Analysts are poised for a break towards the $30,000 level for Bitcoin. However, it remains unclear what path the BTC price action will take in the coming days? Traders look at 5 must-knows this week for Bitcoin and altcoins.

BTC weekly close holds key trendline

Bitcoin may not have inspired with its last weekly close. But some popular traders are finding new reasons for optimism. Meanwhile, BTC remains in the narrow trading range. However, the leading crypto still has a chance for a break towards $30,000.

According to Trader Jelle, it’s only a matter of time before Bitcoin breaks the 30k level once and for all. Jelle notes that the 200-week moving average (MA), a key support line, remains intact.

Trader and analyst Rekt Capital has several support structures on its radar that cover daily timeframes. According to the analyst, these look solid. The analyst clarifies his views on a higher breakout that would potentially invalidate the bearish “head and shoulders” structure of the previous weeks. “So far so good,” the analyst sums up in this context.

In an additional tweet, Rekt Capital talks about BTC successfully retesting a close support.

An analyst nicknamed Game of Trades said, “BTC broke out of the head and shoulders formation in May. But there’s the classic whip around the neckline,” she says. According to the analyst, the pattern remains valid as long as BTC does not rise above the right shoulder. An accompanying chart only gives a potential downside target of $24,000 for Bitcoin due to the head and shoulders pattern.

Others, like Trader Crypto Tony, expect less action. Therefore, he identifies $25,300 as the possible target for Bitcoin. He also notes that the resistance remains unchanged at $28,350.

Macro recession is coming while the dollar is recovering!

The week of June 5-9 will be an unusually quiet week for traders. Because very little macroeconomic data will come from the USA in this date range. Meanwhile, cryptocoin.comAs you follow, the debt ceiling crisis is over. So it looks like the next potential catalysts will be the Consumer Price Index (CPI) data. However, there is still time for that. However, despite the current reductions in oil production, prices continue to fall. Therefore, attention is focused on the oil production cuts of Opec+ members.

Meanwhile, a more direct potential windfall for BTC and altcoins is coming from the US dollar. The strength of the dollar has rebounded since the beginning of May. Since then, DXY has gained about 3.5%. It is important to remember that DXY has an inverse correlation with risky assets. Popular analyst Matthew Hyland points to the increasing relative strength index (RSI) for DXY on weekly timeframes.

Other trader Skew says DXY needs to close above the June high of 104.7% to form a bullish trend. In this context, the analyst makes the following comment:

If DXY closes above $104.7, I would rate it as strength of the dollar. So far this seems risky but we’ll see later.

Meanwhile, TraderSZ sees DXY as bullish until proven otherwise.

