Credit cards, which almost everyone has to use at least one in today’s economic conditions, often make our job easier, but sometimes banks take extra money from us under the names such as membership fees and dues. So, how to get the credit card fee back? Let’s take a closer look at the methods you can apply to get a credit card fee refund.

How many credit cards do you have? If your answer to this question is one, you are lucky, but if you are a low-income person, unfortunately, this answer can reach double digits. Because in today’s economic conditions, we may have to borrow money just to survive. Yes, credit cards are often used by users. provides many advantages, but the credit card fee or under the names such as annual membership fee, they can sometimes create additional expenses for us.

Credit card dues are charged annually and are often not a very high figure, but paying an additional fee can be quite annoying if we are not informed in the application section where banks put on their cutest form. So, how to get the credit card fee back? Don’t worry, the laws are in favor of the consumer. Bride to get a credit card fee refund Let’s take a closer look at the methods you can apply.

How to get credit card fee back? Here are all the methods you can apply:

- Method #1: Call the customer service of the bank where you used the credit card.

- Method #2: Write a petition to the bank branch of which you are a customer.

- Method #3: Contact the Consumer Arbitration Committee in your county.

- Method #4: Apply to the Consumer Arbitration Committee via e-Government.

Method #1: Call the customer service of the bank where you used the credit card:

Even if it is not very effective, the first method you should apply for a credit card fee refund is that you are using the credit card. contacting the bank’s customer service. It is possible to do this when you call the bank’s customer service and explain the situation and request a refund of the credit card fee.

Let’s open a little parenthesis at this point. It is a legal request to call customer service and request a refund, but most of the time the person you talk to the representative will say that this is not possible. If you get such a response, you can reach the result by applying other methods.

Method #2: Write a petition to the bank branch of which you are a customer:

If you call the customer service of the bank and request a refund of the credit card fee and you are rejected, another method you should apply. to the branch of the bank you are a customer of to write a petition on the subject. You can create your petition using the following example;

TO THE GENERAL DIRECTORATE OF THE ……………… BANK

CITY

SUBJECT: About refund of credit card annual membership fee

I am pregnant…. …. …. …. From credit card no. ….. year ..…. I have learned that the annual membership fee of …… TL credit card has been deducted from the Account Notification Statement for the month of May. The deducted annual membership fee is contrary to the provision of “Unfair Terms in Contracts” and related legal regulations regulated in Article 6 of the Law on Consumer Protection No. 4077 amended by Law No. 4822.

For the reasons explained above, I object to the annual membership fee in the Account Statement Statement of ….. and I submit to your information the necessity of deducting the annual membership fee of …… TL from the amount in the next account statement statement. . …/…/….

Name surname

Signature

Address :

TR Number:

Phone Number :

ATTACHMENTS:

1. …/…/…. account statement with due date

2. Copy of identity card

Method #3: Contact the Consumer Arbitration Committee in your county:

I called the customer service of the bank, and it was not enough, I wrote a petition, but if you still say that you could not get a credit card fee refund It’s time to contact the authorities. In every city of our country, there is a Consumer Arbitration Committee that works under the trade directorates and the district governorships in every district.

With a short Google search, you can reach the contact information of the Consumer Arbitration Committee in your district. You must go to the Consumer Arbitration Committee and fill out an application form. In the application form, you should clearly state the issue and bring the additional required documents with you. If you do not have time to go to the Consumer Arbitration Committee, you can apply online with the next method.

