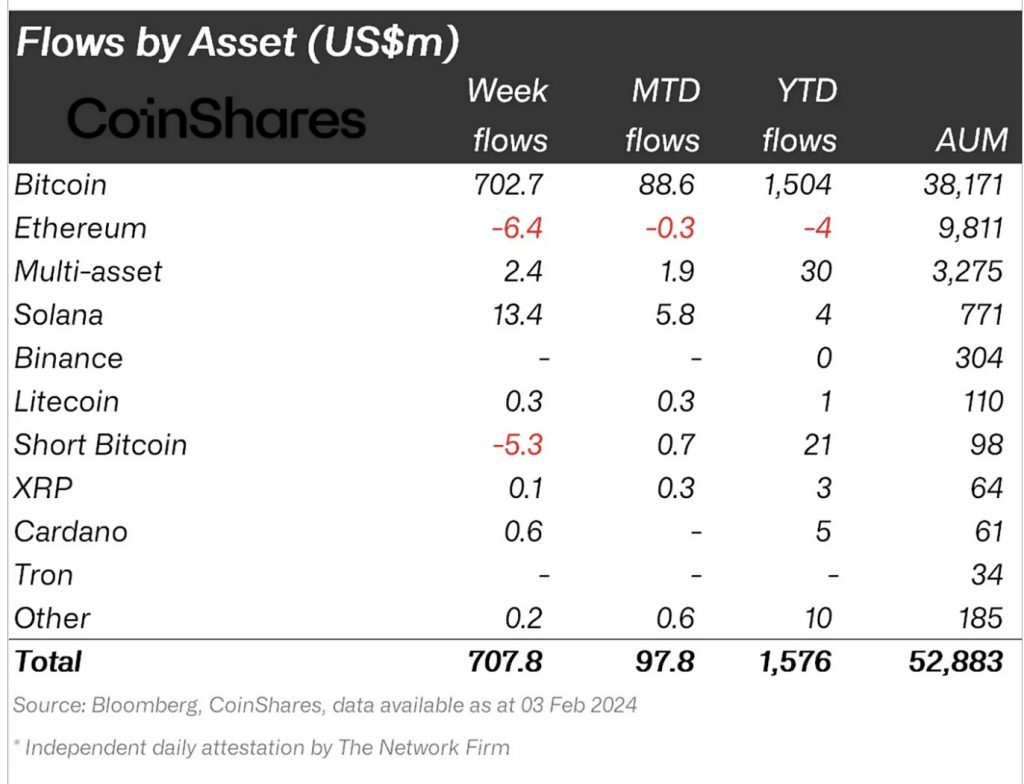

Recently, intense interest in Bitcoin exchange-traded funds (ETFs) in the US has driven a record $708 million inflow into digital asset investments. According to CoinShares’ report, total investment in this area since the beginning of the year reached 1.6 billion dollars, while global assets under management increased to 53 billion dollars.

Bitcoin ETFs, particularly new ETFs tracking BTC futures contracts, have once again proven demand in the market, with an inflow of $1.7 billion last week. These new ETFs have attracted a total of $7.7 billion since their inception, beating expectations with an average inflow of $1.9 billion in the last four weeks.

Additionally, some existing investment products have struggled with the success of new ETFs. For example, Grayscale experienced a $6 billion exit and is under pressure to convert into an ETF because its shares are trading at a significant discount to net asset value.

Bitcoin accounted for 99% of digital asset inflows last week, demonstrating continued investor interest in the leading cryptocurrency. Solana was the only other notable digital asset with an inflow of $13 million, and Ethereum and Avalanche experienced outflows of $6.4 and $1.3 million, respectively, due to competition from Solana.

Blockchain stocks continue to benefit from growth and innovation in the crypto sector, although they showed mixed results last week. CoinShares’ report reflects the growing adoption of crypto and blockchain technology and diversifying investor preferences. The positive outlook for the future of the sector is expected to be supported by greater regulatory clarity and innovation.