveal the evolving preferences of crypto investors when we look at it as cryptokoin.com.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.