The cryptocurrency market presents a journey full of constant fluctuations, and the causes and consequences of these fluctuations are frequently discussed. Recently, analyst Rekt Capital issued a warning about the future performance of Bitcoin (BTC) and presented an interesting scenario by examining the history of BTC.

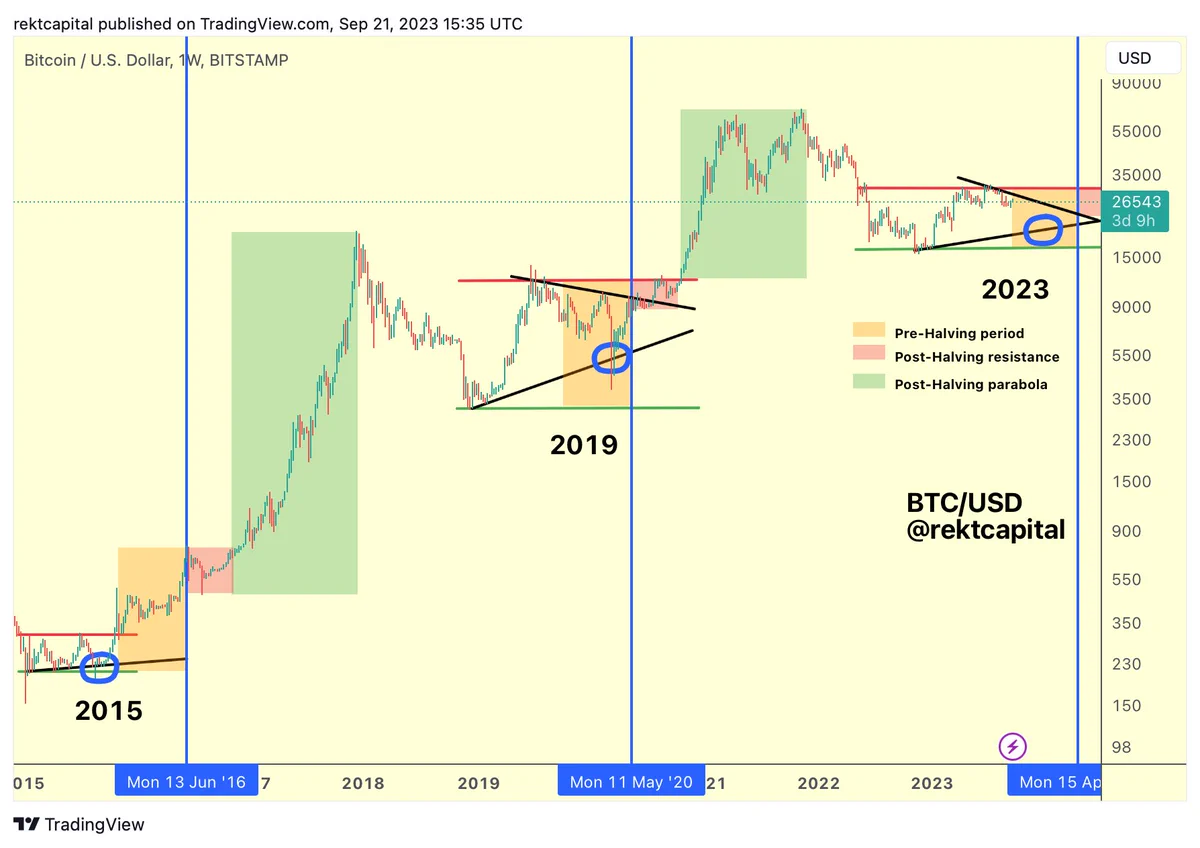

Rekt Capital studied the history of Bitcoin (BTC) and analyzed the history of this digital asset, predicting possible future scenarios. evaluated. The analyst warned that if Bitcoin repeats the pattern seen in the previous two halvings, a market correction could occur by the end of this year. These two periods correspond to 2015 and 2019. In such a scenario, according to the analyst, Bitcoin could drop to $ 20,000.

“BTC: 2015, 2019 and maybe even 2023? “Bitcoin has a history of retesting the macro higher low price (blue circle) in the pre-halving period.”

Bitcoin operates in a system where its supply is reduced by a “halving”, an event that occurs every four years. This means the reward required for mining each new block by miners is halved. This usually causes the price of Bitcoin to increase because less Bitcoin means more demand.

