Along with the bear market, the collapse of several projects caused great chaos in the market. November was a tough month for the crypto industry. A downtrend triggered by FTX wiped out all previously accumulated gains of crypto assets. However, the whales who took advantage of the fall went on a buying spree. Cardano sharks, in particular, have packed $83 million in ADA since November 7.

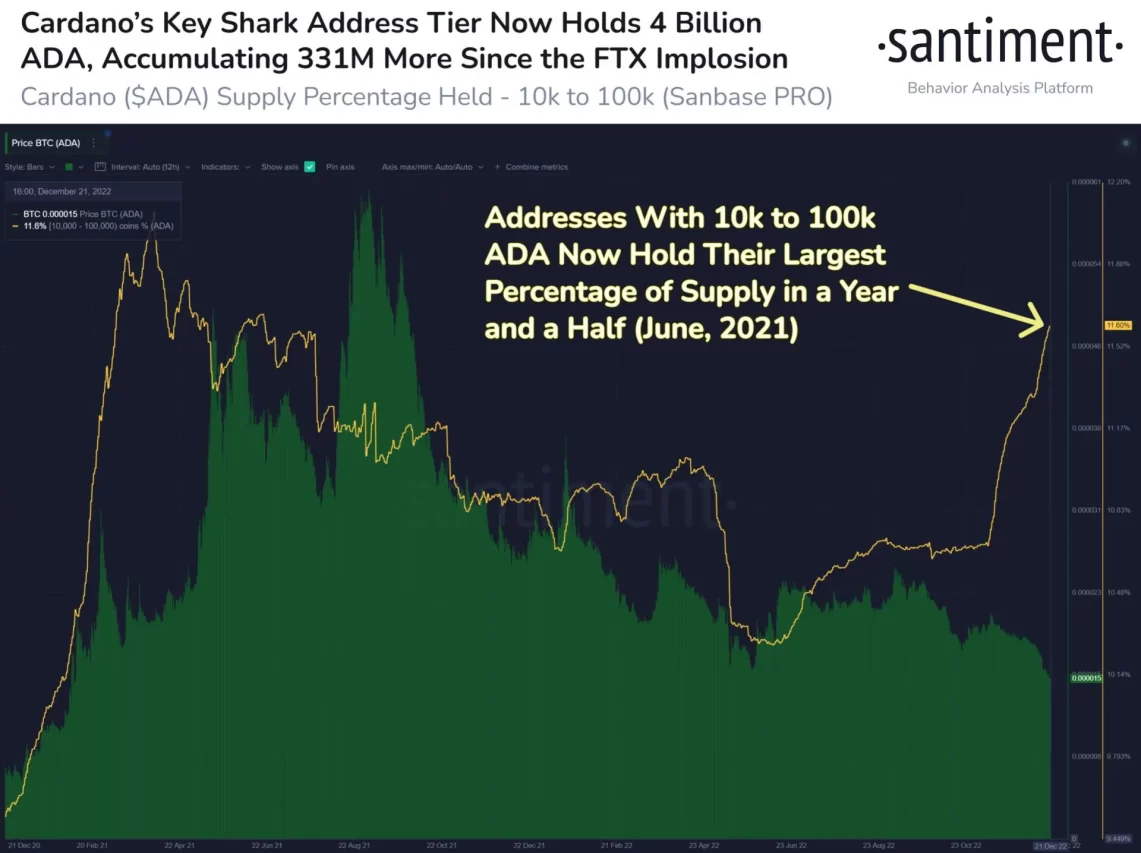

The last thing Santiment shared data Cardano investors holding 10,000 to 100,000 ADA in their wallet hold the largest percentage of supply since June 2021, according to the report. Currently, these sharks have a total of 4 billion ADA. Koinfinans.com As we reported earlier, after the FTX debacle, 331 million ADA worth $83 million was added to these investments.

While much of the market was skeptical of buying the bottom, Cardano sharks made the most of it. Unfortunately, this buying spree was not reflected in the altcoin price. The altcoin was trading at $0.429 at the beginning of November. After that, the asset fell as low as $0.2482 earlier this week.

Cardano surpasses Ethereum and Litecoin

On top of that, Cardano noticed tremendous growth in on-chain metrics throughout the year. According to Messari, the altcoin ranked second in terms of on-chain activity. The asset witnessed a transaction volume of $2.34 billion. It is worth noting that Bitcoin took the first place. In addition, the total number of transactions in the network is again moving towards 100 thousand. At press time, the number of transactions was 80,881.

In addition, the number of active addresses in the Cardano network is 77,844. Ethereum, the largest altcoin [ETH] ranked fourth, while Litecoin [LTC] took third place.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.