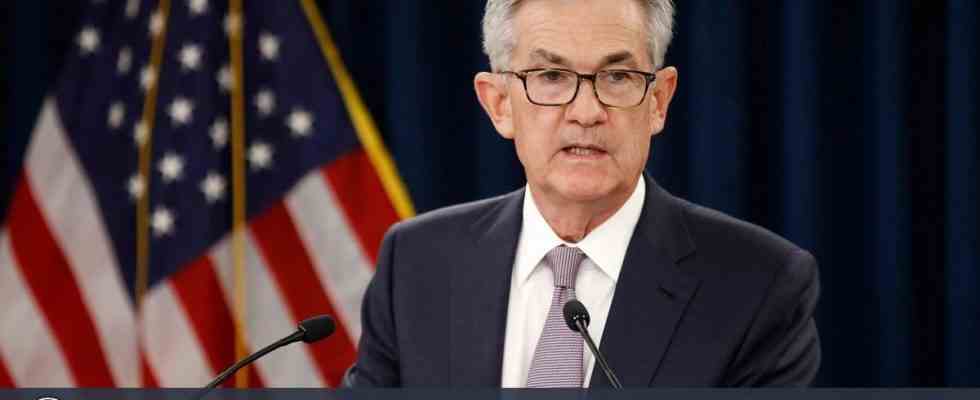

bitcoin and all eyes on the cryptocurrency market tonight FEDConverted to future interest statement.

While experts state that it would be better for the future of the economy for the FED to keep the interest rates constant after the banking crisis in the USA, we see that the expectations are united around a 25 basis point interest rate increase, but the opinions of the world’s largest banks on this issue differ.

While some banks expect an increase of 25 basis points from the FED, some banks express their opinion that interest rates will not be increased or cuts will be made.

Some banks’ FED Interest Rate Forecasts are as follows:

“JP MORGAN raises 25 basis points

BANK OF AMERICA 25 basis points increase

MORGAN STANLEY 25 basis points raise

CITI 25 basis point raiseBARCLAYS 25 basis points raise

DEUTSCHE BANK 25 basis points increase

GOLDMAN SACHS 0 basis point increase

WELLS FARGO 0 basis points increase

CREDIT SUISSE 0 basis points increase

NOMURA 25 basis points cut”

What is the Effect of FED’s Interest Rate Decision on Bitcoin?

Analysts evaluating the impact of the FED’s interest rate decision on BTC and the cryptocurrency market “If the Fed decides not to raise rates, then there could be a pump. However, if the FED increases by 25 basis points within the expectations, there may not be a downward or upward movement in the market. With an increase of 50 basis points, it seems likely that the crypto market will experience a dump.” commented.

How Will BTC Be Affected in 25 BPS Scenarios?

At this point, in our opinion, in case of a 25 basis point interest rate increase, the statements in the FED’s interest rate decision will be decisive in the direction of the market.

If, after a 25 basis point rate hike, the Fed’s use in every text from March 2022 “The board considers continued interest rate hikes to be appropriate” If the expression is removed from the text, we can see a serious rise on the side of Bitcoin and gold. The reuse of this expression in the text will reflect on the markets as selling pressure.

Investors, who look at the 25 basis point interest rate hike with certainty, will follow whether the phrase “the board thinks continuing interest rate hikes will be appropriate” used by the FED in every text since March 2022 will also be included in today’s text. #FED #Bitcoin

— Bitcoin System (@bitcoinsystem) March 22, 2023

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!