On Thursday, US retail sales data came in better than expected. This eclipsed hopes for a smaller rate hike. Also, the demand for safe haven has weakened due to recent geopolitical concerns. After these developments, gold prices fell with the pressure of the stronger dollar. Analysts interpret the market and share their forecasts.

“Gold gave an excellent performance, but…”

Spot gold was down 0.69% at $1,756.6 at the time of writing. U.S. gold futures fell 0.91% to $1,759.7. City Index analyst Matt Simpson comments:

Gold did an excellent job. However, it succumbed to the strength of the US dollar after struggling to rise above $1,790. It looks like it went into a fix. A further pullback for gold is possible given the magnitude of its previous rise, which is likely to spur take profits and attract a few upside bears around these highs.

“There will be recession under until new information about US CPI”

The dollar rose 0.2% against its rivals. Thus, it made gold more expensive for other currency holders. By the way cryptocoin.comAs you follow in , San Francisco Fed President Mary Daly said it is reasonable for the Fed to raise the policy rate to the 4.75%-5.25% range early next year. She also noted that pausing interest rate hikes is not part of the discussion.

TD Securities commodity strategist Daniel Ghali says news fueling geopolitical tensions has had a limited impact on gold. Therefore, he adds, there will be a recession until new information about US inflation. The strategist also comments:

It is possible that we will continue to see this movement resulting from the short closing in the very near term. However, it will likely decline above the $1,850 threshold. After that, we expect gold prices to weaken.

“Gold is currently digesting the latest price increase”

Brien Lundin, editor of Gold Newsletter, evaluates the impact of recent developments on gold as follows:

When gold’s rally/rest cycle from about a week ago seemed to break its inverse correlation with the dollar index, it was replaced by a very short safe-haven buying move. Gold is currently digesting the recent price hike and waiting for the next catalyst. What triggers gold’s next move depends on every breath of any Fed official.

“Current levels are a bargain for gold in the longer term”

Brien Lundin says she expects to see a half-point rate hike next month, with the Fed taking a break to see the effects of its actions. Based on this, he makes the following statement:

They’ll likely have to wait a while, as inflation peaks and another recession approaches. This will be bullish for all other assets, not just gold, at least initially. In the longer term, I believe current levels for gold will prove to be a bargain.

“A deeper fix does not look favourable”

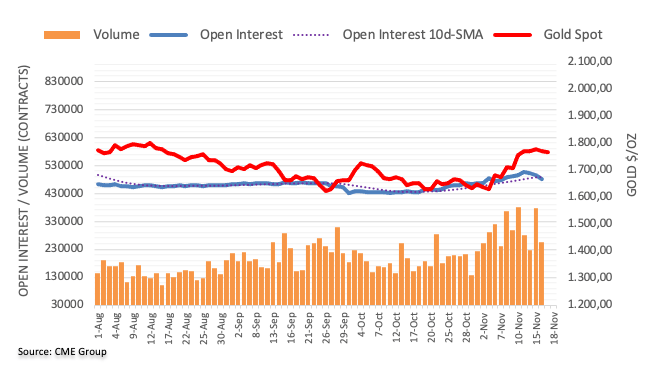

Open interest on gold futures markets narrowed by more than 16,000 contracts on Wednesday. Thus, it extended the downtrend for the third consecutive session, according to preliminary data from CME Group. Volume followed suit, with around 123.2k contracts falling.

Market analyst Pablo Piovano says gold prices have seen corrections from recent highs. However, the downside move was behind a significant decline in open interest and volume. In addition, the analyst notes that it reduces the possibility of a deeper pullback in the very near term. For the recent rally to continue, the next rating hurdle needs to be met at the critical $1,800 mark, which coincides with the equally relevant 200-day SMA ($1,802).

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.