The altcoin market is falling sharply in response to the Fed’s fixed interest rate decision. However, some altcoins don’t care too much about the sell-outs…

These 3 altcoins challenge the Fed’s hawkish stance

The Federal Open Market Committee (FOMC), chaired by Jerome Powell, decided yesterday to halt the aggressive cycle of rate hikes. In his statements, Powell signaled that two additional rate hikes could be on the way before the end of 2023. This possibility triggered a wave of negative sentiment among crypto players. As a result, the entire altcoin market is trading in the red, including Bitcoin and Ethereum. The most depreciating cryptocurrencies of the day:

However, news of the update and partnership in Uniswap (UNI), Algorand (ALGO) and Terra LUNA Classic (LUNC) ignited the rally as opposed to the drop. Apart from the SEC lawsuits, the main development that took over the market were the statements from the FOMC meeting yesterday…

Fed hawk took a break

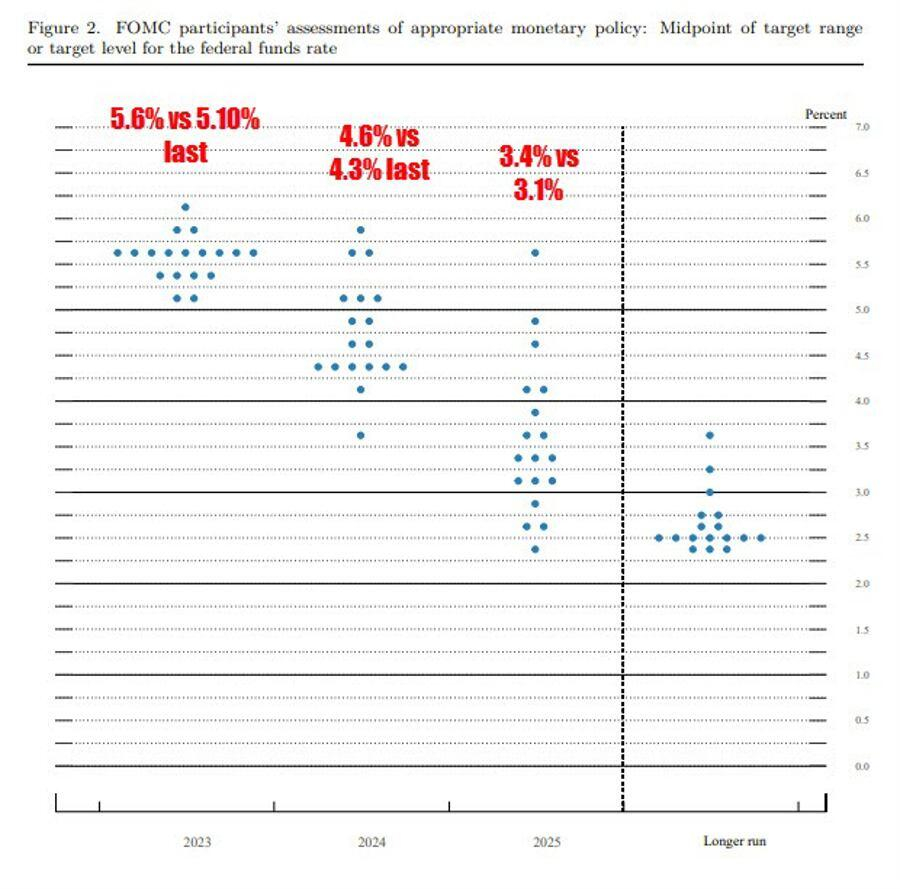

The US Federal Reserve closed its two-day meeting on Thursday with a “hawkish pause”. FOMC members further detailed their expectations for interest rates through a “dot chart”. The dots have moved up, meaning the median expectation for interest rates rose to 5.6% at year-end, above the previous estimate of 5.1%.

The FOMC Point Chart consists of up to 19 dots where individual committee members indicate they believe the Federal Funds ratio should be in the future. The dot chart is widely followed by investors and economists to gauge potential changes in monetary policy.

The projected terminal rate is 5.6% as of June 2023. This rate means two more rate hikes by the end of the year. Rate hikes make the US dollar more attractive to investors, diverting capital away from risky markets. The prospect of two rate hikes at the end of the year triggered drastic drops in top cryptocurrencies like Bitcoin and Ethereum.

Amid the bloodbath, investors of only 3 altcoins won

UNI, ALGO and LUNC prices have risen by 4.3%, 1.6% and 1.6% respectively since Wednesday.

Catalysts behind ascension

Uniswap (UNI)

Uniswap has announced that it will release code version 4 on June 13. Here, the features that attract developers to the protocol are highlighted. Publishing the source code serves as Uniswap’s interaction with community members. It will also be the first step for UNI to drive adoption. All these developments were a bullish catalyst for the UNI price. The DEX coin has gained 11.37% on Binance since Tuesday.

Algorand (ALGO)

Algorand recently announced a partnership with cloud company Seracle to drive blockchain adoption for Web3 companies. The partnership cuts Blockchain costs for Web3 projects by up to 90%. After the announcement, the price of ALGO has increased by about 2% since Wednesday.

Terra LUNA Classic (LUNC)

Terra LUNA Classic’s core developer group successfully completed the v2.1.1 parity upgrade on Wednesday. Since the upgrade, the LUNC price has gained 7.7%.

cryptocoin.com In this article, we have included other important developments of the day that may be important in terms of price.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.