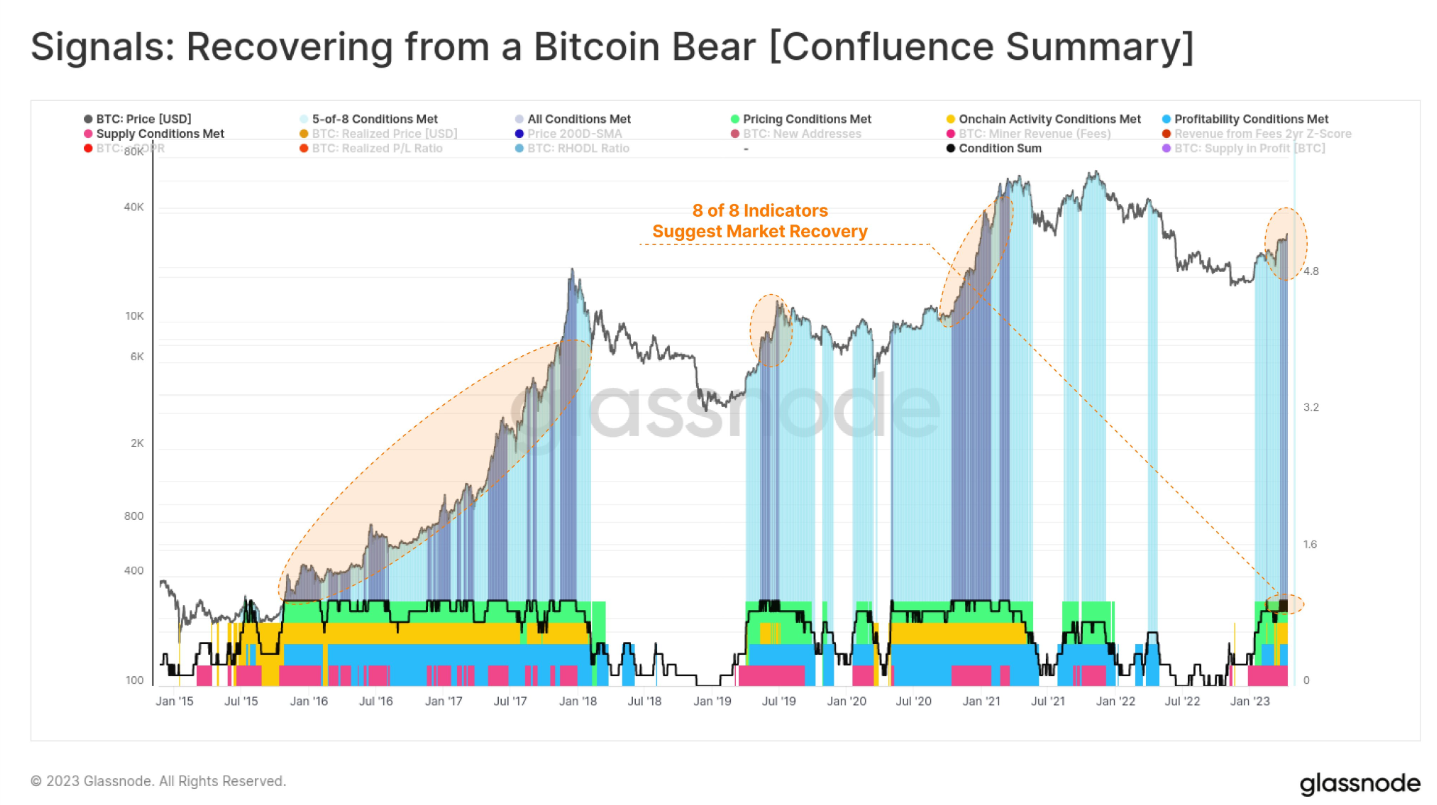

The detailed report published by on-chain data platform Glassnode revealed that the bear season for the cryptocurrency market may be over.

Glassnode took the pulse of the cryptocurrency market in a detailed research report published on Monday, April 17th. According to the report, which makes use of many different tools and data, for the cryptocurrency market the worst days are probably behind.

Especially since the beginning of 2023 from 80% Bitcoin, which has a very bullish performance its correlation with gold The report pointed out that this situation did not weaken even during the US-based banking crisis. According to the report, the investors of the past process “hard money” revealed that their belief in the concept increased.

More affirmation of all data or at least neutral While it is stated that a market atmosphere is entered, contrary to the volatile structure of the market, user psychology and on-chain data are show clear consistency with past cycles underlined.

While Bitcoin and digital assets experience a relatively high degree of market volatility, many on-chain indicators are surprisingly consistent, reflecting collective human decisions. Bitcoin is in neutral territory and above the underlying supply cluster of $16,000 to $25,000 where substantial assets change hands.

Marking three important supply clusters in an overall perspective, Glassnode 25 thousand dollars under, 25-30 thousand dollars between and over 30 thousand dollars showed that they were priced.

