Dusseldorf Carl Eschenbach has completed a tour of Europe. The co-head of the US software provider Workday recently visited the individual country offices in seven days. He took a particularly close look at Germany.

“It’s going really great, I’m impressed. Europe offers us enormous opportunities,” says Eschenbach in an interview with the Handelsblatt. In the past fiscal year, Workday achieved around three quarters of its sales of 6.2 billion dollars in the USA and one quarter in the rest of the world. The manager announces an offensive, the global market potential has only been marginally exhausted.

Germany should be one of the drivers, “due to the size of the economy alone,” says Eschenbach. In this country, Workday is particularly successful with its software for personnel management. Just a few weeks ago, the company gained Mercedes-Benz as a customer, and Siemens and Deutsche Bank are also involved. “Half of all DAX companies use our software globally,” says Eschenbach.

Around 1,400 customers use Workday in Germany

Overall, Workday is growing very rapidly and, according to investment bank Barclays, will generate $7.2 billion in revenue this fiscal year. “Workday has ambitious goals in Europe and Asia,” said Greg Leiter, software analyst at IT consultancy Gartner. “In Europe, the company brings financial service providers on its side in particular.”

Overall, Workday has around 10,000 customers, 1,400 of whom use it in Germany. Among them are the Bundesliga soccer club Borussia Dortmund and financial service provider N26.

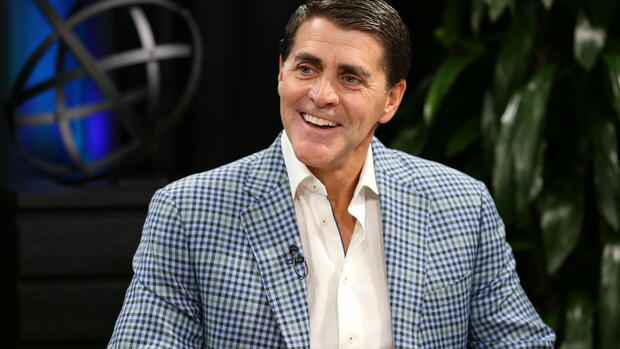

Eschenbach is a household name in Silicon Valley. The American has worked for the well-known venture capitalist Sequoia since 2016, where he made investments in the video conferencing service Zoom, the cloud provider Snowflake and the manufacturer of automation software Uipath. Before that, he had worked his way up to COO of the software company VMware in 14 years.

Just a few months ago, Eschenbach became CEO of Workday and initially shared the task with Aneel Bhusri. However, the Workday co-founder will step down from the post in six months and take over the chairmanship of the board of directors. The many changes at the top – the head of marketing, customer manager and partner manager were also replaced – caused some unrest. But Eschenbach now promises continuity.

A foot in the door through HR software

Workday wants to grow in SAP’s home market of all places. During the interview, Christopher Knörr, head of Germany, sits next to Eschenbach. He’s more than self-confident: “SAP will be afraid of us,” says Knörr.

However, the Walldorf-based company is the undisputed market leader with its “Enterprise Resource Planning” (ERP) software, which companies can also use to manage their human resources department. According to Gartner, Workday grew more than twice as fast as the European ERP software market in 2022. In other words, Workday is gaining market share.

The Workday Germany boss wants to take market share from SAP.

(Photo: Workday)

However, explains Analyst Leiter, Workday is primarily trying to entice customers away from Oracle. “The company still lacks the offers and knowledge for the processing industry, where SAP is strong,” says Leiter.

>> Read also: “We want to be the spider in the web”: SAP enters into partnership to digitize factories

So far, Workday has managed to penetrate financial institutions and human resources departments in particular. “It’s great software that is well tailored to the needs of the HR department,” says Peter Wedde, a management consultant specializing in employment law and data protection. “No wonder it’s catching on.”

The former professor at the Frankfurt University of Applied Sciences is in contact with many companies and works councils through his consulting firm D+A Consulting. He hears from them that Workday is particularly convincing when compared to the SAP HR software Success Factors, which is often judged to be “bulky”.

More than 120,000 skills differentiated by employees

Workday’s software captures employees with unprecedented accuracy. In the past fiscal year, there were a total of around 629 billion transactions in all human resources departments of companies – from further training courses to feedback from employees or bosses.

According to Jens Löhmar, head of technology at Workday in Europe, the software company uses artificial intelligence and machine learning to “extract” information from job applications, feedback discussions or self-assessments.

More than 120,000 skills are listed on the so-called Skill Cloud. Based on this, companies can assess applicants or employees very precisely and steer their careers with so-called “development plans”.

>> Read also: Where HR managers now find a lucrative job with what skills

According to Eschenbach, the amounts of data are processed anonymously in order to be able to make them available to all customers. In this way, small and medium-sized companies could draw from the data pool. “Data security is the top priority,” says Eschenbach.

Find out about employee sentiment with surveys

Expert Wedde is nevertheless skeptical: “A representative from Workday once said: Our software knows more about employees than they do themselves.” Workday wants to be able to identify which employees are thinking about leaving – before they even think about resigning. “It’s a bit scary what’s happening there,” he says.

The tool is called “Peakon Employee Voice” at Workday. This is the software of the Danish start-up, which the US company took over in 2021 for almost 600 million euros. Companies can use this to query the well-being of employees with four to five questions a week, according to Workday there are 500 million data points that are generated every year.

>> Read also: Digital Surveillance: How Companies Shadow Their Employees

Analyst Head of Gartner at Workday sees a need for improvement, especially in the prices. Due to numerous acquisitions, new technologies and options, the price model is “complex”. For software renewals, the prices are higher than the industry average, and Workday also charges additional “innovation fees.” The company knows exactly: “It is difficult and expensive for customers to switch,” says Leiter. However, this applies to all providers.

More: What SAP is still missing for the trend reversal – Dax group in the balance sheet check