Automated driving is opening up a new billion-euro market for chip manufacturers.

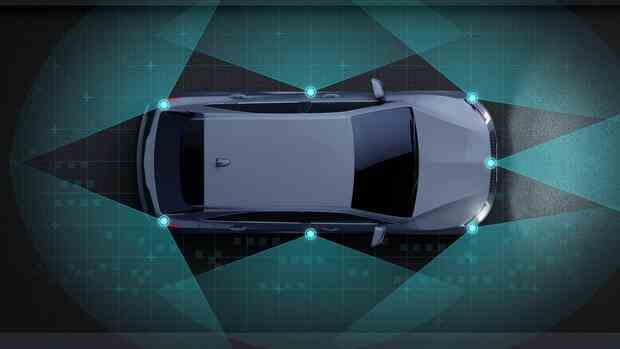

(Photo: Infineon)

Munich Rain, storms and darkness are a nightmare for drivers, but they are not a problem for modern radar solutions. Even under adverse conditions, radars record what is happening around the vehicle. “Radar is the fundamental technology for autonomous driving because it is so robust in any weather and at any time of the day,” says Torsten Lehmann, head of radar business at chip manufacturer NXP.

It will be years before cars drive independently on a large scale. Electronic assistants, on the other hand, are already catching on today. “Customers are asking for more and more radar systems, while at the same time stricter legal requirements are ensuring increasing quantities,” emphasizes Lehmann.

European semiconductor producers in particular benefit from this. Radar is one of the few fields in the chip industry that is not dominated by American and Asian suppliers. In the booming business, the Dutch manufacturer NXP is fighting for dominance with the Munich-based Dax group Infineon.

NXP counts all major car brands as customers

“With our radar products, we do business with every single one of the 20 largest car manufacturers,” emphasizes NXP manager Lehmann. That’s not all: “We’re gaining market share.” Radar solutions are one of six growth areas at NXP, which, according to CEO Kurt Sievers, promise an annual increase in sales of 20 to 25 percent. This benefits Germany as a chip location, because the division is based in Hamburg.

According to the latest figures available, chip manufacturers achieved sales of almost $1.5 billion with radar chips in 2021, around 15 percent more than in the same year. According to the analysts at Yole, NXP had a market share of 44 percent and Infineon 33 percent.

Infineon assumes that manufacturers will deliver almost a quarter more radar systems every year by 2027. After all, electronics play a crucial role on the road to autonomous driving. As a rule, radar is combined with cameras or lidar systems in order to record the environment as completely as possible. Lidar uses lasers to measure distance.

Only Tesla doesn’t want to know anything about radar

Only one manufacturer does without it: Tesla, the electric car pioneer from America. “Tesla is the only one swimming against the tide and relying entirely on cameras and software,” says Albert Waas, chip expert at BCG. “Everyone else is convinced that only the combination of cameras and sensors is safe enough.”

However, the various systems are expensive. For the so-called Level 2 of automated driving, BCG calculated the costs for the necessary chips to be 290 dollars per vehicle. At this level, drivers can at least temporarily take their hands off the steering wheel.

It becomes even more lucrative for the chip manufacturers in the subsequent stages. At level 3, the person behind the wheel can temporarily turn away from the traffic, at level 5 the vehicle drives completely independently. This requires significantly more chips in each case.

>> Read here: Federal government paves the way for record investment by Infineon

For car manufacturers, this means additional costs: According to the industry, a radar chip currently costs around five dollars. For the associated microcontroller, which are minicomputers for very specific tasks, customers have to estimate the same amount again. NXP assumes that by the middle of the decade there will be five radar sensors in every mid-range vehicle, and ten or more in every premium sedan.

Infineon wins major order from truck manufacturer

So far, however, the costs have not deterred car buyers. “Radar technology has long since found its way into the golf class,” emphasizes Burkhard Neurauter, Head of Radar Chip Development at Infineon. The business is crisis-proof, adds NXP manager Lehmann: “More and more cars with radar are coming onto the market. That more than compensates for dents in car production.”

Manufacturers are also fueling business with innovative solutions that are more powerful and require less space. At the beginning of the year, NXP presented a system that is intended to better identify particularly vulnerable road users, such as pedestrians or cyclists. At the same time, developers have downsized the electronics, which should make it easier for car designers to install more sensors. The first customer is Denso, the world’s second largest automotive supplier after Bosch.

Technology is even more important for professionals than it is for private individuals. At the beginning of February, Infineon announced a major order from a truck manufacturer who wants to use the radar chips for Level 4, i.e. for highly automated driving. The order volume: a three-digit million amount.

More: What a medium-sized Bavarian company does for the chip industry