Digital asset manager Grayscale Investments announced the inclusion of five new cryptocurrencies among its investment products on Monday, May 16. announced. The new tokens have already started trading in the markets, bringing the total number of single-asset investment products offered by Grayscale to 14.

Grayscale is among the new products offered by the platform. Basic Attention Token Trust (GBAT), Grayscale chainlink Trust (GLNK), Grayscale Decentraland Trust (MANA), Grayscale Filecoin Trust (FILG) and Grayscale livepeer Trust (GLIV). The digital asset manager offers investors comprehensive exposure to the cryptocurrency market without investing directly in altcoins.

Grayscale has 25 cryptos on its rubric.

Grayscale already has investment products for 24 digital assets supporting different crypto projects, including top cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) investment products.

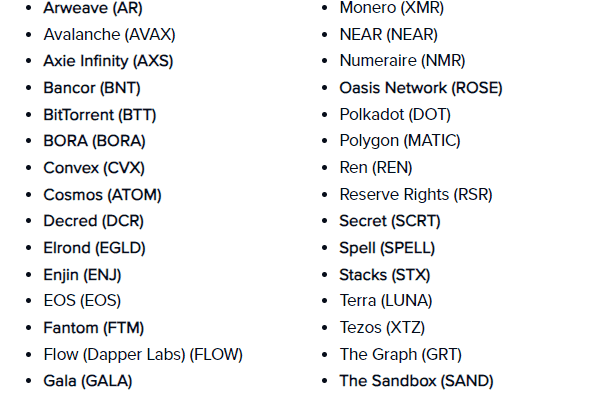

In addition to these, the company announced earlier this year that Grayscale; Cosmos (ATOM) and Phantom (FTM) He shared a list of “Assets Under Evaluation”, which includes 25 crypto assets he considers as new investment products, including popular altcoins such as There are also many well-known projects among the 25 new cryptos under review by Grayscale.

“’Assets Under Consideration’ lists some digital assets that are not currently included in a Graysclae investment product, but that came to our attention as part of our research on this industry and that our team has identified as possible candidates for inclusion as a future investment product.”

The list includes tokens from many different DeFi, non-fungible token (NFT) and metaverse projects. Popular altcoins in the DeFi industries Algorand (ALGO) and Convex (CVX) While taking its place on the list, the investment giant Axie Infinity (AXS), Sandbox and Enjin (ENJ) He is also interested in metaverse projects such as

Other assets of interest to the platform include the following cryptocurrencies:

Grayscale’s leadership in crypto

The addition of the tokens to Grayscacle’s basket came at a time when the cryptocurrency market was witnessing a huge hit. Within a week, the collapse of Terra’s stablecoin UST caused massive damage that was reflected in the broader market. Grayscale’s chief legal officer, Craig Salm, highlighted the company’s leadership in the space in an announcement today, saying:

“Sometimes leadership means going against the current. With our current and future offerings, we hope to provide discerning investors with tools to build a diversified portfolio of digital assets.

Today’s announcement underscores Grayscale’s commitment to move all of our digital currency investment products through the intended four-stage product lifecycles with the goal of ultimately converting each of them into an ETF. We believe investors deserve access to the digital currency ecosystem through secure products.”

Grayscale said earlier in the day that it will launch several new products listed in Europe as part of its transatlantic debut. Grayscale’s first European fund will be listed on the London Stock Exchange, Borsa Italiana and Deutsche Börse Xetra. In addition, the ETF will be available to trade across all of Europe.

Grayscale, the world’s largest asset management firm, wants to collaborate with investors to allocate capital to cryptocurrencies. Apart from Bitcoin, the firm’s single-asset investment packages allow investors exposure to a variety of cryptocurrencies. Bitcoin Cash (BCASH), Ethereum (ETH)Ethereum Classic, Horizon (ZEN), Litecoin (LTC), Left (LEFT), Stellar Lumens (XLM) and Zcash (ZEC) offers are also among these single-asset investment products.

The platform also includes diversified products that comprise the top 70 percent of the digital currency market by market cap. Grayscale Digital Large Cap Fund It offers investors exposure to digital assets through

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.