Stocks support the rise in BTC and altcoins

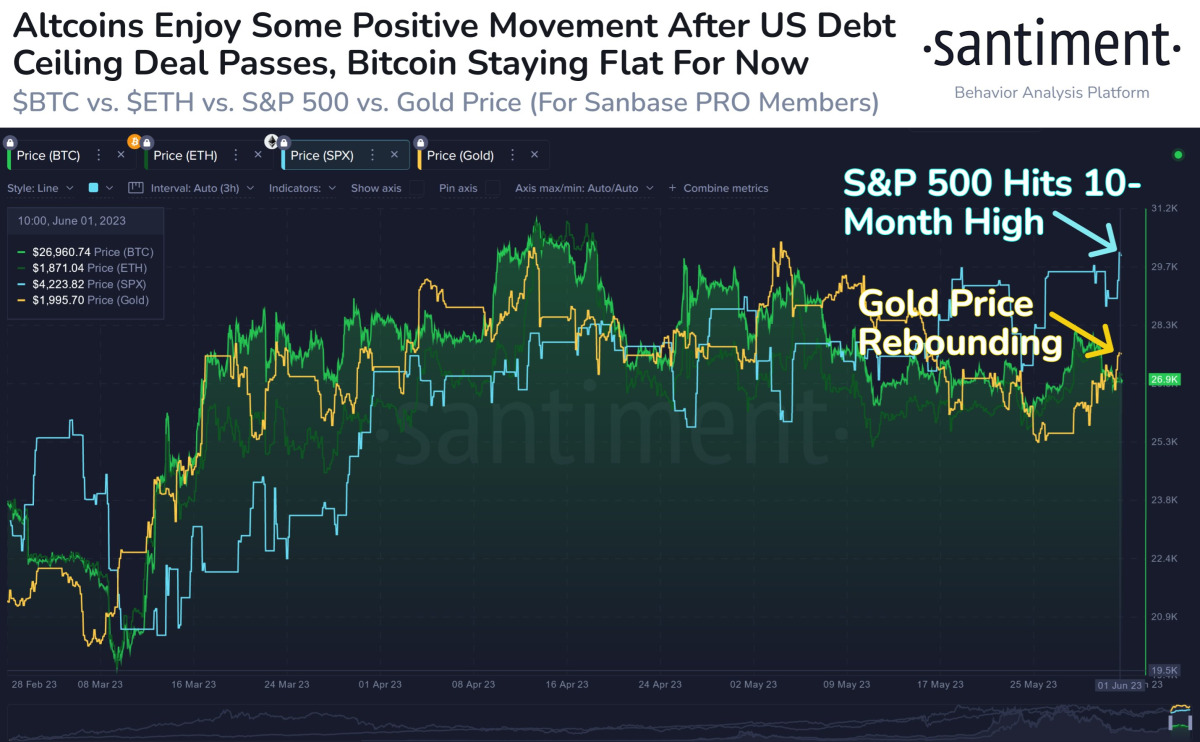

The debt ceiling decision had an immediate cathartic effect on stocks. However, the crypto markets in general did not live up to their enthusiasm. Market players suggest that this will change as the S&P 500 hits 10-month highs. In this context, the research company Santiment makes the following assessment:

The US House has passed a major debt ceiling agreement. Thus, the SP500 hit its highest price since August. Altcoins such as LTC, LEO, and FGC also made a splash afterward. With crypto lagging behind stocks, it may soon be time to catch up with BTC.

Currently Bitcoin hodler is sitting in profit

Technical analyst CryptoCon suggested last month that the Bitcoin rally is not over. According to the analyst, this is easy to claim, but the facts are not. At the time of analysis, BTC was almost $1,000 higher than current levels. But enthusiasm was equally lacking.

The analyst looks at the profitability of the Bitcoin hodler using the net unrealized profit/loss (NUPL) metric. Over the past few months, NUPL has remained almost stable around 0.25. This indicates that the overall supply of BTC is modestly “in the black”. The analyst says that NUPL is retesting its uptrend, although it has been calm in recent months. He states that this is also a reason for trust.

Biggest Bitcoin whales at the center of the ‘dilemma’

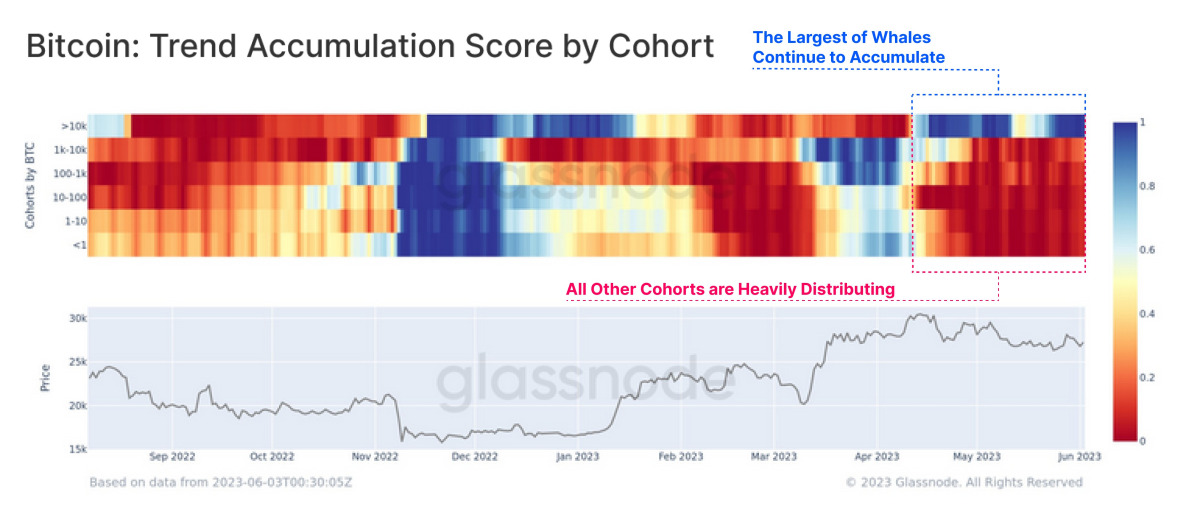

As for investor sentiment, the current market outlook varies widely between hodler classes. According to Glassnode, many remain risk-averse in BTC; Since May, sales have dominated. On the other hand, the only exception was from the largest class of Bitcoin whales.

Glassnode reads on a graph whose accumulation and distribution is adjusted according to groups. The chart shows that wallets holding at least 10,000 BTC are adding to their positions. It turns out, however, that everyone else is reducing their position.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.