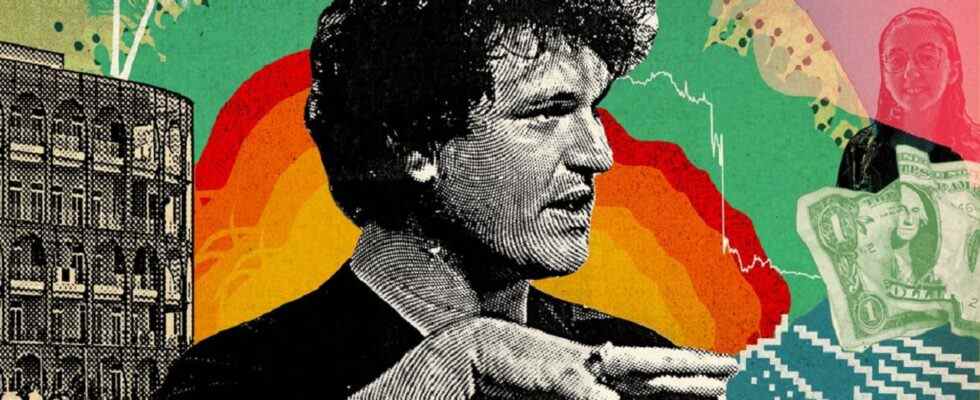

After the collapse of Sam Bankman-Fried’s FTX and complex network of crypto companies, countless unanswered questions remain. One of the biggest: how trading firm Alameda Research apparently lost billions of dollars

FTX crashed, many questions left behind

These losses appear to have resulted in someone in Bankman-Fried’s operation improperly transferring client funds from the FTX trading platform to Alameda. This decision left FTX vulnerable to a withdrawal run that precipitated sudden bankruptcy. Many details are still unknown. However, a blurred picture is taking shape of the possible reasons behind Alameda’s massive losses. Half a dozen crypto traders and investors familiar with Alameda provide explanations to understand the leading theories.

What was behind the collapse of Bankman-Fried and FTX?

Moving from arbitrage to high-risk bets

The first theory is that young traders at Alameda, once one of the largest crypto trading companies in the world, are not as sophisticated as their reputations suggest. When Bankman-Fried founded Alameda in 2018, he was seen as an excellent trader. It focused on arbitrating price differences in cryptocurrencies in different markets. The following year, however, he shifted his main focus to launching his trading platform, FTX. According to Doug Colkitt, a senior high-frequency stock and crypto trader, Alameda brought colleagues Gary Wang and Nishad Singh to FTX, who are some of the most talented people at the trading firm.

After Bitcoin began to rise sharply in the fall of 2020, Alameda has moved away from its initial focus on making high-speed, market-independent bets that are not dependent on predicting whether cryptocurrencies will rise. Some traders believe that Alameda has changed its strategy. Because, as more experienced firms like Jump Capital accelerated their crypto trading business, it lost its competitiveness. In March 2021, 26-year-old Caroline Ellison, then one of Alameda’s co-CEOs, seemed to agree with this axis when she tweeted:

It can also be attributed to the point where he realizes he’s wasting time trying to trade back and forth for several endpoints. The way to really make money is to understand when the market will rise and take the balls long before that. Trading means betting that prices will go up.

“What makes you a hero in bull markets kills you in bear markets”

A month later, Sam Trabucco, Alameda’s other CEO, tweeted, “In the winter of 2020 … uh, we have a really long time.” As the justification for this, he added, “that’s where the money is.” Both Ellison and Trabucco had only a few years of trading experience in traditional markets before joining Bankman-Fried to trade crypto. That means shallow knowledge and experience.

According to several traders, most of Alameda’s long-term bets have likely suffered huge losses from May 2022 after the dramatic collapse of stablecoin TerraUSD and sister cryptocurrency LUNA sharpened the decline in the crypto market. “What makes you a hero in bull markets is what kills you in bear markets,” says Marina Gurevich, COO of London-based Wintermute, one of the most active crypto trading companies in the world. Indeed, Bankman-Fried acknowledged that LUNA fell at a time when many risky leverages were piling up in his business.

