Owners of all motor vehicles such as cars, motorcycles, trucks and trucks pay Motor Vehicle Tax (MTV) regularly every year. This year, prices were increased by 61.5 percent due to inflation. Since the last payment date is January 31st, we also asked the 2023 MTV amounts and “How to pay MTV?” We share our guide.

How is MTV paid? MTV payment guide: step by step!

Motor Vehicle Tax – How is MTV paid? In the last part of our news, we share with you the 2023 MTV fees. Since the amounts listed here are automatically determined by the system, you do not need to calculate the amount you will pay separately.

However, you can verify by checking before making a payment. In addition, it should be noted that the specified amounts are not divided into two equal parts, in January and June. For example, if you have a 1-3 year old car with a cylinder volume of 1300 cc or less, you have to pay 2 thousand 120 TL MTV this year. This payment is made as 1,060 TL in January and 1,060 TL in June.

MTV payment guide

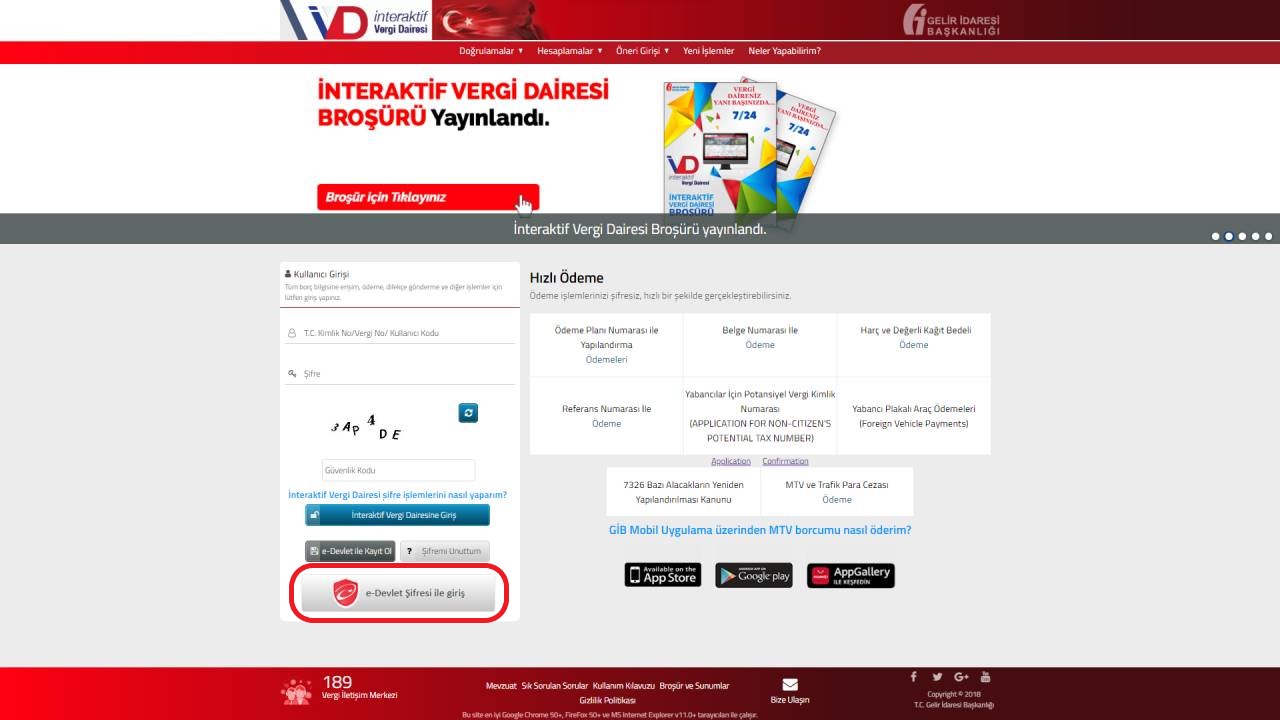

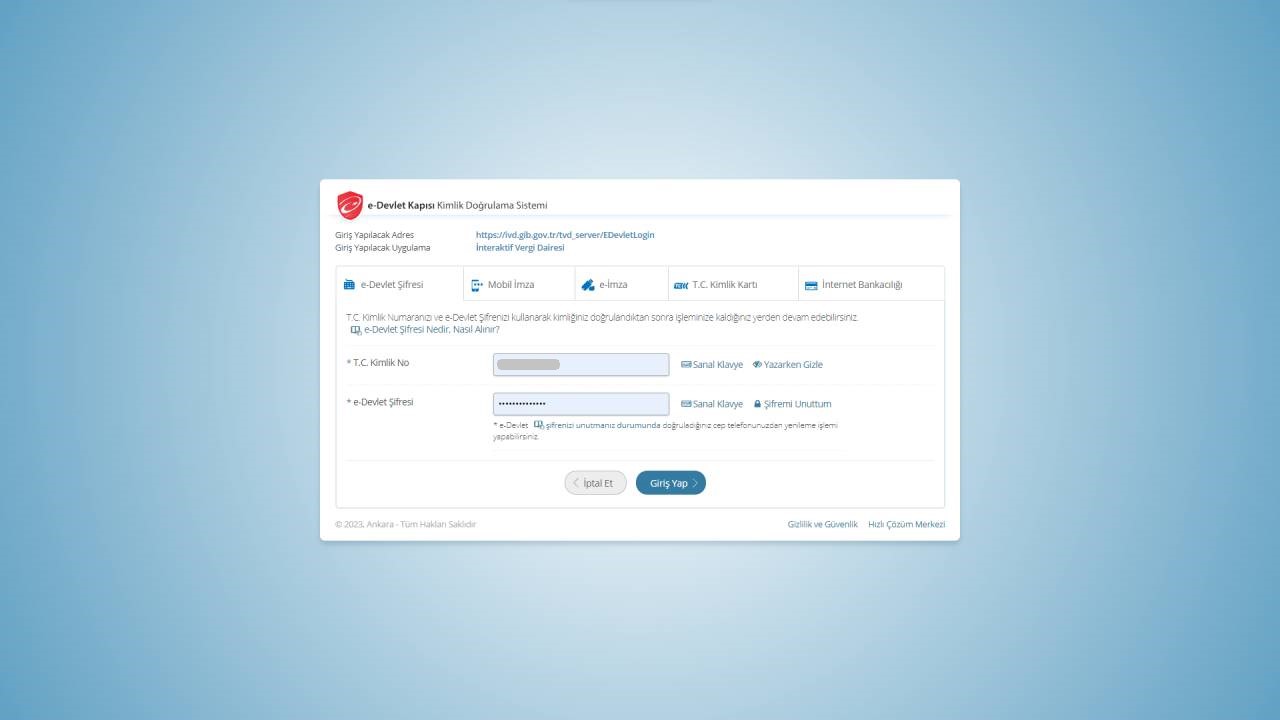

- In the bottom left part of the page, “Login with e-Government passwordClick the ” button.

