Bitcoin and altcoins continue to grapple with the fallout, which weakened significantly after the stock market’s FTX boom last week. Bitcoin has been seriously injured. But the big names are keeping their faith, as the data shows that investors have a chance to “buy bearish” in BTC. Let’s take a look at the factors that will affect the price action of BTC and altcoins in the coming days.

Crypto brackets for fresh FTX contagion risk

While little is certain in the current crypto market environment, it’s safe to say that FTX and beyond are now the number one source of Bitcoin price volatility. The weekly chart says it all. It shows a ‘red’ candle of $5,500 for seven days through November 13 to the lowest weekly close since mid-November 2020.

At the time of writing, BTC is still around this close. BTC dropped to just $15,780 overnight on Bitstamp. Later, $16,300 resurfaces as a relief bounce.

The story is not over yet, as companies with positions in the stock market and related organizations on FTX find themselves in trouble. As such, on-chain effects are leaving more and more crypto names out of business. That’s why analysts are predicting repeat performances in the coming days and weeks.

Meanwhile, exchanges are particularly on the radar as Crypto.com, KuCoin, and others become a source of doubt over liquidity. There was a spike in withdrawals on Crypto.com and Gate.io that day. This led to warnings of a ‘bank run’ as investors tried to take control of their funds. Data from on-chain analytics firm CryptoQuant shows 1,500 BTC leaving Gate.io on Nov. 13. Also, on Nov 14 it is currently at around 800 BTC and bullish.

More generally, the data showed BTC reserves to be an estimated 2.09 million BTC. Also, CryptoQuant stated that it may not reflect the real situation due to the turmoil. The last time reserves were this low was in early 2018.

BTC bounces off $15,700 as Musk believes in Bitcoin

Against the background of ongoing uncertainty, making BTC price predictions is therefore no easy task. Turning to the moving average convergence divergence (MACD), analyst Matthew Hyland warns that the BTC/USD 3-day chart is about to repeat the bearish trend. He also says that this also led to losses both times he appeared in 2022. In this context, the analyst makes the following statement:

Bitcoin 3-day MACD is in a position to move into bears tomorrow for the first time since April. BTC can be prevented from getting positive price action before the 3-Day closes. The previous two crossovers last year resulted in more downward price action.

Yet Hyland, 2014 Mt. Gox states that after the hack, it took almost a year for Bitcoin to find a macro price bottom after the initial shock. “It hasn’t even been 11 days since FTX was shut down,” he adds.

Meanwhile, fellow analyst Crypto Capo argues that the market is ready for a ‘final capitulation’ that will come sooner or later. This, he notes, will come in a series of tweets, first in the form of a ‘bull trap’ followed by outright rejection. It also says it will send the market to new lows. He predicts the drop for altcoins will be “40-50% on average”.

On shorter timeframes, analyst Crypto Tony fears that even the lowest weekly close in two years may not hold up as support. The analyst comments on the recovery from the intraday lows of $15,780:

A nice breakout, but if we can’t keep the swing low at $16,400 then it would just be a fake exit. In this case, we expect a lower test.

The move came as Twitter CEO Elon Musk emerged in tacit support. “BTC will make it, but it may be a long winter,” he wrote in a Twitter discussion that day.

A short-term price catalyst also came from the largest exchange, Binance. Binance has chosen to create a private recovery fund to help protect businesses.

Quiet macro week focuses on stocks correlation

The picture outside of crypto further underscores the extent to which FTX has flagged as a “black swan” event for the industry. Bitcoin and altcoins are busy, falling more than 25% in days. Against this backdrop, US stocks rebounded from losses earlier in the month.

Market commentator Holger Zschaepitz also points out the widening gap in Bitcoin’s performance against the Nasdaq. In this context, he notes:

The gap in Bitcoin’s weekly performance marked the Nasdaq’s biggest rise since 2020. The crypto universe has shrunk to the equivalent of 1% of global stocks.

The strength of the US dollar is making some erratic moves of its own. So it’s possible that this diminishing correlation will come at a macro-beneficial time. The US dollar index (DXY) attempted to cross 107 and failed. As a result, there is a belief that risky assets should increase.

