Blockchain research and data tracking firm Into The Block A report published by B.C. reveals how billion-dollar institutional trade has dominated BTC liquidity since 2020.

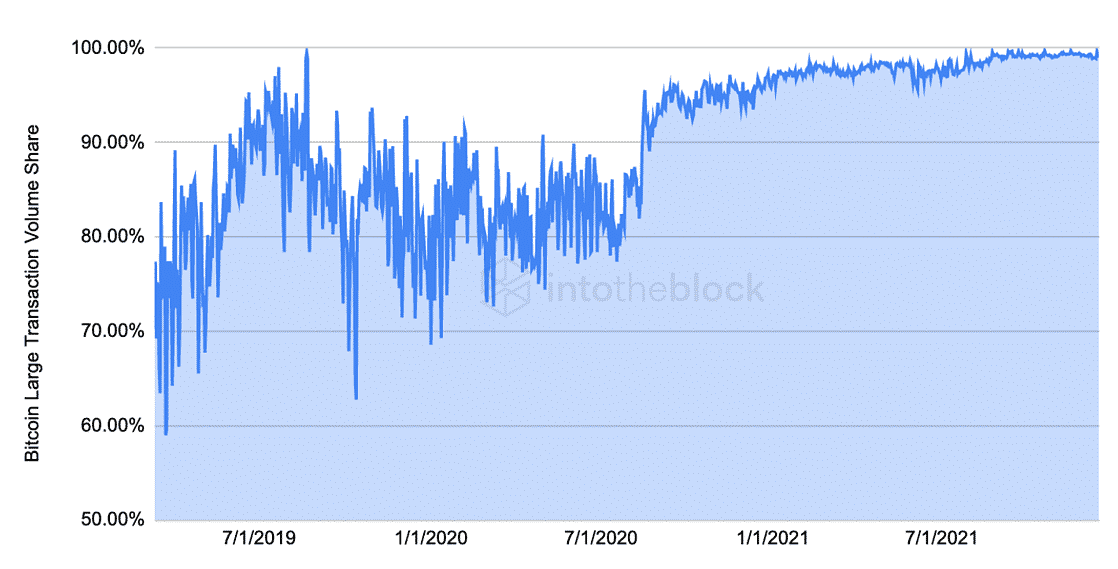

According to the recently published report, large transactions (transactions over $100,000 to the firm) have consistently accounted for more than 90% of Bitcoin’s trading volume since 2020.

The report attributes this to new entrants and/or increased demand from existing players (especially institutional demand). The year 2020 was a landmark year when several major trading venues and hedge funds recognized the viability of Bitcoin as a store of value.

Organizations such as Tesla, Block and Paypal also started investing in Bitcoin in 2020.

As a result, Bitcoin (BTC) The average transaction size for was a balloon. According to Into The Block, the average Bitcoin transaction since August 2021 has been over $500,000, with BTC hitting $1.2 million when it hit a record high in November.

Despite the enormous market volatility in 2022, institutional interest in Bitcoin has shown little sign of slowing down. Recent data from Coinshares has revealed that crypto markets have seen inflows of institutional capital for seven consecutive weeks this year.

Investment firm Bain Capital announced earlier this month that it had raised a $560 million crypto fund, while Pantera Capital announced it had pledged over $1 billion for a blockchain fund.

“The belief that crypto is an unrelated asset class may dwindle, but it doesn’t seem to deter interest from traditional financial and technology institutions. The main players in crypto continue to evolve, and there are signs that institutional demand continues to rise, even if it is not reflected in prices.

-Lucas Outumuro, Head of Research Into The Block”

This trend drives Bitcoin and crypto market, which has helped trade more in line with traditional stocks. For example, Bitcoin is trading down about 15% this year, largely in line with losses in the S&P 500 and Nasdaq indices.

The recent volatility in crypto markets has also been attributed to panic trading by institutions in response to the economic disruption caused by the Russia-Ukraine conflict.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.