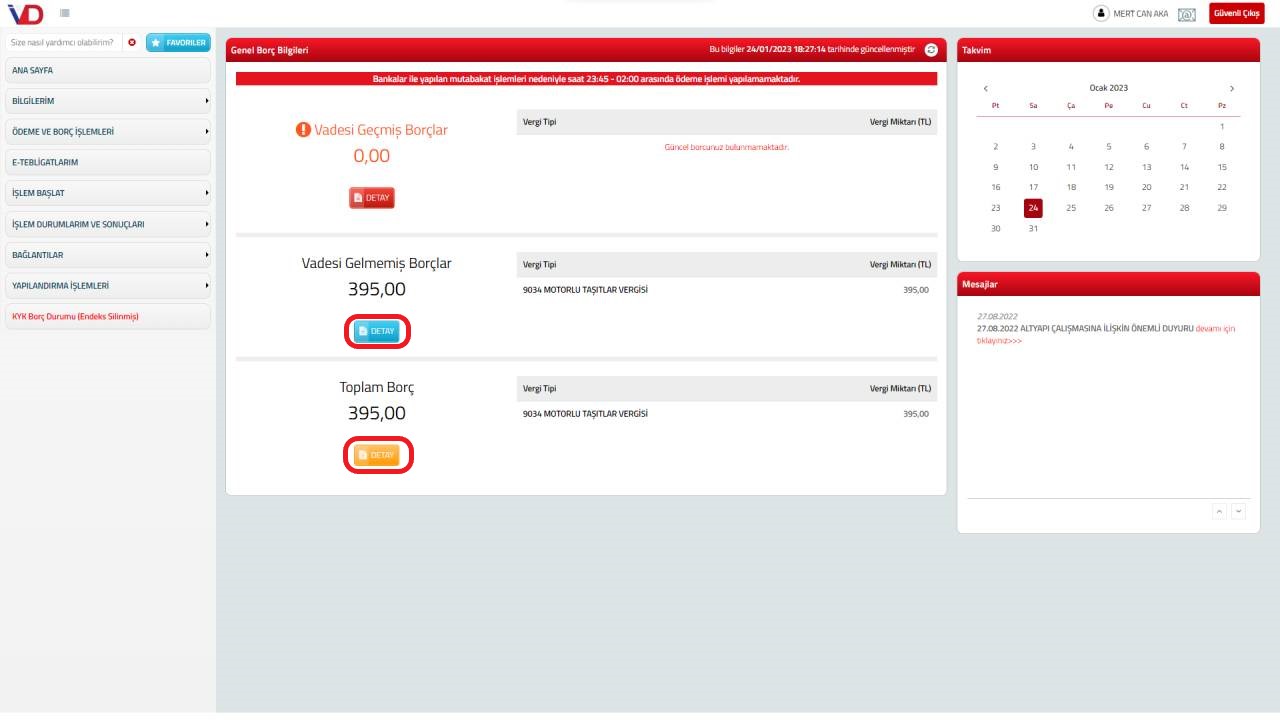

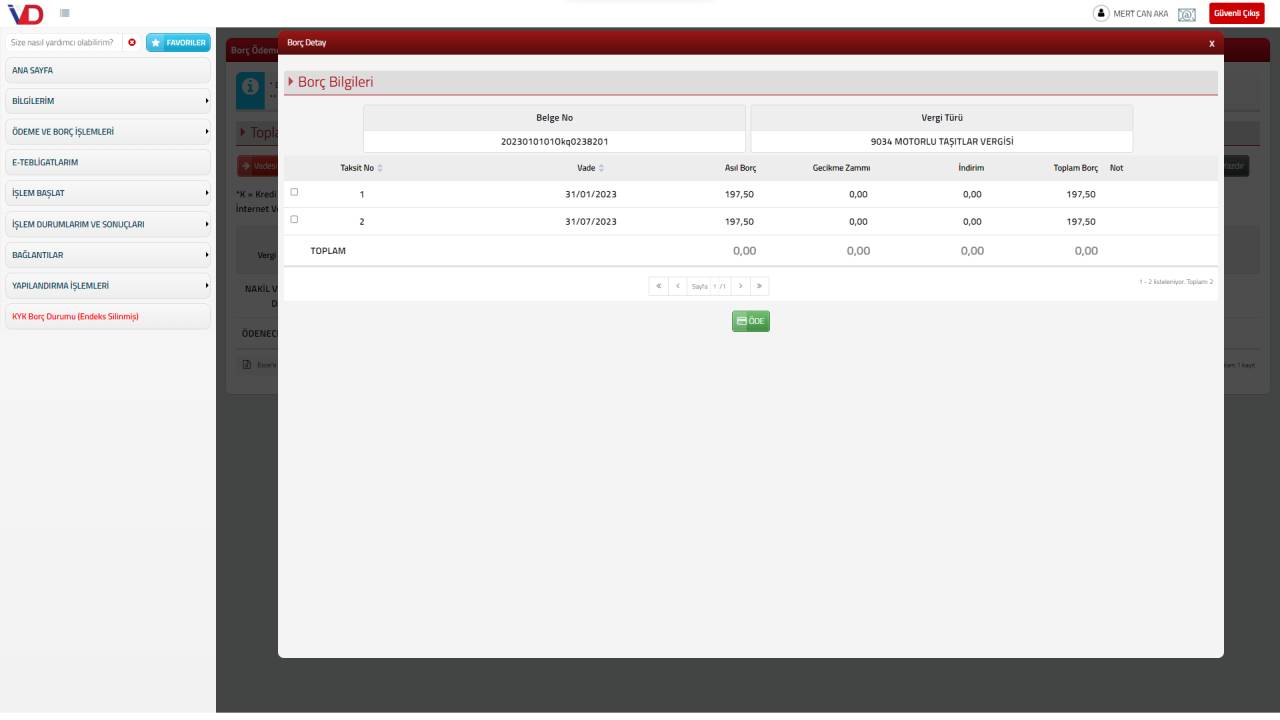

- In the section Undue Debts or Total Debt, “Detail” we click the button.