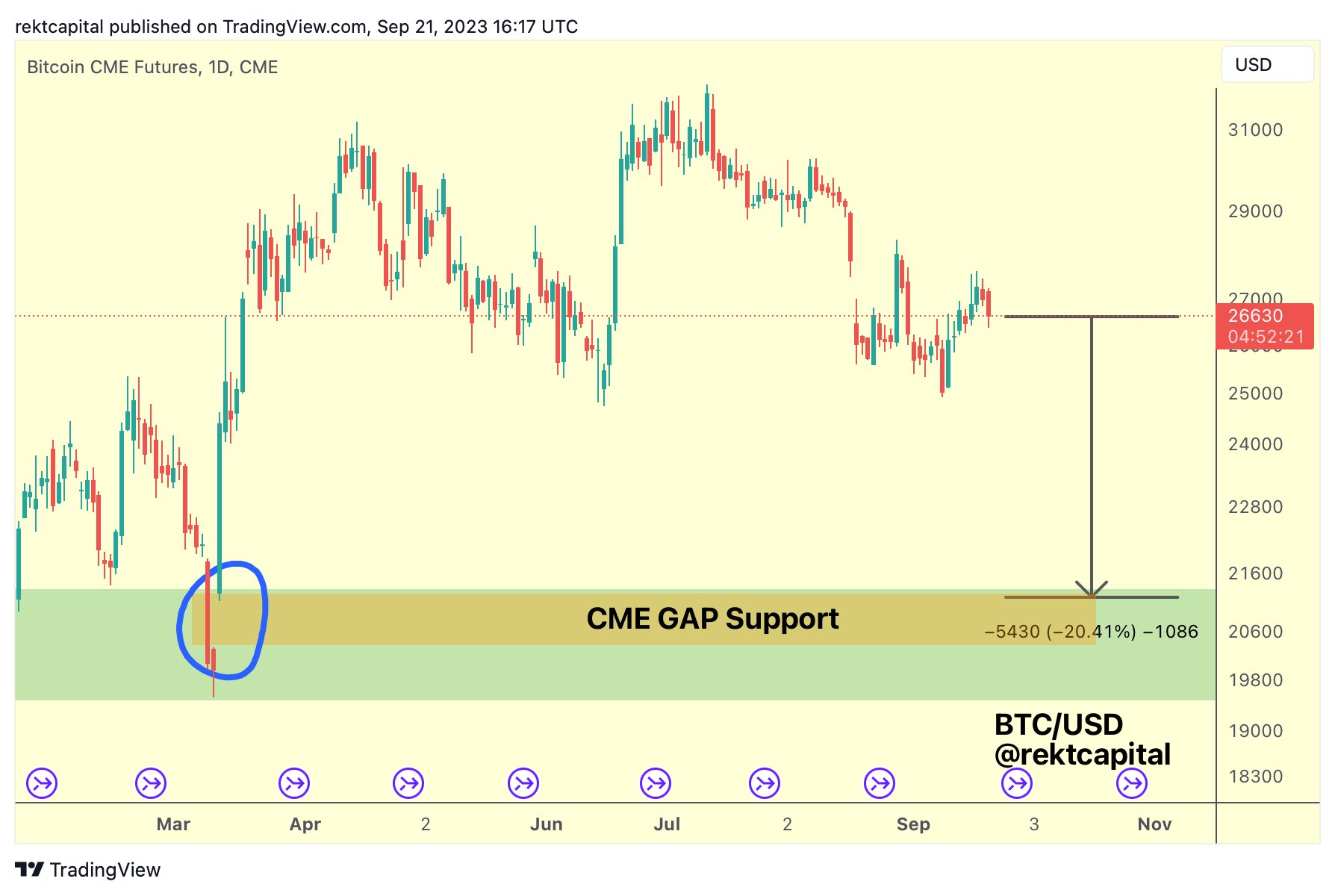

Considering what happened during these two previous halving periods, Rekt Capital suggests that a similar scenario may occur again. Besides these, the analyst says that another indicator that Bitcoin may retest the $ 20,000 level is a gap created in this range by transactions on the Chicago Mercantile Exchange (CME).

“If Bitcoin continues to establish lower prices, could BTC fill the CME gap at around $20,000 late this year or early 2024? If so, Bitcoin may finally revisit the macro higher low this cycle (blue circle).”