Those priced below $25,000 are those that changed hands substantially between June 2022 and January 2023, according to the charts. Long-term holders in this range (LTH) and short-term holders (STH) There is a fairly even balance between them.

Last buy level $25,000 to $30,000 investors with the total supply 7.25% of forms. According to this data, investors who buy from the bottoms want to make a profit. 25-30 they sold their assets for a thousand dollars, but this sale a small denominator forming.

On the other hand, the total supply 22%if it is survivors of the last bear loop that is, it represents users who have not made any sales in 2022. This shows that long-term belief is embraced by a substantial segment. In this direction, investors are targeting higher prices and do not miss the opportunity to buy at the levels that can be described as the bottom.

Revealing how much of Bitcoin’s market value is held as unrealized profit NUPL according to the current metric with a value of 0.36 The market is positioned at a fairly neutral level.

According to the report, this coincides with past cycles of transitions between bear and bull markets. Also, the market 16 thousand dollars neither excessively discounted nor 68 thousand dollars It turns out that it is overvalued around the top as it is at the top.

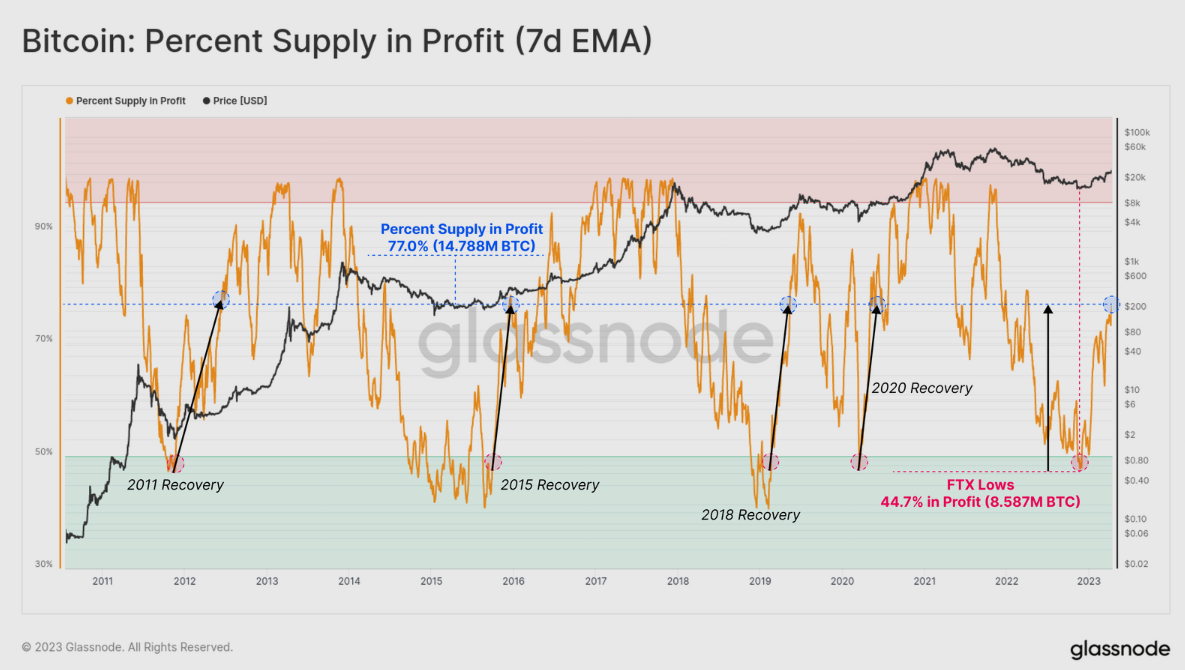

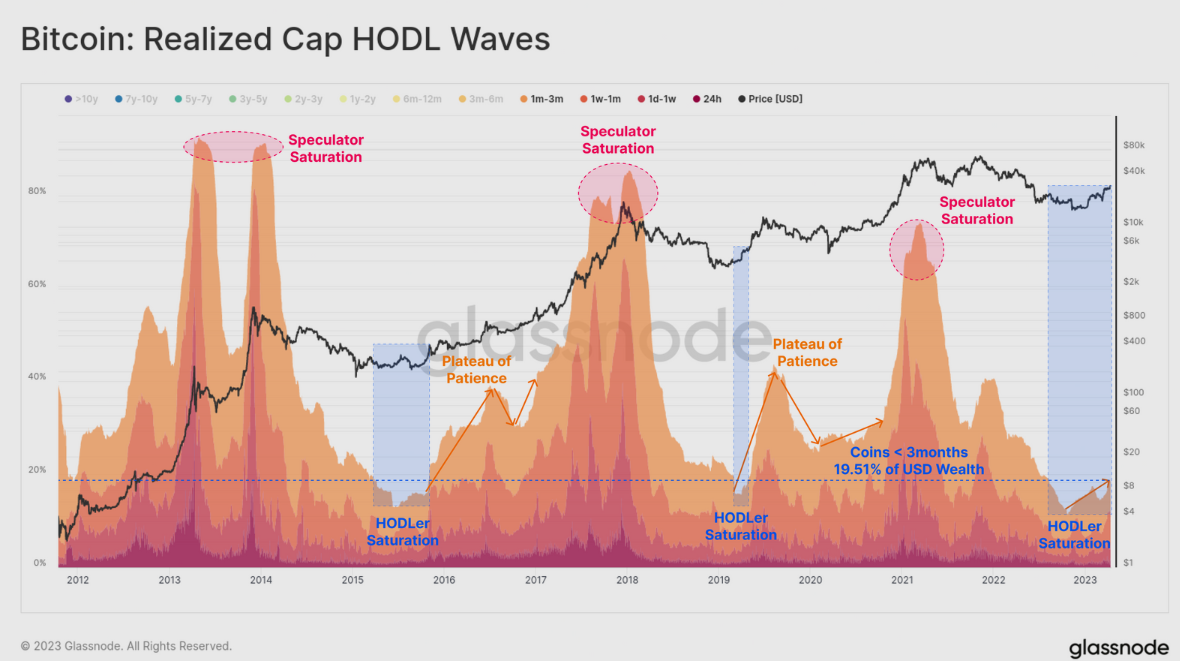