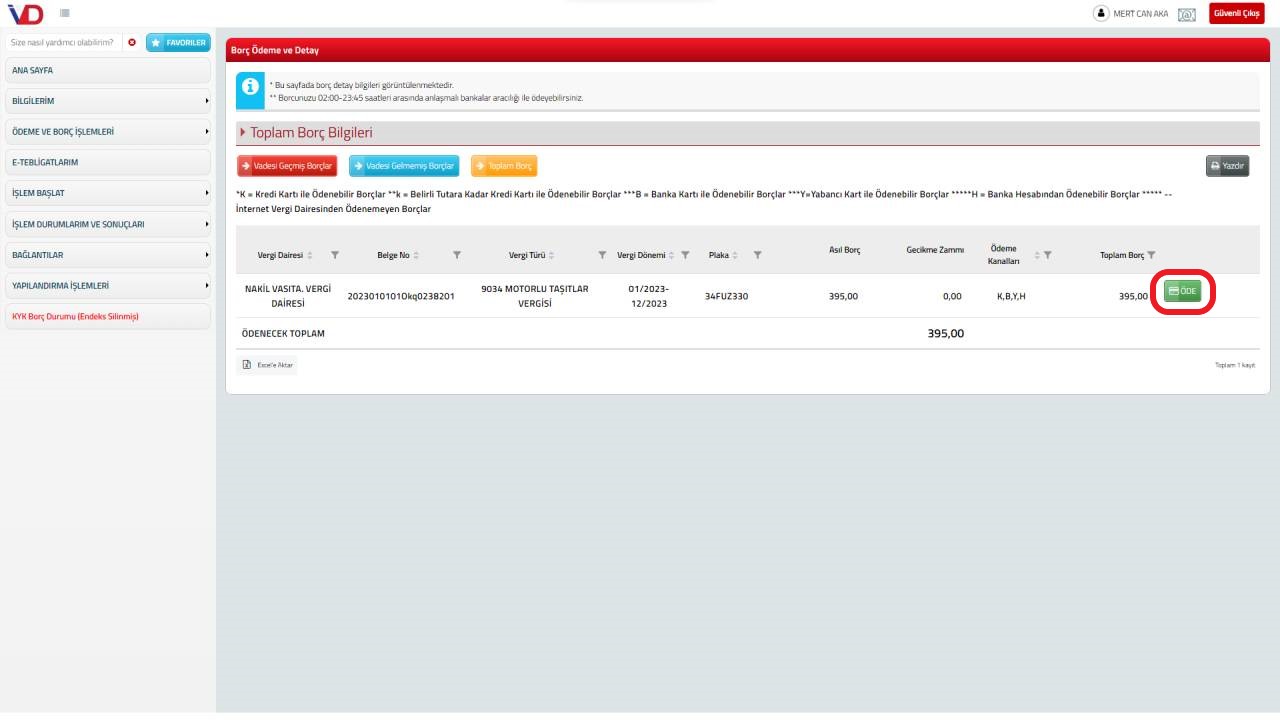

- On the Total Debt Information screen, on the right side of the Motor Vehicles Tax option, “PAYClick the ” button.

- With the selection you make here, you can pay the 1-year (2-term) MTV amount of your vehicle or the first period amount between January-June.

