There is a report recently published by ARK Invest. It reveals encouraging trends in the cryptocurrency market. It also shows that Bitcoin holdings are on the rise among institutional investors and long-term holders. The report looks at the measurements on the chain. It focuses on the growth of Bitcoin held in over-the-counter (OTC) wallets, which has reached all-time highs.

Rising cryptocurrencies Bitcoin assets: A signal from institutional investors

As noted in ARK Invest’s report, institutional investors and other large organizations are increasing their Bitcoin holdings. The analysis reveals the record high Bitcoin balance, which has reached nearly 8,000 Bitcoins held in OTC wallets. This represents an impressive increase of around 60% in the quarter. What does Bitcoin’s increased presence in OTC wallets indicate? It is seen as a reflection of the growing institutional activity and interest in cryptocurrency.

The report also features Grayscale Bitcoin Trust, a leading digital asset investment product. Accordingly, the outstanding performance of GBTC is also highlighted. GBTC witnessed a significant increase in value as its shares doubled from $8.65 to $20 in 2023. This significant increase represents a growth rate of over 150% in just six months. On the other hand, the cryptocurrency underlines the positive sentiment surrounding Bitcoin as an investment.

Long-term holders strengthen their bitcoin positions

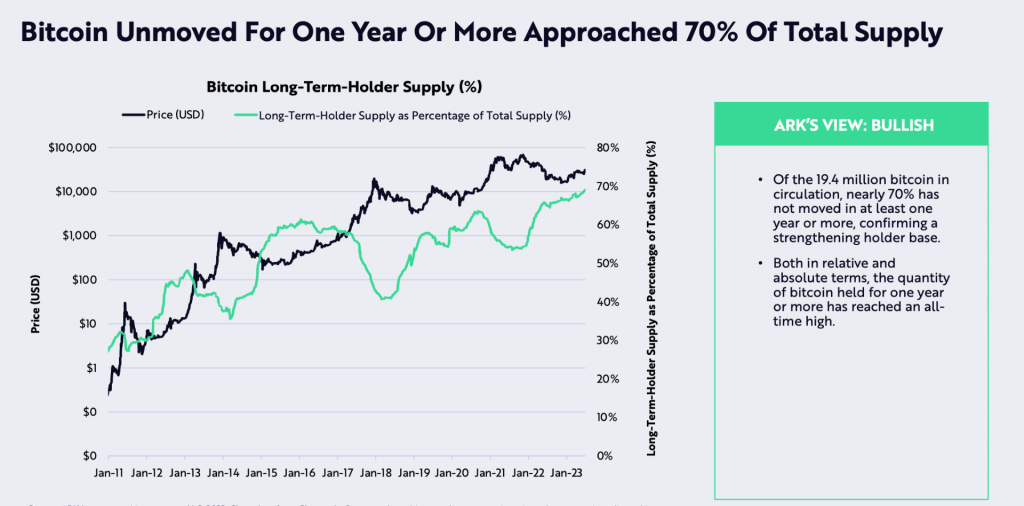

ARK Invest’s report highlights a significant number of long-term Bitcoin holders who are avoiding moving their assets. About 70% of the Bitcoin supply, i.e. 19 million BTC, has been dormant for over a year. Accordingly, this is a record level in both relative and absolute terms. These data show a significant increase in long-term Bitcoin holdings. On the other hand, it shows strong belief in the future potential of cryptocurrencies.

Findings from ARK Invest’s report shed light on the growing interest in Bitcoin among institutional and long-term investors. The growing Bitcoin accumulation of these organizations, coupled with record levels of on-chain metrics, reflects a positive sense of Bitcoin’s role as a store of value and investment asset. These trends bode well for Bitcoin’s future growth and potential in the financial world.

cryptocoin.com Overall, ARK Invest’s report provides valuable insight into the evolving landscape of Bitcoin investing as institutional investors and long-term holders expand their Bitcoin holdings. The increase in Bitcoin balances in OTC wallets and the outstanding performance of the Grayscale Bitcoin Trust reinforce the trust in Bitcoin as a long-term investment. These developments, combined with a record number of dormant Bitcoin holdings, highlight a positive sentiment. It also solidifies Bitcoin’s position as a store of value and investment asset.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow on. Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.