While the issue of tax refund is confusing on the phones, we explain in the clearest way how to get your tax refund and where you should apply.

“which has been on the agenda for months”tax-free phone, tablet and computer” topic caused us to have high hopes in the first place. But soon the conditions for this were announced and we saw that there was a major limitation. However, we provide you with many models that we think can basically meet student needs.

But even if we show these models tax refund how to doIssues such as , where to do it and where exactly to apply create confusion in minds. We have collected everything that has been announced so far in a single content. question marks We remove it.

How to get a tax-free phone refund?

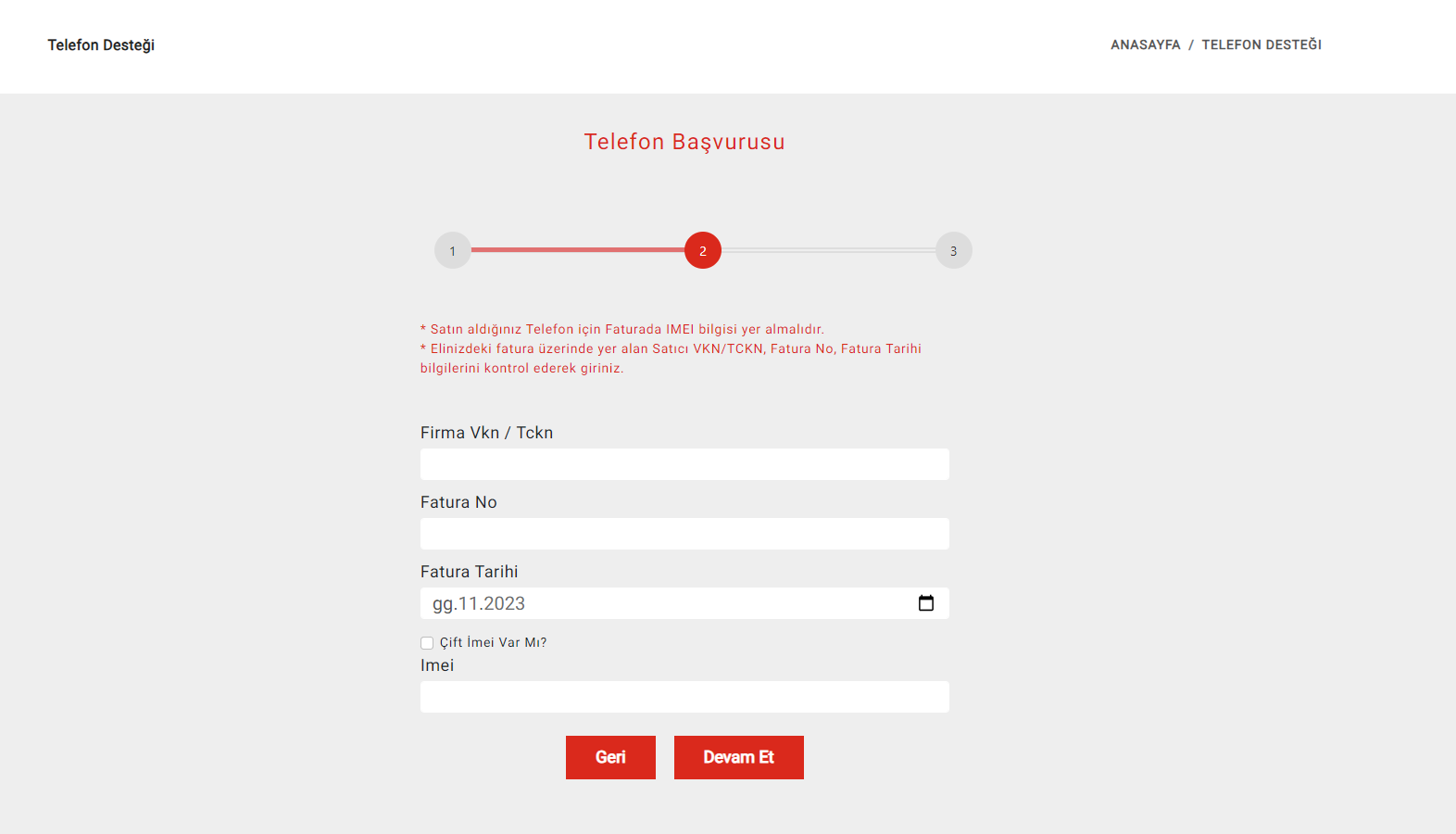

- Step #1: Go to the relevant section on the Ministry of Youth and Sports Website. contact.