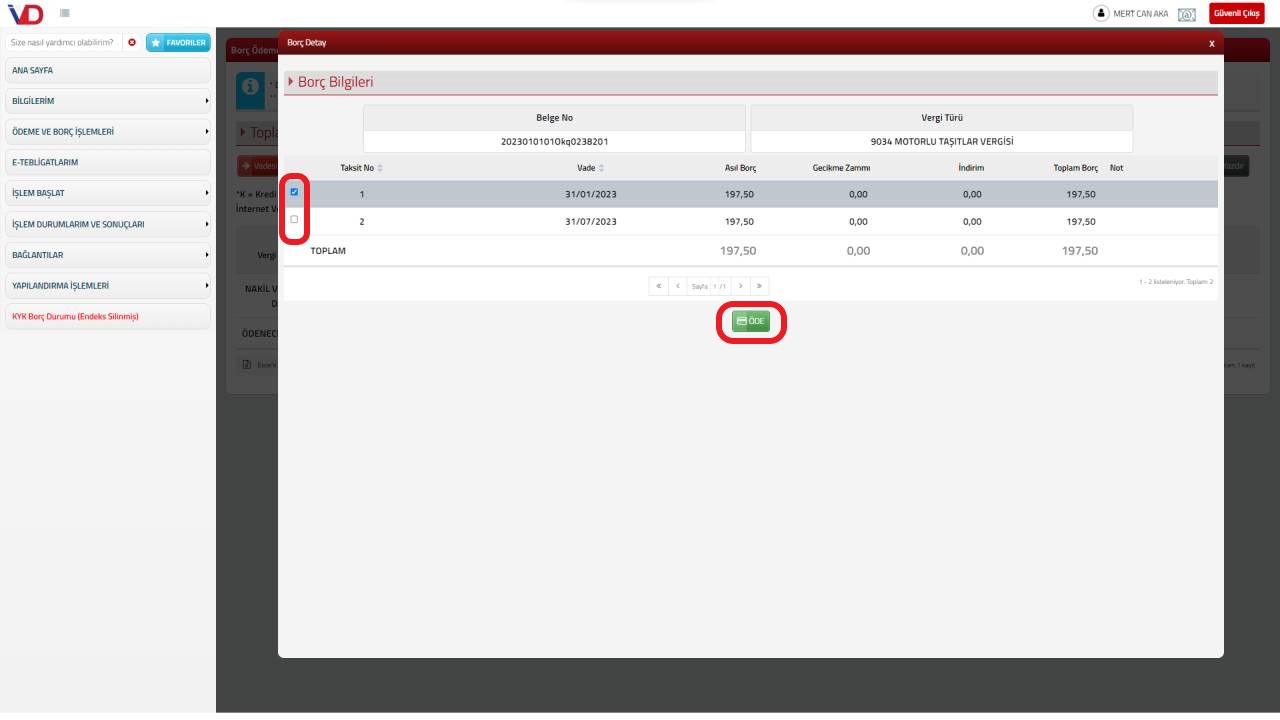

- In order to select the periods you will pay, check the boxes on the left side of the “PAY” Click the button.

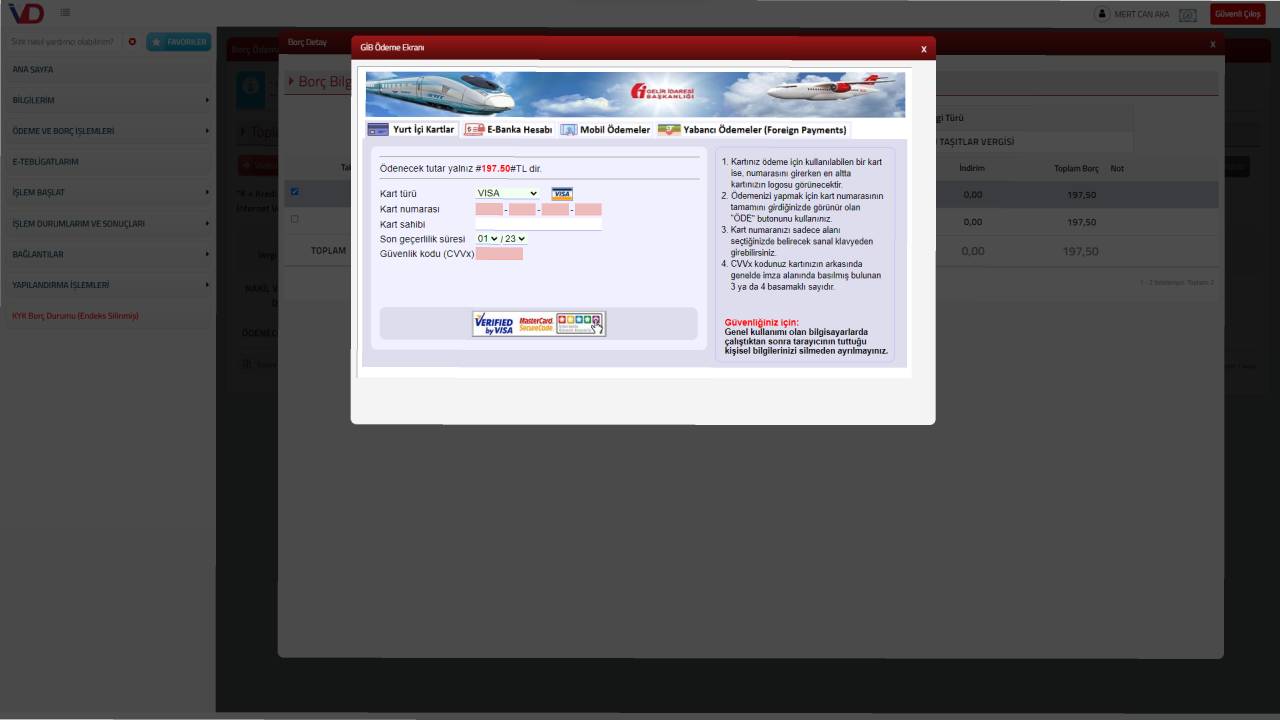

- You will be transferred to the payment page. Continue by entering your credit or debit card information here.