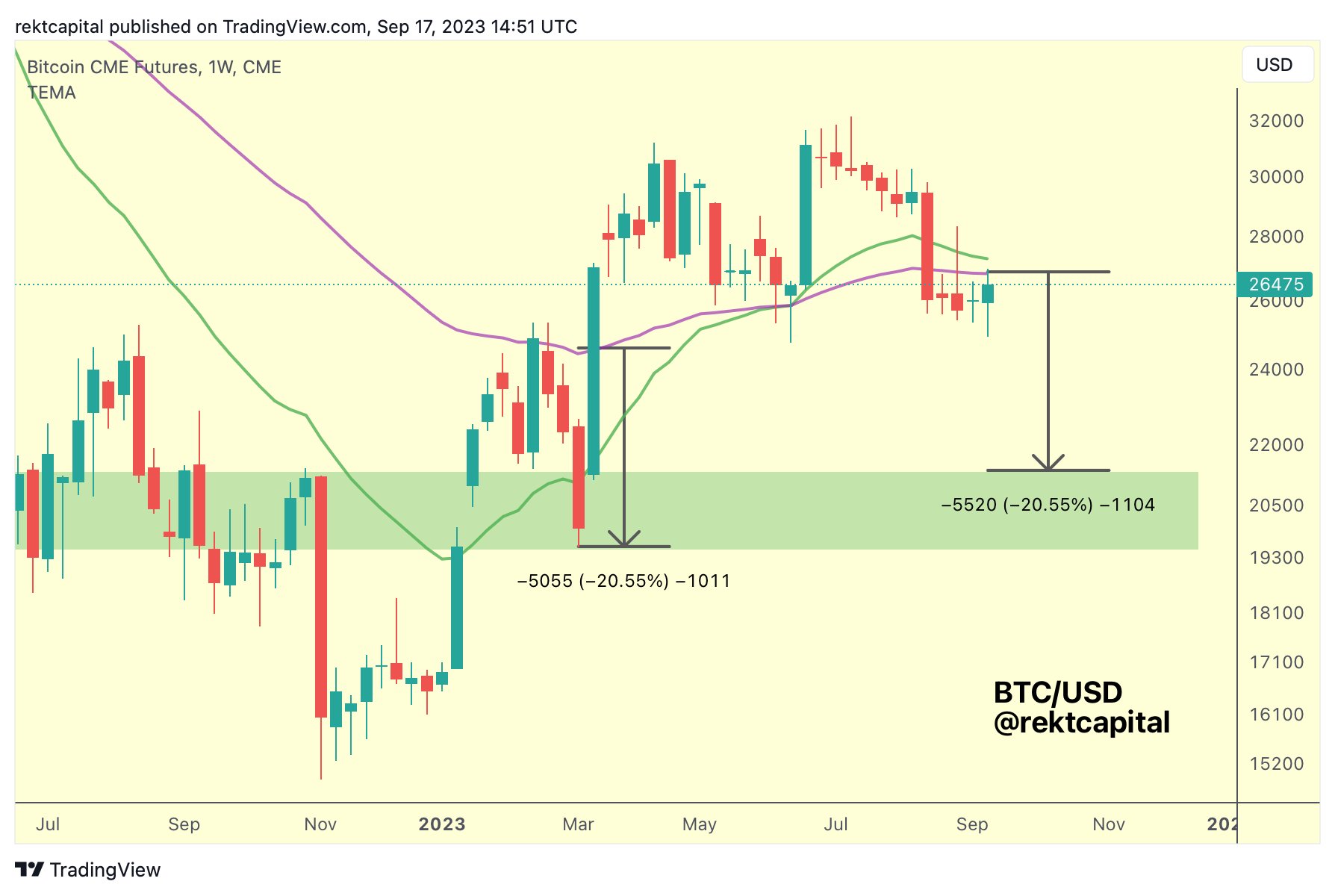

The trader also points out that another bearish indicator for Bitcoin is the 50-week exponential moving average (EMA):

“The last time BTC rejected from the 50-week EMA (purple) BTC pulled back 20%. If history repeats itself and BTC falls 20% from here, the price will drop to the ~$21,000 area (green). This is where the daily CME difference (orange) is.”

On the other hand, the trader also states that his prediction that Bitcoin will fall may be invalid if BTC exceeds a significant price level in the near term.

“It’s really simple. If BTC can break the black lower high resistance, it will have a chance to properly challenge for a breakout of ~$31,000. But until then, additional negativities can always occur.”

According to Trader, Bitcoin will not revisit the $31,000 level until the next halving event, which is expected to occur in April 2024. He also predicts a parabolic rally after next year’s halving event, with BTC rising above $65,000.

If ~$31000 was the Top for 2023…

Then the next time we see these prices will be months from now, just after the Halving (red box)

Only difference between now and then?

In this Pre-Halving period, $BTC could still retrace from here

But after the Halving, BTC would… pic.twitter.com/jz8rzGjGkz

— Rekt Capital (@rektcapital) September 21, 2023

You can follow the current price movement here.