The Russian invasion of the country is worrying the people of Hamburg.

Dusseldorf The Hamburg port and logistics group HHLA has stopped operating its container terminal in Odessa because of the Russian attacks on Ukraine. All 480 employees are safe, a spokesman said. The company has set up a crisis team that is in contact with the local authorities and the federal government. Two ships are still there, which have already been dispatched. It was unclear whether they could leave the port.

HHLA is one of the major German investors in Ukraine. The partially state-owned group, 69 percent of which is held by the Hanseatic City of Hamburg, has been operating the country’s largest port terminal in Odessa since 2001. In 2021, handling there climbed by an impressive 8.5 percent to 650,000 standard containers (TEU). Now there is a risk of a serious setback.

German HHLA employees are no longer in the country, the company said. Business trips from Germany were previously prohibited, which is occupied exclusively by Ukrainian employees in the south-west of the country.

Possibly bitter for the Hamburg-based company: According to its own statements, it has invested more than 170 million US dollars in the location on the Black Sea in the past 20 years, including in handling capacities for bulk goods, general cargo and project cargo.

Top jobs of the day

Find the best jobs now and

be notified by email.

There were also expenses for rail freight transport in Ukraine, which HHLA started in October 2020 under the company name “Ukrainian Intermodal Company”. With freight trains, the people of Hamburg created a connection from Odessa to the hinterland, with the railways heading for major cities such as Lviv (Lemberg) and Kharkiv in the north-east of the country.

>> Read about this: Odessa and Mariupol have this strategic importance

With its investments, HHLA wanted to offer a freight alternative to the often dilapidated roads in Ukraine. The Hamburg company even opened its own railway terminal a few months ago in the port of Odessa. In addition, Germany’s largest seaport operator installed door-to-door delivery in the Ukraine, as well as professional goods storage for its customers.

“Odessa and Ukraine are important locations for us,” a spokeswoman confirmed when asked. “We can only wait and see how the situation develops.”

But even in their own homeland, the people of Hamburg are threatened with a downturn in business. The Russian market, which could collapse almost completely as a result of the planned EU sanctions, is HHLA’s fourth-biggest after China, the USA and Singapore. Last year, it contributed 4.1 percent to container handling at the four terminals in the Hanseatic city, three of which are under the control of HHLA.

Significant declines in turnover after the annexation of Crimea

The fact that the handling volume remained comparatively low, although there are numerous sea connections from Hamburg through the Baltic Sea to Kaliningrad, Ust-Luga and St. Petersburg, is due to the economic sanctions already imposed after the annexation of Crimea. In 2015 alone, Hamburg recorded 9.3 percent less container handling than in the previous year.