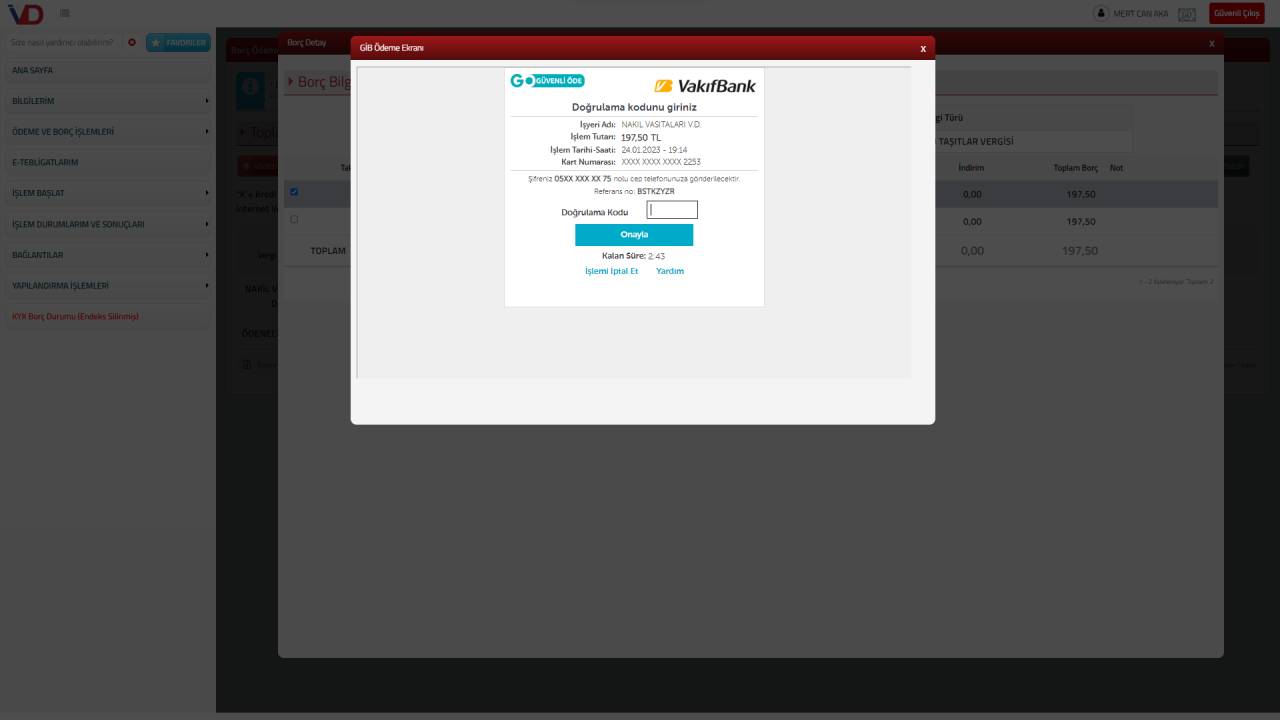

- Confirmation will be required for the card you are paying with. By typing the password in the SMS sent to the card holder’s phone, “Approve” Click the button.

