With just ten days until the highly anticipated Bitcoin halving, the cryptocurrency finds itself in a precarious position. The price is currently trading above $70,000, a key level, reinforcing the optimistic forecasts of analysts predicting a major price increase. However, fundamental concerns about profit taking and the Fed’s tightening on liquidity overshadow this bullish outlook. Here are the Bitcoin predictions and expectations of various analysts

Bitcoin prediction after halving: Will there be a price explosion?

Analysts at Bitfinex paint a rosy picture, recommending a potential 160% price increase following the halving. This bullish prediction, based on a regression model, translates into a price range of $150,000 to $169,000 over the next 14 months. This optimism is supported by Bitcoin’s strong weekly performance, currently up over 7.5%.

But analysts also acknowledge a potential hurdle: unprecedented selling pressure. Unlike previous halving cycles, Bitcoin had already reached its all-time high before the event. They argue that this encourages investors who bought above $60,000 (representing a significant portion of the circulating supply) to potentially cash out their profits.

ETF entries attracted attention

Moreover, cryptokoin.com As we reported, the FED’s quantitative tightening policy, which aims to reduce liquidity in the market, may reduce Bitcoin’s post-halving rise. Arthur Hayes, co-founder of BitMEX, thinks that there will be a decrease in prices due to this tightening. He then predicts that this could potentially trigger a “violent sell-off” in crypto assets.

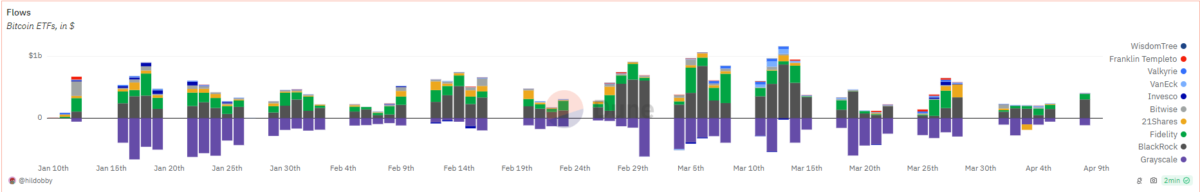

The recent increase in Bitcoin ETFs (Exchange Traded Funds) has undeniably played a role in the price rise. These investment vehicles, primarily US-based spot ETFs, were responsible for approximately 75% of new Bitcoin investments when the price exceeded $50,000. While the inflows have significantly increased the price of Bitcoin, they also raise concerns about long-term sustainability. Currently, Bitcoin ETFs hold 841,900 BTC, representing the bulk of the circulating supply. The current accumulation model indicates that these ETFs could potentially absorb 2.6% of the total annual supply.

Watch out for BTC in the coming weeks

As a result, the coming weeks will be very important for Bitcoin. The halving itself is a bullish event that can significantly affect the price. But the interplay between profit-taking pressures, macroeconomic factors and the evolving role of Bitcoin ETFs creates uncertainty. It is not yet known whether Bitcoin will meet optimistic predictions or face a post-halving correction. One thing is certain: The next ten days will be tense for the world’s leading cryptocurrency.

To be informed about the latest developments, follow us Twitter’in, Facebookin and InstagramFollow on . Telegram And YouTube Join our channel.