Looking at the graph of cryptocurrency hodlers, the previous with bull starts There is clear agreement.

Both of the above two bull-start observations show that the number of hodlers increases at the peak and decreases significantly at the bottom. The number of users currently holding Bitcoin has moved from a bottom to the top, which is the cycle likely turned in favor of the bulls it states. On the other hand, Bitcoin price may no longer be in a region below its value.

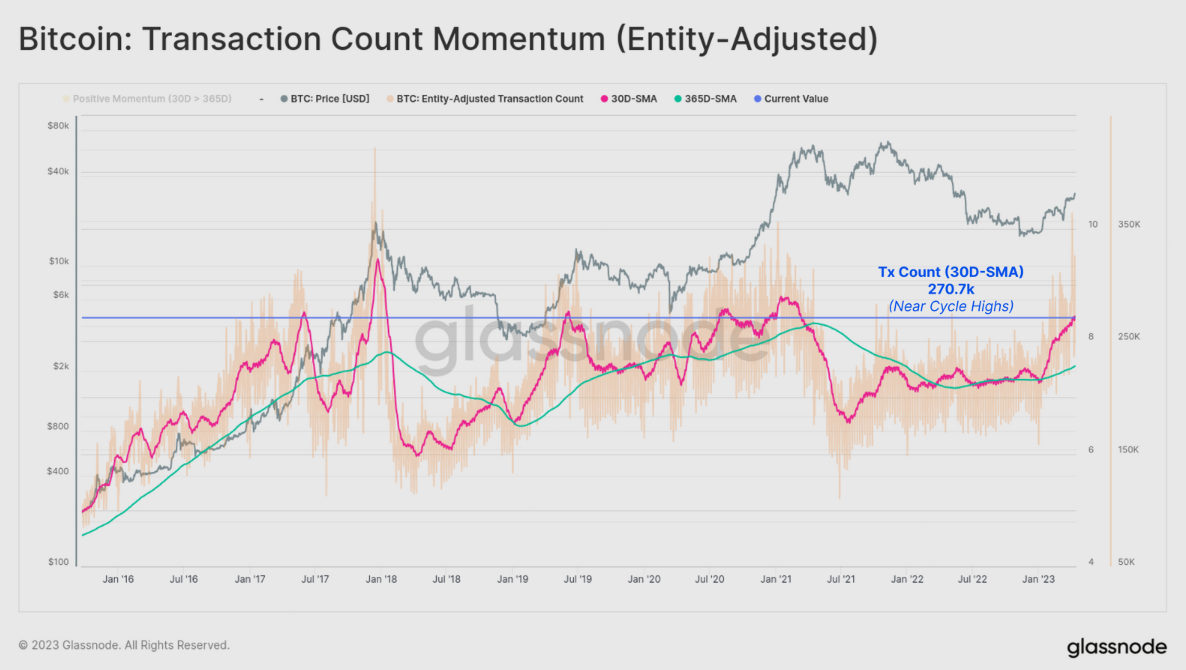

Significant increases in on-chain activities and the proportional increase in its consistency with the end of last month’s seasons drew attention. Pressure on the price of increased on-chain activities turned positive The battle of miners to find a block has been gaining momentum in recent months. Although this causes the difficulty level to increase, it comes with network security And frequency of use highlights positive indicators such as

Looking at the presented report from the general perspective, the behavior of Bitcoin investors seems to be quite consistent throughout the cycles, and all the data in the current table we are in. at least the worst days are over is showing.

This report points out that a few indicators on the on-chain bear market conditions (or at least the worst) may be in the past.

*The data shared in the news is for informational purposes only and does not constitute investment advice in any way.