However, any turn towards the final peaks and the picture can quickly look very different. Still, intraday DXY dips saw the index return to untested support since mid-August. Therefore, as Santiment points out, there is a clear divergence between Bitcoin and risk assets. This helps break a correlation that has persisted over the past year. On the subject, Santiment made the following statement:

As the trading week closes, the story of the week has been the marked divergence between crypto and stocks. If the confidence of BTC investors recovers after the unfortunate events, a bullish divergence with the SP500 is formed.

However, Stockmoney Lizards commented on the long-term performance. In line with this, he said DXY has broken a parabolic curve in place since 2021. “The fix will be good for Bitcoin,” he said in some of his Twitter comments.

‘Buy at the bottom’ fever rises as BTC miner sales slow

Many existing hodlers are trying to withdraw cryptocurrencies from exchanges or figure out how to make up for losses. Therefore, not everyone stands still. On-chain data shows that investors alike, large and small, are seizing the opportunity to “buy bearish” as BTC hit several-year lows last week. According to Glassnode, wallets containing 1 to 10 BTC have seen a dramatic increase.

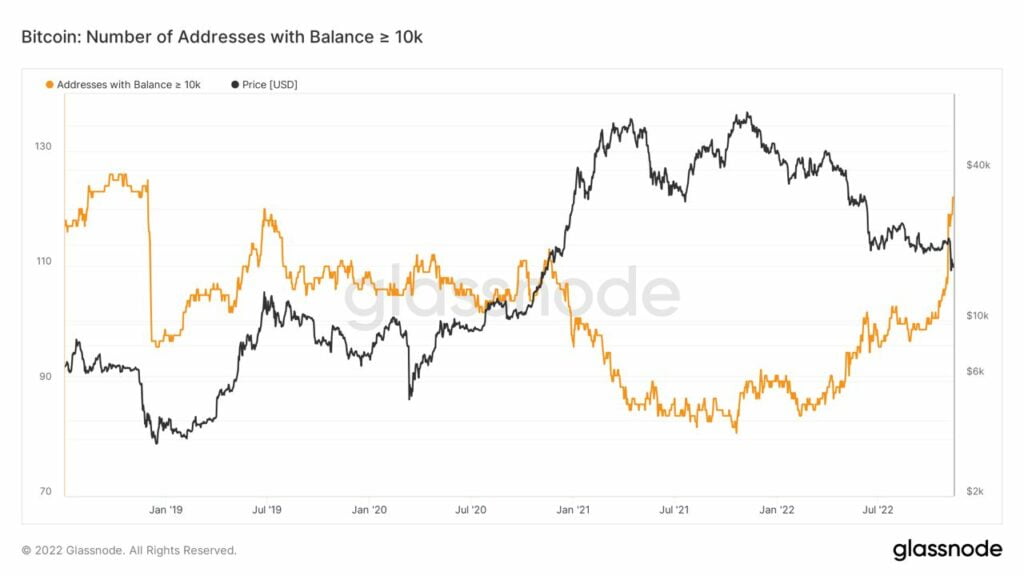

The trend also seems to be playing out among the largest group of hodlers, Bitcoin’s ‘mega whales’. According to Glassnode, these assets with wallet balances of 10,000 BTC or more are also growing. At present, their number is almost 130. “Whales are accumulating at a rate never seen before,” says social media commentator Crypto Rover.

cryptocoin.comAs you can see from , a group that is not currently in accumulation mode is miners. Miners saw a sharp drop in their reserves last week. CryptoQuant says that the BTCs held by miners are still in a bearish trend. Despite this, reserves are higher than at the start of 2022. Recent sales make up an insignificant portion of the miners’ overall position.

BTC sentiment data gives some hope

Predictably, the overall crypto market sentiment has been hit hard by FTX. But is it really that bad? According to the Crypto Fear & Greed Index, it’s likely the industry is actually getting most of the bad news step by step.

Over the weekend, the index’s score touched a local low of 20/100. Thus, he definitively described the market mood as ‘extreme fear’. This represents a 50% drop compared to the 40/100 peak seen on 6 November. It also marks the highest sentiment in three months.

However, 2022 saw much lower scores for Fear and Greed reaching only 6/100 during the year. In case the bearish escalates further, even a fresh 50% drop from current levels will bring sentiment to the area (around 10/100) that normally marks macro price dips for BTC.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.