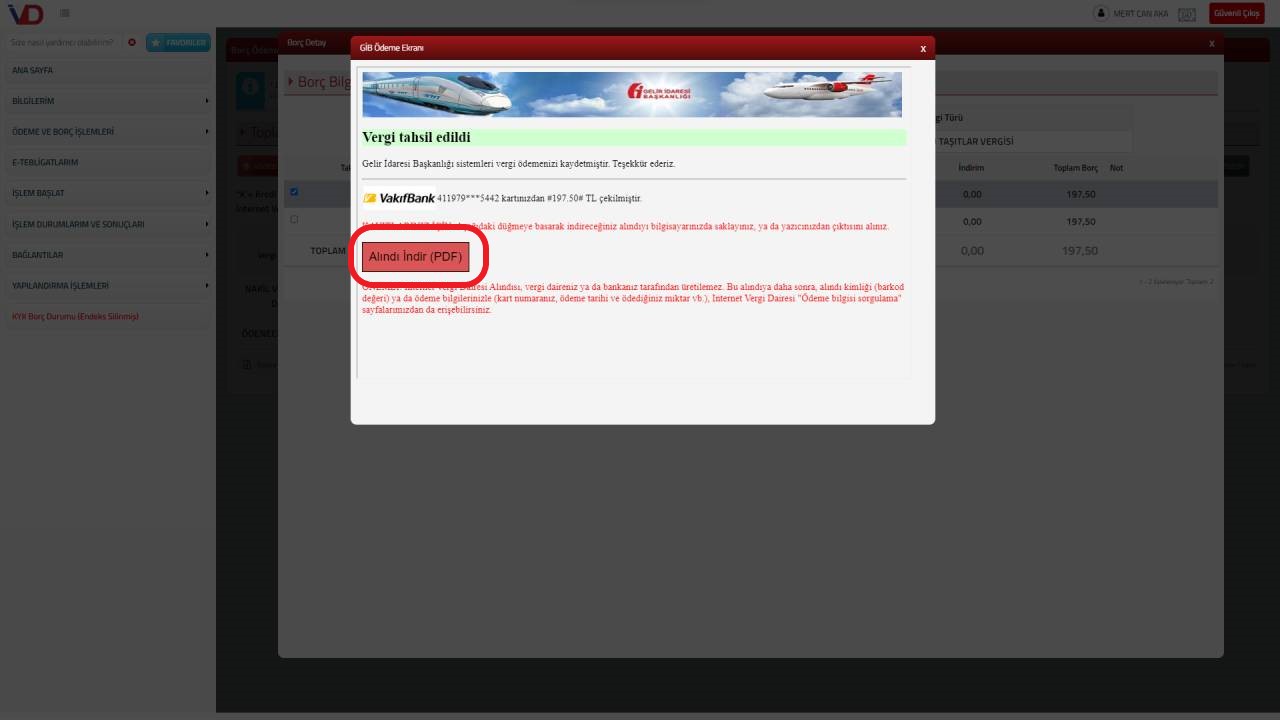

- At the end of the transaction, you will see the text Tax Collected. We recommend that you download and keep the PDF receipt at the bottom.

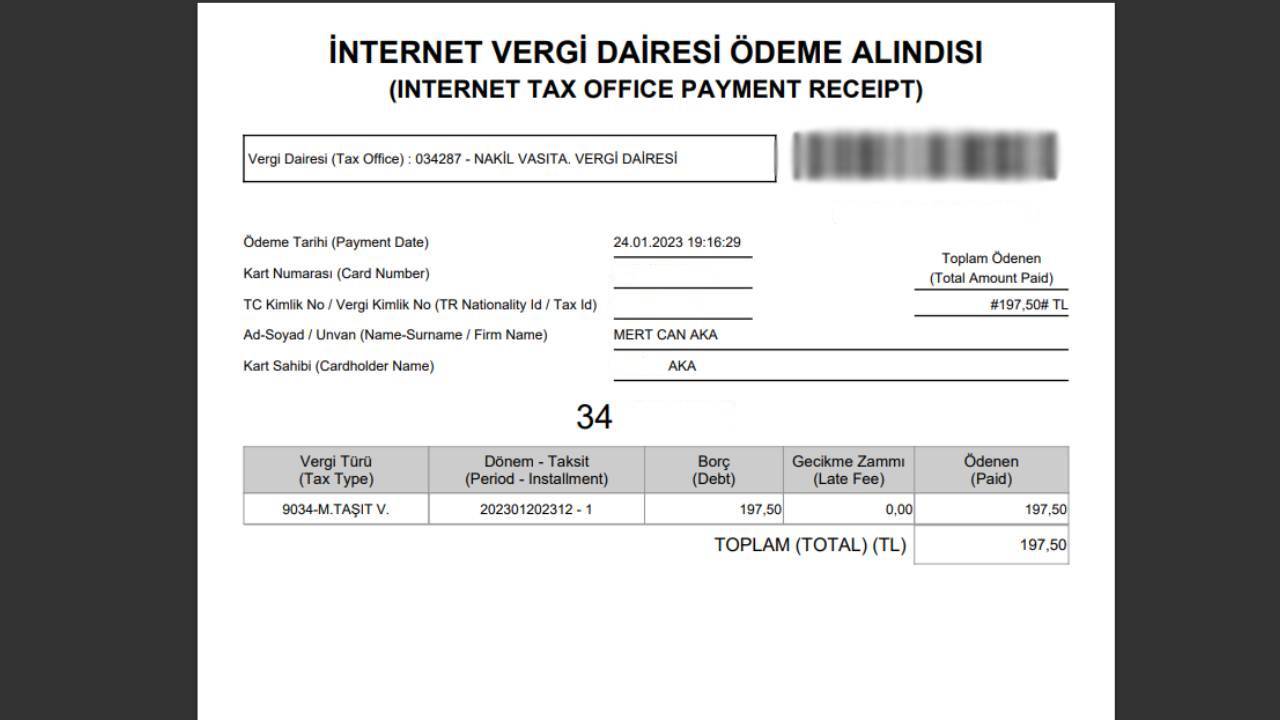

- The receipt will be as follows:

How much is MTV in 2023?

