The fund service providers create shell companies with cryptic names for the business.

(Photo: new-horizons.eu/ddp images)

Zurich They are among the riskiest interest-bearing securities on the market: subordinated debt from real estate project developers. Interest rates remained exceptionally high at 15 percent, even in the past zero-interest years. There are no ratings. The terms are flexible at 12 to 36 months. And liquidity is low given the lack of a secondary market.

Investment vehicles such as the troubled Verius real estate financing fund that invest in such debt instruments are also high-risk products. The fund lured – before it was frozen – with an annual performance of eight to ten percent and two distributions a year.

However, small insurers and pension funds that fall under the Investment Ordinance may not invest the funds entrusted to them, the so-called guarantee assets, directly in such funds. “In Bafin’s view, investment funds that allow investments below a speculative rating are not suitable for covering the guarantee assets,” write the experts from Deloitte, for example.

However, lawyers and financial engineers have found a way to make investments in the Verius funds and comparable investment vehicles possible. The magic word is “credit enhancement”. The German financial regulator Bafin is said to have approved these credit enhancement structures, according to industry circles.

Top jobs of the day

Find the best jobs now and

be notified by email.

The Bafin explains on request: “The insurance companies are responsible for checking compliance with the investment principles and the qualification of the investments for the guarantee assets.” If in doubt, the companies are encouraged to refrain from investing.

