MATIC price failed to register any growth in the last two months. Specifically, it has been facing some resistance for the past month and a half, and clearing that resistance will be crucial to kick off a return to a price point last tagged by the cryptocurrency in February 2022.

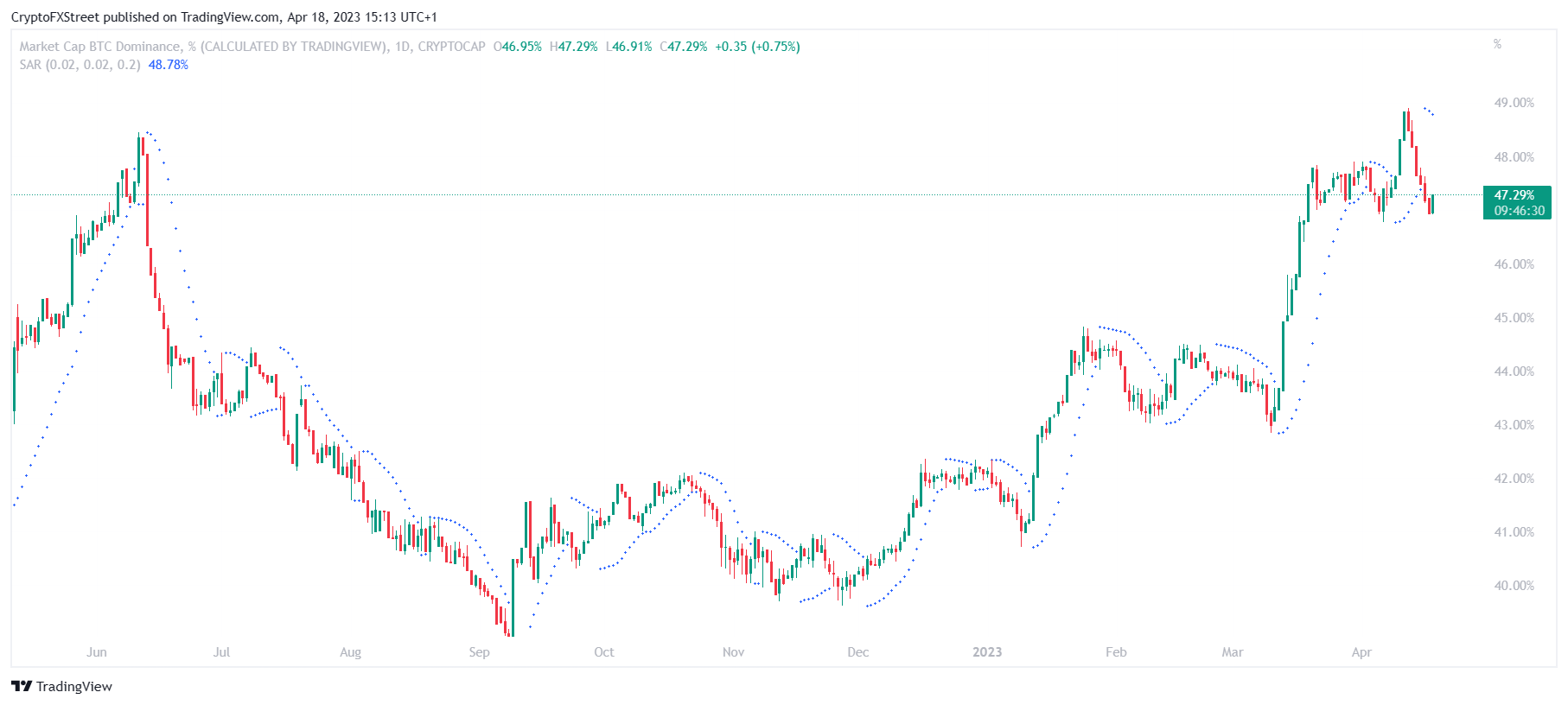

MATIC has been looking for a bullish signal since the beginning of March, when it was trading at $1.17. A major reason behind the lack of growth is the uncertainty surrounding the long-awaited altcoin season as Bitcoin’s dominance continues to signal otherwise. However, BTC dominance dropped to 47.32% last week, which has revived hopes for the bottom season.

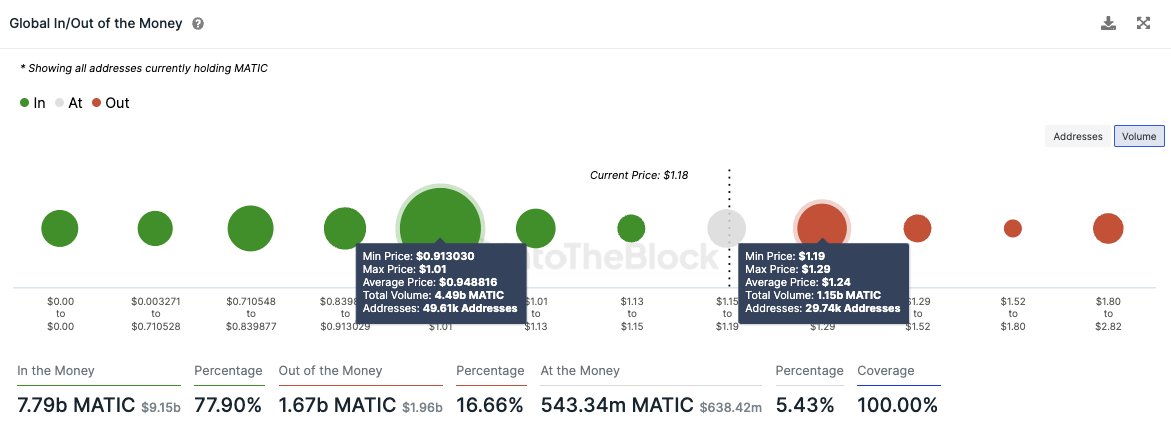

While the altcoin season will be subject to speculation, optimism could be instrumental in the recovery of MATIC price. According to analysts, it is very critical that it can maintain a sustained rise above $1.24. This particular price point is the average cost at which approximately 30,000 addresses purchased approximately 1.14 billion MATIC tokens worth $1.34 billion.

Thus, a break of $1.24 will not only make these tokens profitable after a month, but a close above the daily candlestick could trigger a 53% spike to $1.80. On the way, MATIC will face two more supply walls at $1.42 and $1.64, unlocking 265 million assets worth a total of $310 million.

But strong demand is needed to trigger such an increase. Second, it is currently showing bullish signs as cohorts holding 100,000 to 1 million MATICs are recording a 7.4% increase in supply.

Similarly, larger wallet addresses with anywhere from 1 million to 10 million MATIC are accumulating. The supply of these addresses increased by 35% from 128 million to 173 million.

However, the demand we just mentioned is not strong enough, so it will not be easy to break the resistances. While adoption should increase, real data point to the opposite. Network Growth fell 37% from 130,000 to 81,000. While this is clearly not a bearish sign, it does highlight some of the doubts investors have.

You can follow the current price action here.