Bitcoin is starting a new week below $30,000 as analysts’ predictions of a retest of short-term support come true. So, what developments stand out this week? Here are the developments that Bitcoin and altcoin investors should follow…

Bitcoin price stabilizes at $30,000

cryptocoin.com As we reported, after a “boring” weekend for BTC price movements, volatility returned in a classic fashion at the weekly close of April 16. However, BTC/USD has returned to $30,000, retesting its first major support since hitting a 10-month high above $31,000 last week. Traders and analysts have widely predicted this move, arguing that it would constitute a healthy pullback to prepare for the continuation of the uptrend.

Analyst Michaël van de Poppe, founder and CEO of trading firm Eight, was among those considering buying just under $30,000 but kept his options open in case of a deeper correction. According to the analyst, Bitcoin is heading into the long fields – reversing towards the lower range and could stand out as an entry point from this range towards $32,000. There could be a long entry at $28,600. Analysis resource Skew spoke of a “clean divergence” between spot sellers and derivatives traders, noting how the drop has taken place in exchanges.

Meanwhile, popular trader and analyst Rekt Capital took an optimistic note, “This is exactly the BTC test I was talking about. BTC is currently successfully retesting the top of the Bull Flag price a few days ago,” he said. Its chart shows that BTC/USD is close to holding on a key trendline. A more cautious analyst Daan Crypto Trades nonetheless pointed to a contention between the bulls and those who only trade in the current range, saying that the contention will not end until one side gives up.

Earnings reports dominate the macro process

After an important week in which macroeconomic data was released, the coming days will offer risky asset investors a comparative respite. United States jobless claims and manufacturing numbers are due towards the end of the week, but the macro focus will be elsewhere, particularly on earnings. These include heavyweights like Tesla and Netflix, as well as a number of banks that have been carefully watched by market participants following recent events.

“Earnings season has officially arrived,” financial comment source The Kobeissi Letter summed up. Last week, Tedtalksmacro, another crypto-focused financial commentator, summed up the current environment as extremely conducive for Bitcoin to continue its rise. However, when it comes to equity markets, the picture looks more blurred and consensus among market participants is hard to spot. NorthmanTrader CEO Sven Henrich said more evidence of a breakout in the S&P 500 is needed for the “bull market” rhetoric to be valid.

Important data draws attention in the USA

In addition, many economic data and events that may affect the markets will be released in the next few days. On Monday, Tuominen of the European Central Bank will speak, followed by ECB President Lagarde later in the day. On Tuesday, China’s first quarter Gross Domestic Product (GDP) will be released and the growth rate is expected to be 4%. Later in the day, the United States will release data on building permits, which are expected to decline slightly. The day will also feature a speech by Fed Chairman Bowman.

On Wednesday, UK and Eurozone inflation rates will be announced and expectations will be 9.8% and 6.9% respectively. The “Beige Book” of the US Federal Reserve will also be announced and will provide information on economic conditions across the country. Data on unemployment claims and current home sales in the US will be released on Thursday. Fed’s Williams, Waller and Bowman will speak at various times throughout the day.

On Friday, the US will release its manufacturing and services Purchasing Managers’ Indices (PMI) data. Manufacturing PMI is expected to indicate contraction at 49, while services PMI is expected to indicate slight expansion at 51.5. In addition, Fed Chairman Cook will also make a speech. Finally, in the case of cryptocurrencies, $70.5 million APE and $35.5 million AXS will be unlocked today. Rocket Pool will release an update on Tuesday.