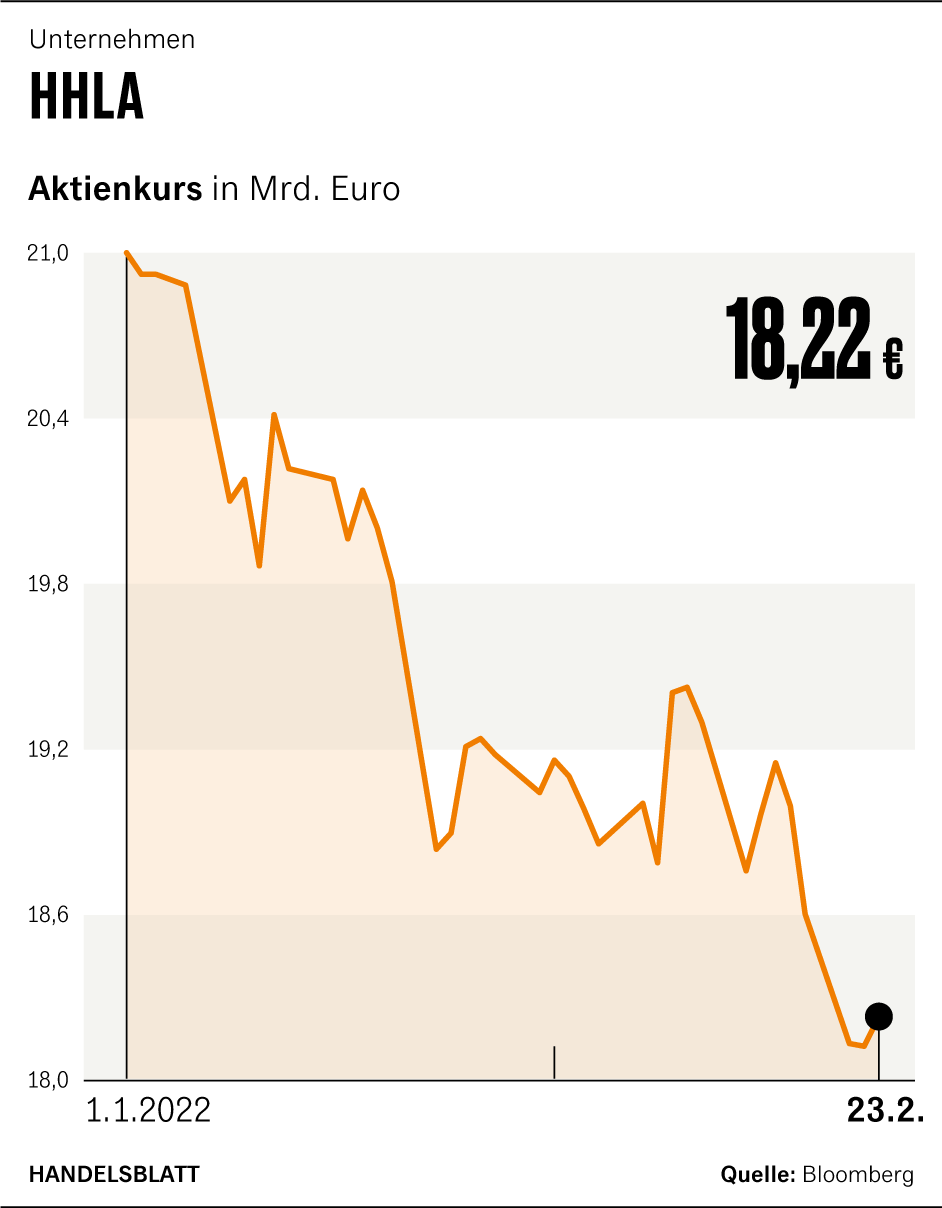

The uncertainties surrounding the Hamburg terminal and railway operator have long since reached the stock exchange. Since the beginning of the year, the shares have lost around twelve percent. The Hanseatic city, which has its interests represented by ex-Bahn boss Rüdiger Grube at the top of the supervisory board, has since become poorer on paper by around 125 million euros.

>> Read about this: German economy fears the Russia crash

A spokeswoman said it was not yet possible to quantify what specific effects the Ukraine crisis is likely to have on the current financial year. HHLA CEO Angela Titzrath intends to submit the outlook for the year on March 24 of this year.

At the end of January, the city’s own port company, Hafen Hamburg Marketing, had announced “moderate growth” in the Russian port industry of two to five percent, which probably also gave Hamburg itself significant impetus. Those responsible on the Elbe may have buried their hopes by now.

Just a few days ago, HHLA had raised great hopes among its shareholders with its preliminary figures for the past financial year. Despite Corona and the associated delivery bottlenecks at sea, she reported an increase of 2.5 percent in container handling for 2021. Container transport – mainly via the group’s own rail transport – increased by ten percent, and group sales even increased by 12.7 percent to 1.47 billion euros. In addition, the operating profit doubled to 228 million euros.

“Once again it is confirmed that HHLA is a stable and efficient node in the global supply chain and ensures reliable supplies to companies and consumers in Europe at all times,” said CEO Titzrath in praise of her own company. At least in Ukraine, this could now change.

More: How the German North Sea ports are fighting for survival