Leverage layer on top of big bets

Alameda made big bets. Besides that, there was probably too much leverage. That is, he was borrowing to increase gains and losses. Apparently there was a way for company executives to do this. It was also using largely illiquid cryptocurrencies (like FTX Token FTT, Serum (SRM)) as collateral to obtain a loan.

For example, Bankman-Fried helped incubate the creation of Serum (SRM), which was released in 2020. Serum’s circulating supply of cryptocurrencies was low. Initially it was only possible to trade 10% freely. The other 90% have been locked up for years. But technically, if the circulating supply of SRM is worth $1 billion, it’s possible to say that all cryptocurrencies in existence have a market cap of $10 billion. He could then take out a loan based on this high valuation. Bankman-Fried has also run this playbook with other digital assets, as crypto investor Jason Choi wrote. This has come to be known as ‘Sam coins’ by industry experts. Choi recently concluded in a tweet: ‘

This is probably how Alameda/FTX covered the multi-billion dollar deficit. Alameda has promised illiquid collateral to borrow money to finance margin bets this year as markets fall.

Invest in other crypto players with borrowed money

Another capital outflow was venture investments. According to PitchBook, Alameda has made more than 150 investments in the crypto industry. Among them are Bitcoin miner Genesis Digital Mining and crypto broker Voyager Digital. Alameda apparently took out a loan to fund these bets. When the crypto market crashed, lenders tried to recall funds tied to these illiquid investments. According to the Wall Street Journal, FTX and Alameda executives then took the dubious step of trying to repay some of these Alameda loans using FTX client funds.

Borrowing for other major expenses

The financial situation of Bankman-Fried’s conglomerate is very complex and complex. Much of this remains a mystery, even to the attorneys, financial investigators, and bankruptcy veterans who have taken over. But according to bankruptcy court filings, FTX executives borrowed billions of dollars from Alameda to finance everything from political contributions to Bankman-Fried’s $650 million purchase of a 7.6% stake in Robinhood. It is unclear how these loans could have contributed to Alameda’s losses. Alameda itself has $5.1 billion in outstanding debt, according to a filing in a Delaware bankruptcy case.

Poor quality record keeping and accounting controls

Bankman-Fried’s companies had terrible record-keeping and accounting systems. FTX customer deposits were not tracked, according to a bankruptcy filing. Also, this has created uncertainty about what is owed to customers in bankruptcy proceedings. An example of this confusion: The leaked FTX balance sheet shows $8.8 billion in liabilities. However, filing in the Delaware bankruptcy case Thursday shows just $6.4 billion. It is not clear what is responsible for the inconsistency. But regardless, the numbers are still changing. cryptocoin.comJohn J. Ray III, FTX’s new CEO, who oversaw the bankruptcy, said in the filing, “This balance sheet was prepared while the Borrowers were controlled by Mr. Bankman-Fried. I don’t trust it,” he said. Bankman-Fried tried to explain almost the entire problem as “messy ledger + margin.”

Bankman-Fried’s careless accounting habits seem to date back to Alameda’s early days. Crypto venture capitalist Alex Pack saw them lose $10 million in a single month while considering due diligence to invest in Alameda in early 2019. That’s a huge amount for such a small company. When Pack asked about this, Bankman-Fried said it was “caused by trading errors.”

Pack says he continues to investigate, but never understands what happened. “At one point I was like, ‘Sorry, we didn’t have good record keeping at the time. They said, ‘We can’t answer all these questions. However, Pack accepted the deal. He thought they looked like smart traders. But he walked away due to “serious recklessness in taking risks and extremely poor infrastructure and accounting”.

Today, Pack says it’s particularly difficult to track positions in crypto. Because he notes that you have to set up your own trading systems and the task gets ‘exponentially harder’ as your business book grows. If Alameda started with bad accounting systems, Pack says, it’s “not inconceivable that they eventually got into much more debt than they anticipated, as Bankman-Fried claims.”

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.