Bitcoin mining difficulty reaches fifth consecutive record level

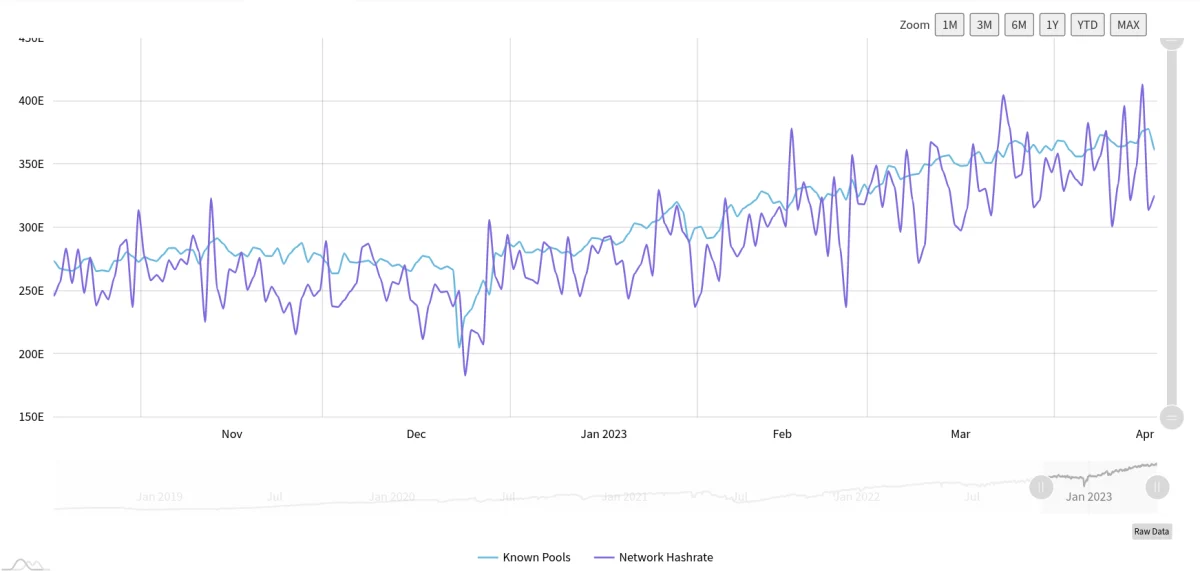

Recently, the fundamentals of the Bitcoin network offer nothing but all-time highs. Difficulties are expected to increase – currently by an estimated 0.45 percent – this week, according to forecasts from monitoring resource BTC.com. This will mark the fifth consecutive increase that has not occurred since February 2022. Since the start of 2023 alone, more than 4 trillion have been added to the difficulty tally, while the hash rate is constantly setting new highs.

Raw data from MiningPoolStats calculated an all-time high of 413.4 exahash per second (EH/s) on April 15. On January 1, the estimated hash rate was 285 EH/s. Hashrate changes may not be suitable as a benchmark for Bitcoin’s health when measured using exact numbers. All may not be as it seems, as Casa co-founder and chief technology officer Jameson Lopp noted in a new blog post published to coincide with the all-time high hashrate estimate.

After comparing various hashrate estimation methods, Lopp said in summary: “Whenever you see someone claiming that a change in network hashrate is newsworthy, you should always question the method and timeframe used to arrive at the hashrate estimation.”