| Engine displacement (cm3) | vehicle value (X TL) |

1-3 years old (X TL) |

4-6 years old (X TL) |

7-11 years old (X TL) |

12-15 years old (X TL) |

16 years and older (X TL) |

|---|---|---|---|---|---|---|

| 1300 and six |

not exceeding 114,000 | 2,120 | 1,479 | 826 | 623 | 219 |

| 1300 and six |

Not exceeding 114,000 but not exceeding 199,700 | 2,330 | 1.626 | 907 | 687 | 242 |

| 1300 and six |

Over 199,700 | 2,545 | 1,773 | 993 | 750 | 261 |

| between 1301-1600 | not exceeding 114,000 | 3,693 | 2,769 | 1.606 | 1.135 | 436 |

| between 1301-1600 | Not exceeding 114,000 but not exceeding 199,700 | 4,064 | 3,047 | 1,768 | 1,245 | 476 |

| between 1301-1600 | Over 199,700 | 4,434 | 3,323 | 1,925 | 1,359 | 520 |

| between 1601-1800 | Not exceeding 285,800 | 7.178 | 5.613 | 3,299 | 2013 | 780 |

| between 1601-1800 | Over 285,800 | 7,834 | 6,120 | 3,604 | 2,199 | 851 |

| between 1801-2000 | Not exceeding 285,800 | 11,309 | 8,709 | 5.119 | 3,047 | 1.198 |

| between 1801-2000 | Over 285,800 | 12,340 | 9,505 | 5,584 | 3,323 | 1,308 |

| Between 2001-2500 | Not exceeding 356,900 | 16,967 | 12,317 | 7,695 | 4,596 | 1.818 |

| Between 2001-2500 | Over 356,900 | 18,511 | 13,436 | 8,393 | 5.016 | 1.983 |

| Between 2501-3000 | Not exceeding 714,300 | 23,656 | 20,583 | 12,857 | 6,915 | 2,535 |

| Between 2501-3000 | Over 714,300 | 25,810 | 22,451 | 14,027 | 7,545 | 2,766 |

| Between 3001-3500 | Not exceeding 714,300 | 36,030 | 32,421 | 19,528 | 9,748 | 3,570 |

| Between 3001-3500 | Over 714,300 | 39,309 | 35,365 | 21,303 | 10,631 | 3,900 |

| Between 3501-4000 | Not exceeding 1,143,400 | 56,650 | 48,919 | 28,808 | 12,857 | 5.119 |

| Between 3501-4000 | Over 1,143,400 | 61,806 | 53,364 | 31,432 | 14,027 | 5,584 |

| 4001 and over |

Not exceeding 1,357,700 | 92.725 | 69.530 | 41,179 | 18,507 | 7.178 |

| 4001 and over |

Over 1,357,700 | 101.152 | 75,853 | 44,924 | 20,189 | 7,834 |

Automobiles, pickpockets, land vehicles and similar vehicles registered and registered before 31/12/2017 are taxed according to the tariff numbered (I/A) regulated in the provisional article 8 of the Law No. 197. Accordingly, the MTV rates are as follows:

| Engine Displacement (cm³) | 1-3 years old (X TL) |

4-6 years (X TL) |

7-11 years (X TL) |

12-15 years (X TL) |

age 16 and up (X TL) |

|---|---|---|---|---|---|

| 1300 cm³ and below | 2,120 | 1,479 | 826 | 623 | 219 |

| up to 1301-1600 cm³ | 3,693 | 2,769 | 1.606 | 1.135 | 436 |

| up to 1601-1800 cm³ | 6.527 | 5.098 | 3.003 | 1,828 | 707 |

| up to 1801-2000 cm³ | 10,284 | 7,918 | 4.654 | 2,769 | 1.091 |

| up to 2001-2500 cm³ | 15.423 | 11,196 | 6,996 | 4.178 | 1.652 |

| up to 2501-3000 cm³ | 21.508 | 18,709 | 11,687 | 6,283 | 2.306 |

| up to 3001-3500 cm³ | 32,755 | 29,473 | 17,752 | 8,859 | 3.249 |

| up to 3501-4000 cm³ | 51,503 | 44,472 | 26,190 | 11,687 | 4.654 |

| 4001 cm³ and above | 84,294 | 63,211 | 37,435 | 16,821 | 6.527 |

Motor Vehicle Tax (MTV) for Motorcycles –2023

| Engine displacement (cm3) | 1 – 3 years (X TL) |

4 – 6 years (X TL) |

7 – 11 years (X TL) |

12 – 15 years (X TL) |

age 16 and up (X TL) |

|---|---|---|---|---|---|

| up to 100 – 250 cm3 | 395 | 295 | 218 | 134 | 51 |

| up to 251 – 650 cm3 | 817 | 618 | 395 | 218 | 134 |

| 651 – up to 1200 cm3 | 2.109 | 1,253 | 618 | 395 | 218 |

| 1201 cm3 and above | 5.116 | 3,380 | 2.109 | 1,674 | 817 |

Note: You can click here to learn the MTV rates of vehicles such as minibuses, buses, trucks, airplanes and helicopters.

What do you think about this subject? Don’t forget to share your views with us in the comments!