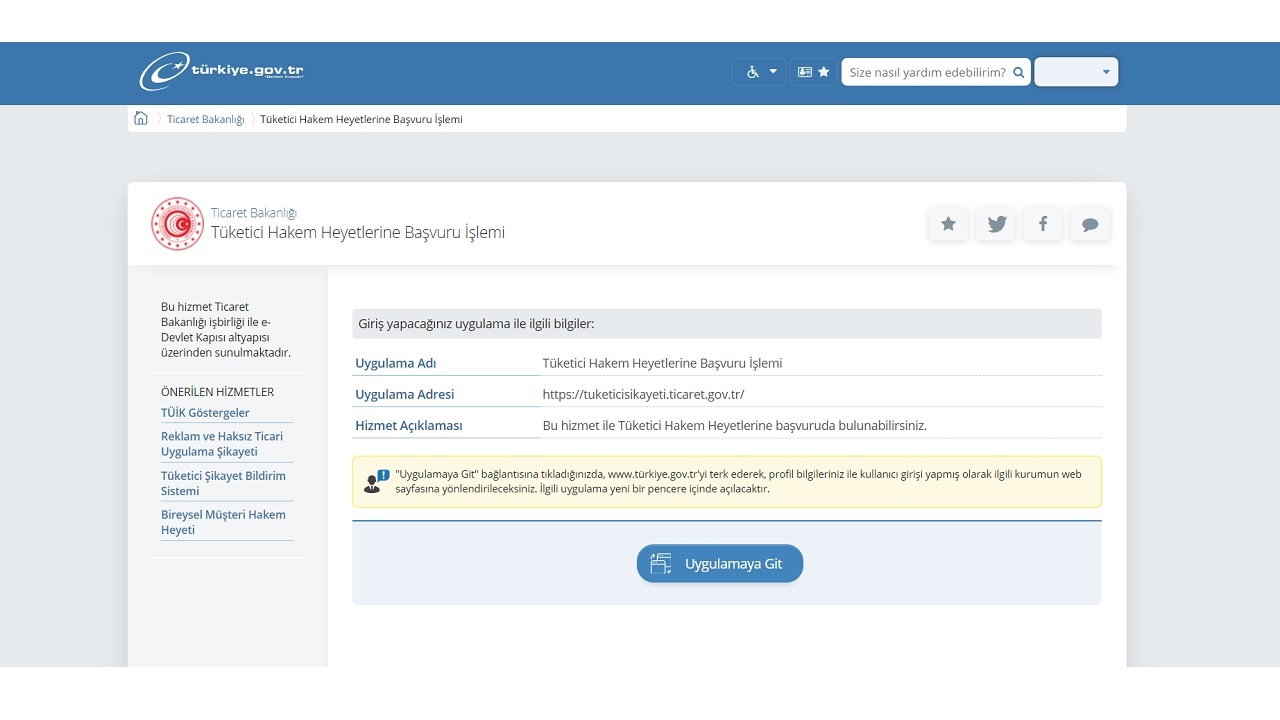

Method #4: Apply to the Consumer Arbitration Committee via e-Government:

- Step #1: Open the e-Government website via the link here.

- Step #2: Log in with your e-Government account information.

- Step #3: Type tubis in the e-Government search bar and search.

- Step #4: Reach the Consumer Arbitration Committee page through the search results.

- Step #5: Open the Consumer Arbitration Committee website with the Go to Application button.

- Step #6: You will be logged in with your e-Government account information.

- Step #7: Create a new reference.

- Step #8: Enter all the details about your request in the most up-to-date way.

- Step #9: Add the payment receipt.

To apply to the Consumer Arbitration Committee via e-Government for a credit card fee refund, simply follow the steps above. At this point, you threw the ball to the Consumer Arbitration Committee. Depending on the workload of the delegation, your application will be examined and most likely decided in your favor.

Are credit card dues legal?

We try so hard, but you may wonder if the credit card fee is legal or the bank charges me such a fee; yes, credit card dues are legal. According to the Communiqué on the Procedures and Principles Regarding Fees to be Collected from Financial Consumers, banks have the right to charge the customer under the name of credit card fee or annual membership fee.

Banks must clearly state the fee they demand in the credit card contract and must obtain approval from the customer. well if it is clearly stated in the contract that the customer will be paid You have to pay the card fee because this is a fee that the bank is legally entitled to demand.

So the state is not protecting us? Of course it protects. In the Law No. 6502 on the Protection of the Consumer, this sentence breaks the whole game; “Card issuers have to offer consumers a type of credit card that they do not charge an annual membership fee or similar name.”

In other words, let’s say you want to use the credit card of the bank X where you have an account or not, but you do not want to pay the credit card fee. Bank X should give you at least two options; A credit card with a paid fee and a credit card with no dues. If you have chosen the option for which the fee is not paid, but the fee has been charged, you can request a refund of this fee with one hundred percent right.

The annual demands of banks from their customers How to get a credit card fee refund By answering the question, we talked about the methods you need to apply for this process. In order not to deal with such transactions in the future, it is useful to read even the smallest details before signing the credit card contract.