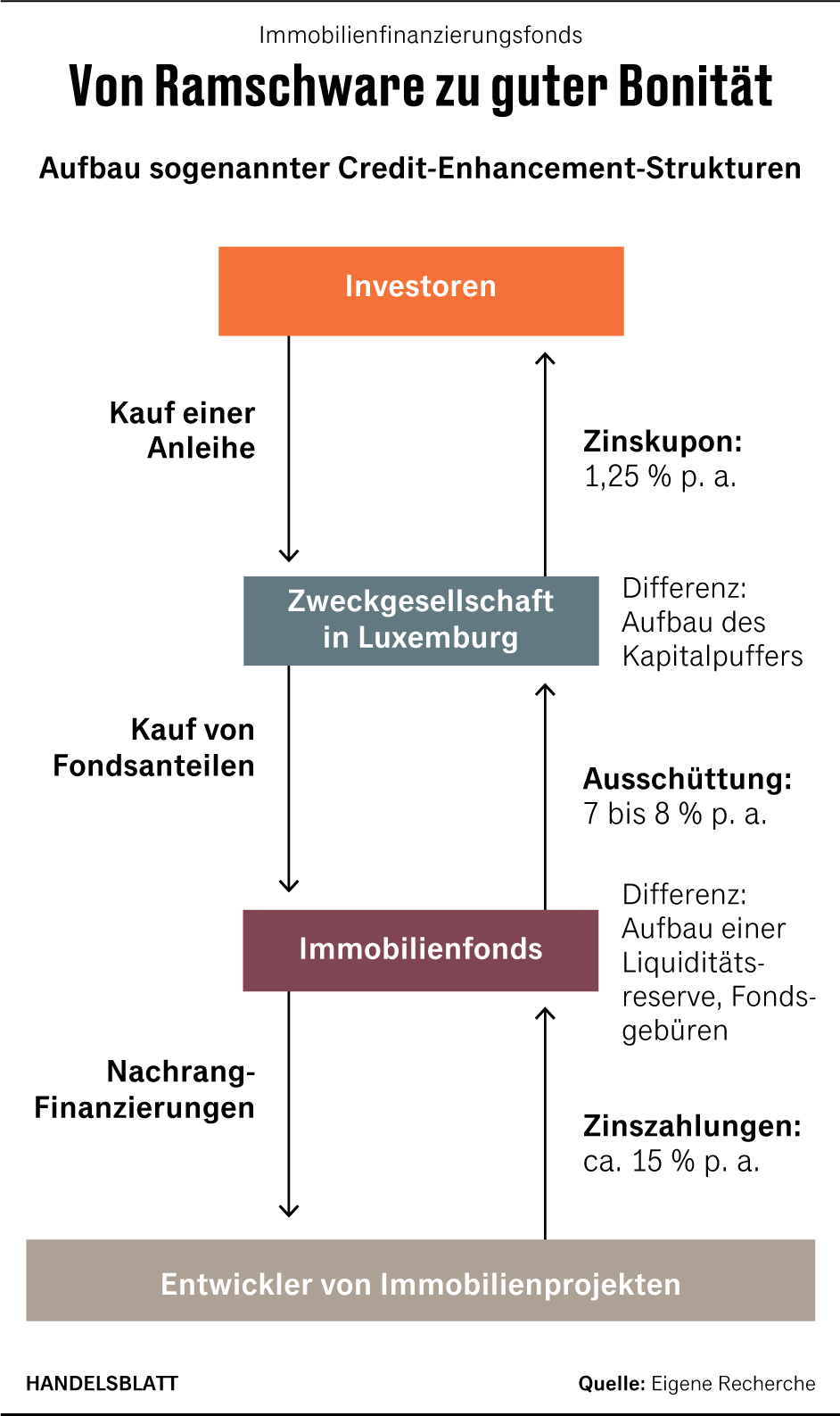

Letterbox companies in Luxembourg

The “credit improvement” works like this: The fund service provider sets up a special purpose vehicle between the fund and the investors. This company, usually with a cryptic name and registered office in Luxembourg, has the sole task of buying fund shares. In the case of the Verius fund, this is Securo Pro Lux SA based in Munsbach, Luxembourg. It issues fixed-income securities, which investors subscribe to. The special purpose vehicle uses the money collected to buy shares in the fund.

The credit enhancement is achieved by the SPV passing on only part of the distributions from the fund to the bond investor. An example: the Verius fund recently distributed between seven and eight percent annually to investors. However, Securo Pro Lux only pays its bond investors a fixed interest rate of 1.25 percent.

Securo Pro Lux retains the difference and thus builds up a kind of buffer. From this buffer, the special purpose entity can service the coupon interest and the nominal value of its own bond even if there are no distributions at fund level.

Accordingly, the buffer is larger if the investment dates back a long time. For example, if a company only invested in the fund a year ago via Securo Pro Lux, only the interest from one year is available as a buffer. As a result, more than 90 percent of the nominal value would not be covered. The Securo Pro Lux bond on the Verius fund is rated triple B minus by Creditreform – just one notch above junk status.

Questionable motivation

The result: The structured bond has a good credit rating, which is why pension funds and insurers are allowed to invest as confirmed by the Bafin. And this despite the fact that the underlying fund invests in unrated interest rate securities of the highest risk class – and would therefore be taboo for many professional investors.

The motivation behind this is to circumvent regulatory quotas. You can do that, but you have to keep the reputational risks in mind. Top manager of a large provider of private markets investments

The outstanding volume of these specially secured bonds on the Verius funds is over 800 million euros – around two thirds of the total fund volume. This means that the majority of investors are invested in the Verius fund via this indirect route.

Many professional investors were also involved in the also frozen multi-billion dollar Stratos real estate fund exclusively via this supposedly safe detour. In many cases, so-called alternative systems are set up in this way, for example in individual infrastructure projects. Industry experts estimate that German insurers and pension funds may have invested billions in such structures.

The financial supervisory authority explains: “Should the Bafin, during the course of its audit work, notice that individual assets are not suitable for the guarantee assets, it would of course ask the company to remove the assets in question.”

The structures are controversial among asset managers. The top manager of a large provider of private market investments says: “The motivation behind this is to circumvent regulatory quotas. You can do that, but you have to keep the reputational risks in mind.”

The crisis at Verius is now revealing the risks of these constructions: The fact that Hauck & Aufhäuser has suspended the calculation of the value of the fund shares is also causing chaos among the creditors of the Securo bonds. Because the price of this bond can no longer be calculated, as market participants confirm.

Pension funds and insurers that hold the bonds are coming under pressure. The Schleswig-Holstein tax consultant pension scheme disclosed investments in the Securo bond in the financial report for 2021.

Should the Verius fund’s value calculation remain suspended for any longer, they could be forced to postpone their own financial statements. It is therefore no wonder that those in the know report that everyone involved is on edge.

More: A multi-billion real estate fund is once again under pressure