- Step #2: Enter your name and surname, your ID number and date of birth.

- Step #3: In the next step, enter the seller’s TIN or identification number.

- Step #4: Enter the invoice information sent to you in the next two lines.

- Step #5: Find out the IMEI number via *#06# and enter it in the relevant line.

Once you complete the form, your application is complete. So where will the technology support payment be made?

When we look at the conditions, tax refunds are given by students as of the twentieth day of the month following the purchase, unless there is something wrong. will be sent to IBAN It is stated. What we mean by setbacks is that there are situations such as cancellation in the order. Apart from this, a person can benefit from both computer and telephone support.

Of course, it is clearly stated that problems arising from incorrect IBAN entry are the student’s responsibility.

The full terms are as follows:

-

Being a citizen of the Republic of Türkiye.

-

Except for open education programs Being a student enrolled in a higher education institution.

-

As of purchase date less than 26 years old to be.

-

Technological device support, portable or desktop computer, tablet or mobile phone It can be used by purchasing devices.

-

Technological devices for devices purchased from abroad support cannot be given.

-

The computer device for which technological device support is applied taxes included final sales price Less than 9,500 Turkish lira It is necessary to have.

-

The final sales price of the phone device for which technological device support is applied must be less than 9,500 Turkish liras, including taxes.

-

Purchased technological device not second hand It is mandatory.

-

Regarding the technological device purchased electronically issued invoice and the invoice must be issued in the name of the student who will receive the support, including the Republic of Turkey Identity Number.

-

Subject to support in invoices issued electronically outside of technological device no product is necessary.

-

The invoice issued electronically includes the invoice date, ETTN number, and mobile phone support. IMEI number and the tax identification number of the company from which the technological device was purchased or the Republic of Turkey Identification Number must be written.

-

Technological device support invoice date the twentieth of the following month It is carried out for devices that cannot be canceled or refunded as of today.

-

The application can be made by the student (except for open education students) through the GSBBiz application of the Ministry or by entering the address gsbbiz.gsb.gov.tr. It is mandatory to do.

-

The student (except open education students) must submit his/her IBAN number.

-

The phone line to be used for the purchased mobile phone device belongs to the student who purchased it is necessary.

-

Starting from the date of benefiting from support for mobile phone devices at least two years It must be used only by the beneficiary of the support for a certain period of time.

-

The information entered by the student (except open education students) during the application and the technological device support of the application If it does not meet the conditionsthe application is rejected through the system, stating the reason.

-

If the application is accepted, the amount of technological device support calculated by the Ministry through the system It is transferred to the student’s account via the IBAN number provided by the student.. Responsibility arising from incorrect IBAN number will belong to the student.

-

For computer devices just once application can be made.

-

For mobile phone devices just once application can be made.

-

Final sales prices of one of the computer devices and the mobile phone device separately Provided that it does not exceed 9,500 Turkish liras It is possible to purchase it by the same person.

-

Final sales price of the mobile phone device 41.23 percentthe final sales price of the computer or tablet device 16.66 percent The amount of technological device support calculated by the Ministry with the student’s IBAN number is transferred to your account.

-

Total technological device support amount Cannot exceed 5,500 Turkish lira.

-

It is later understood that the conditions for benefiting from technological device support are not met at the time of application or the support is withdrawn. If it is determined that illegal use has been madethe benefited support amount will be refunded from the student in accordance with the general provisions, together with the interest to be calculated at the rate of delay interest determined in Article 51 of the Law on Public Receivables Collection Procedure No. 6183 dated 21/7/1953, starting from the date of payment.

So, which devices can you evaluate in this context?

Our phone recommendations:

Our computer recommendations:

RELATED NEWS

Special Support Campaign for Students Who Will Benefit from Tax-Free Phone and Computer Application from Hepsiburada

We will be sharing the developments.

We have also prepared a list of tax-free phone and computer suggestions that you can benefit from this application.

Meanwhile, Hepsiburada launched various campaigns for students for tax-free devices. All phones, computers and tablets included in the application can be purchased in installments without the need for a credit card, with the Hepsiburada limit specific to students. You can check out our list here.

#partnership