Only the “old hands” remain in Bitcoin

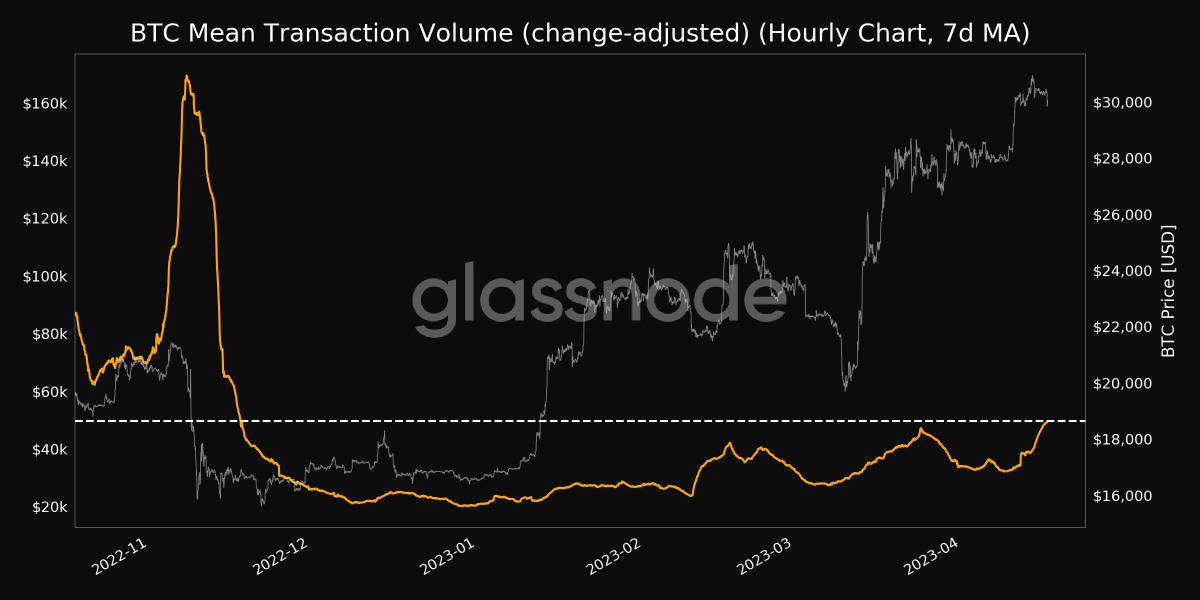

As $30,000 appears and tests as support, the willingness to sell is growing among those who survived the 2022 bear market. Average on-chain transaction volumes have reached their highest level in several months, according to data from analytics firm Glassnode. Overall, more than three-quarters of the issued BTC supply is now in profit – the highest rate in a year and likely a clear incentive to take some of that profit off the table. Analyzing the market composition, Glassnode analyst Checkmate came to some encouraging results.

Long-term holders now significantly outnumber short-term holders or speculators. The 2022 bear market led to a jolt that made the market more resilient to price fluctuations. “No one is left but the hardcore HODLers, no one knows we’ve risen 100% from the lows. They’ll probably only really come back when we get close to the ATHs,” he guessed. “Almost none of the people who have been here for more than a few months are spending right now,” Checkmate added.

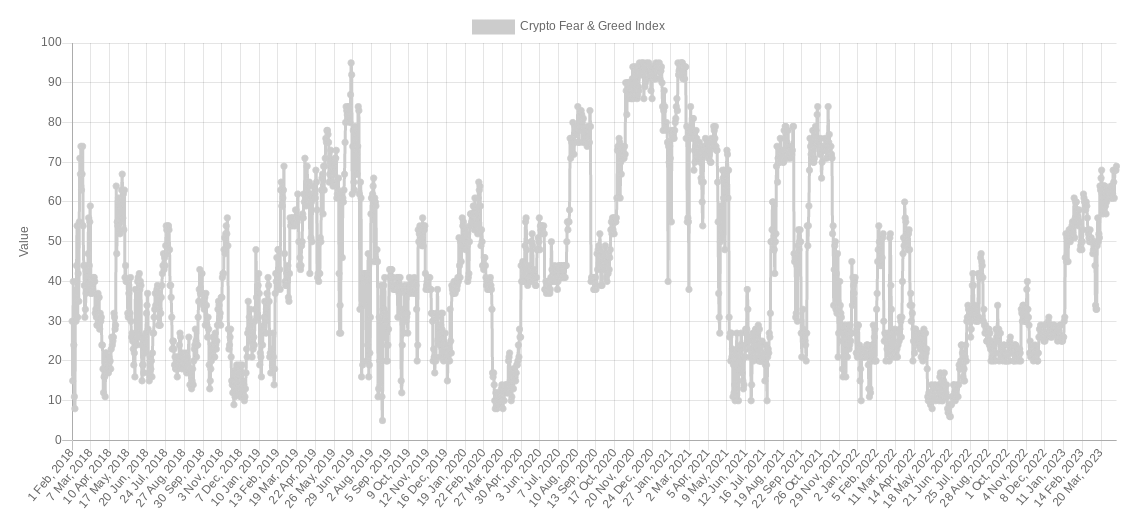

Crypto ‘greed’ just a short distance from its November 2021 peak

Bitcoin may be a long way from its all-time high of $69,000, but one metric fast set to replicate the November 2021 climate is the Crypto Fear and Greed Index. According to the data, the return to $30,000 was due to the rapid increase in “greed” in the crypto market. As of April 17, the index has scored 69/100, just 10 percent off the 75/100 score that BTC/USD traded at its most recent peak.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.